OpenText Investor Presentation Deck

Proven Track Record of Value Creation

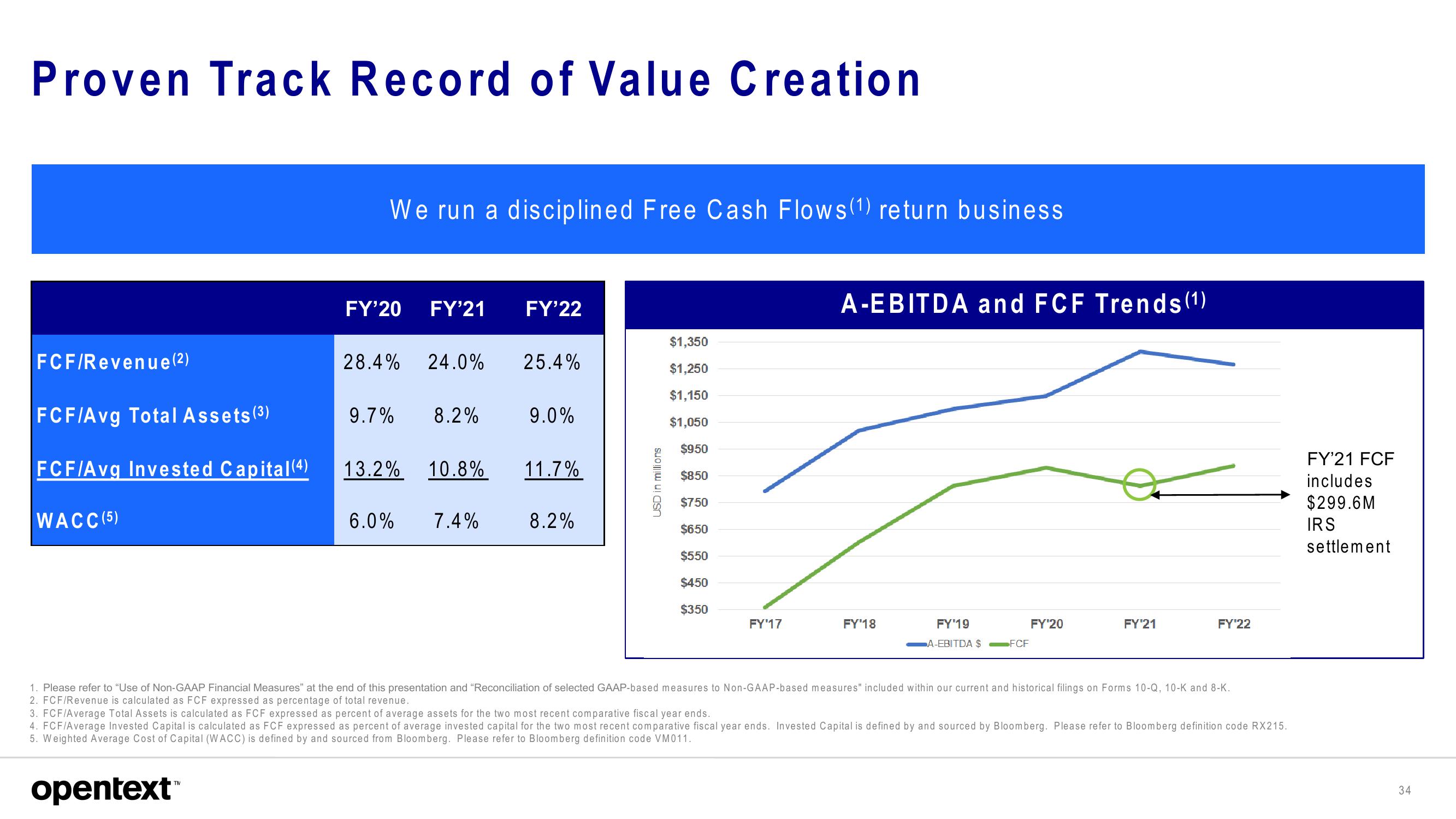

FCF/Revenue (2)

FCF/Avg Total Assets (³)

FCF/Avg Invested Capital (4)

WACC (5)

We run a disciplined Free Cash Flows (¹) return business

FY'20 FY'21 FY'22

28.4% 24.0% 25.4%

9.7% 8.2%

13.2%

6.0%

9.0%

10.8% 11.7%

7.4%

8.2%

USD in millions

$1,350

$1,250

$1,150

$1,050

$950

$8.50

$750

$650

$550

$450

$350

FY'17

A-EBITDA and FCF Trends (¹)

FY'18

FY'19

A-EBITDA $

FCF

FY'20

FY'21

FY¹22

1. Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K and 8-K.

2. FCF/Revenue is calculated as FCF expressed as percentage of total revenue.

3. FCF/Average Total Assets is calculated as FCF expressed as percent of average assets for the two most recent comparative fiscal year ends.

4. FCF/Average Invested Capital is calculated as FCF expressed as percent of average invested capital for the two most recent comparative fiscal year ends. Invested Capital is defined by and sourced by Bloomberg. Please refer to Bloomberg definition code RX215.

5. Weighted Average Cost of Capital (WACC) is defined by and sourced from Bloomberg. Please refer to Bloomberg definition code VM011.

opentext™

FY'21 FCF

includes

$299.6M

IRS

settlement

34View entire presentation