Pathward Financial Results Presentation Deck

COMMERCIAL FINANCE LOAN AND LEASE PORTFOLIO

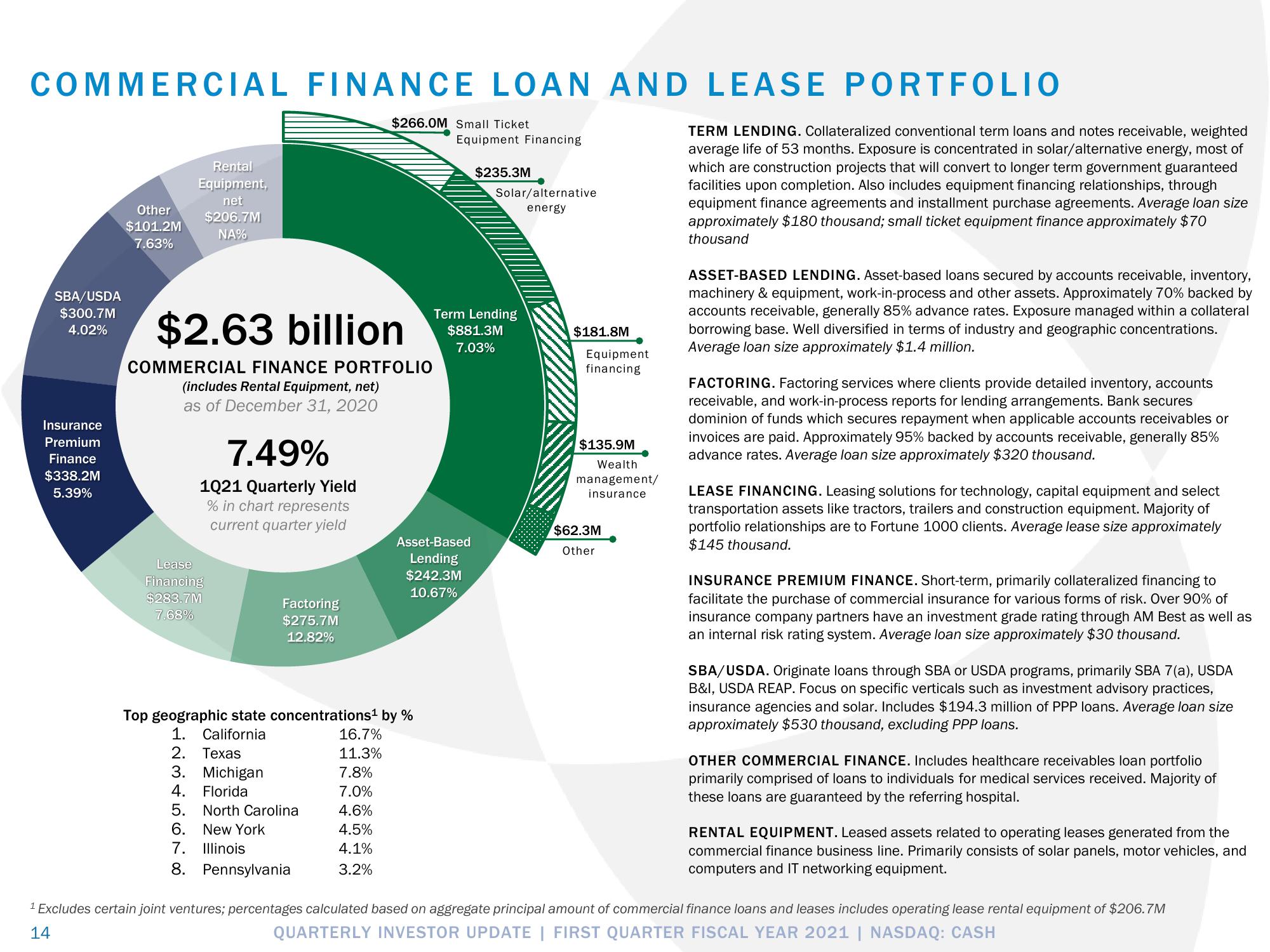

SBA/USDA

$300.7M

4.02%

Insurance

Premium

Finance

$338.2M

5.39%

Other

$101.2M

7.63%

Rental

Equipment,

net

$206.7M

NA%

$2.63 billion

COMMERCIAL FINANCE PORTFOLIO

(includes Rental Equipment, net)

as of December 31, 2020

7.49%

1021 Quarterly Yield

% in chart represents

current quarter yield

Lease

Financing

$283.7M

7.68%

Factoring

$275.7M

12.82%

$266.0M Small Ticket

16.7%

11.3%

7.8%

7.0%

4.6%

4.5%

4.1%

3.2%

Top geographic state concentrations¹ by %

1. California

2. Texas

3. Michigan

4. Florida

5. North Carolina

6. New York

7. Illinois

8. Pennsylvania

Equipment Financing

Asset-Based

Lending

$242.3M

10.67%

$235.3M

Solar/alternative

energy

Term Lending

$881.3M

7.03%

$181.8M

Equipment

financing

$135.9M

Wealth

management/

insurance

$62.3M

Other

TERM LENDING. Collateralized conventional term loans and notes receivable, weighted

average life of 53 months. Exposure is concentrated in solar/alternative energy, most of

which are construction projects that will convert to longer term government guaranteed

facilities upon completion. Also includes equipment financing relationships, through

equipment finance agreements and installment purchase agreements. Average loan size

approximately $180 thousand; small ticket equipment finance approximately $70

thousand

ASSET-BASED LENDING. Asset-based loans secured by accounts receivable, inventory,

machinery & equipment, ork-in-process and other assets. Approximately 70% backed by

accounts receivable, generally 85% advance rates. Exposure managed within a collateral

borrowing base. Well diversified in terms of industry and geographic concentrations.

Average loan size approximately $1.4 million.

FACTORING. Factoring services where clients provide detailed inventory, accounts

receivable, and work-in-process reports for lending arrangements. Bank secures

dominion of funds which secures repayment when applicable accounts receivables or

invoices are paid. Approximately 95% backed by accounts receivable, generally 85%

advance rates. Average loan size approximately $320 thousand.

LEASE FINANCING. Leasing solutions for technology, capital equipment and select

transportation assets like tractors, trailers and construction equipment. Majority of

portfolio relationships are to Fortune 1000 clients. Average lease size approximately

$145 thousand.

INSURANCE PREMIUM FINANCE. Short-term, primarily collateralized financing to

facilitate the purchase of commercial insurance for various forms of risk. Over 90% of

insurance company partners have an investment grade rating through AM Best as well as

an internal risk rating system. Average loan size approximately $30 thousand.

SBA/USDA. Originate loans through SBA or USDA programs, primarily SBA 7(a), USDA

B&I, USDA REAP. Focus on specific verticals such as investment advisory practices,

insurance agencies and solar. Includes $194.3 million of PPP loans. Average loan size

approximately $530 thousand, excluding PPP loans.

OTHER COMMERCIAL FINANCE. Includes healthcare receivables loan portfolio

primarily comprised of loans to individuals for medical services received. Majority of

these loans are guaranteed by the referring hospital.

RENTAL EQUIPMENT. Leased assets related to operating leases generated from the

commercial finance business line. Primarily consists of solar panels, motor vehicles, and

computers and IT networking equipment.

¹ Excludes certain joint ventures; percentages calculated based on aggregate principal amount of commercial finance loans and leases includes operating lease rental equipment of $206.7M

14

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASHView entire presentation