Privia Health IPO Presentation Deck

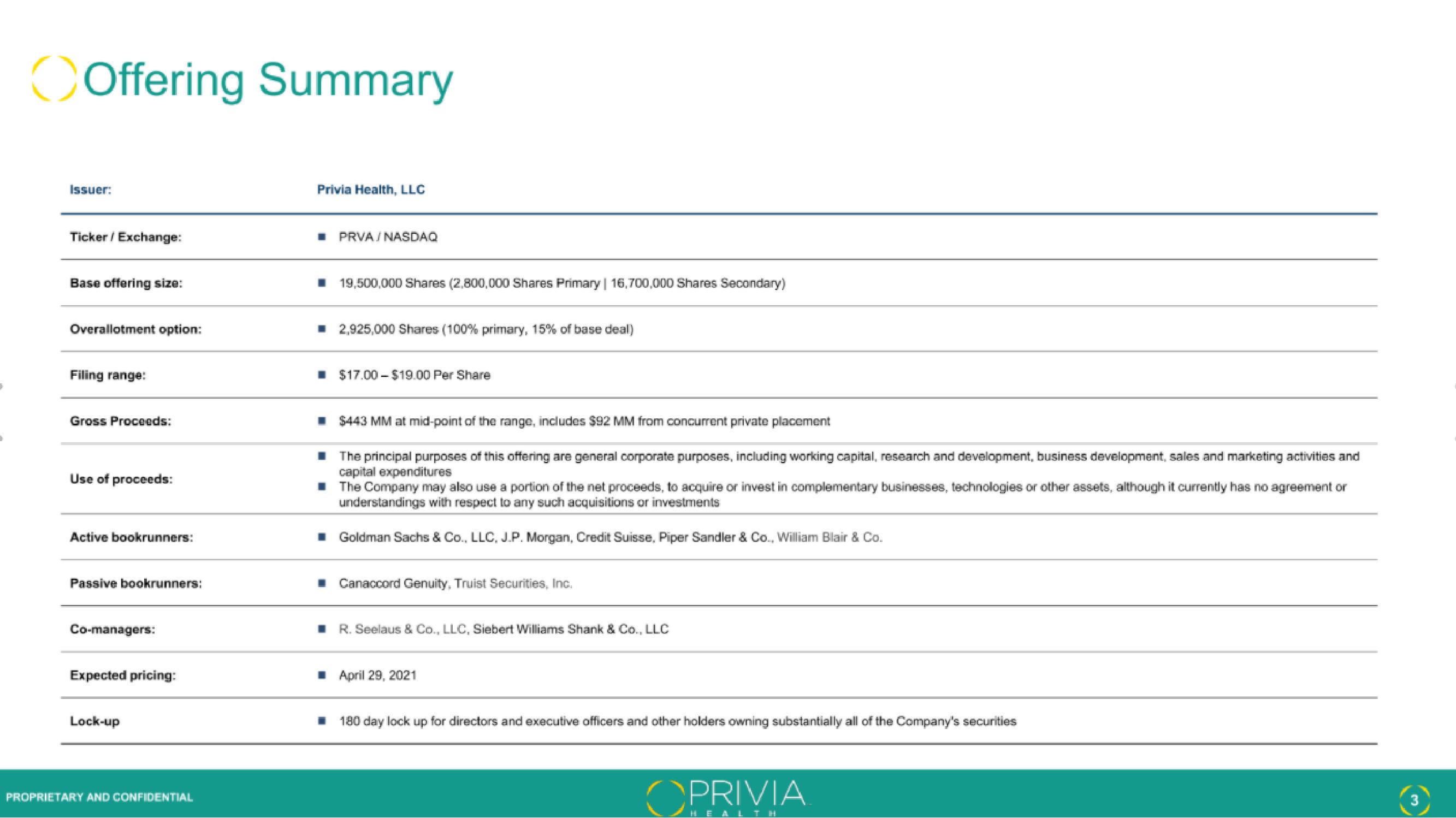

Offering Summary

Issuer:

Ticker / Exchange:

Base offering size:

Overallotment option:

Filing range:

Gross Proceeds:

Use of proceeds:

Active bookrunners:

Passive bookrunners:

Co-managers:

Expected pricing:

Lock-up

PROPRIETARY AND CONFIDENTIAL

Privia Health, LLC

■ PRVA/NASDAQ

☐ 19,500,000 Shares (2,800,000 Shares Primary | 16,700,000 Shares Secondary)

■ 2,925,000 Shares (100% primary, 15% of base deal)

■ $17.00-$19.00 Per Share

■ $443 MM at mid-point of the range, includes $92 MM from concurrent private placement

■

The principal purposes of this offering are general corporate purposes, including working capital, research and development, business development, sales and marketing activities and

capital expenditures

The Company may also use a portion of the net proceeds, to acquire or invest in complementary businesses, technologies or other assets, although it currently has no agreement or

understandings with respect to any such acquisitions or investments

■ Goldman Sachs & Co., LLC, J.P. Morgan, Credit Suisse, Piper Sandler & Co., William Blair & Co.

■Canaccord Genuity, Truist Securities, Inc.

■ R. Seelaus & Co., LLC, Siebert Williams Shank & Co., LLC

April 29, 2021

☐ 180 day lock up for directors and executive officers and other holders owning substantially all of the Company's securities

OPRIVIA

3View entire presentation