Affirm Results Presentation Deck

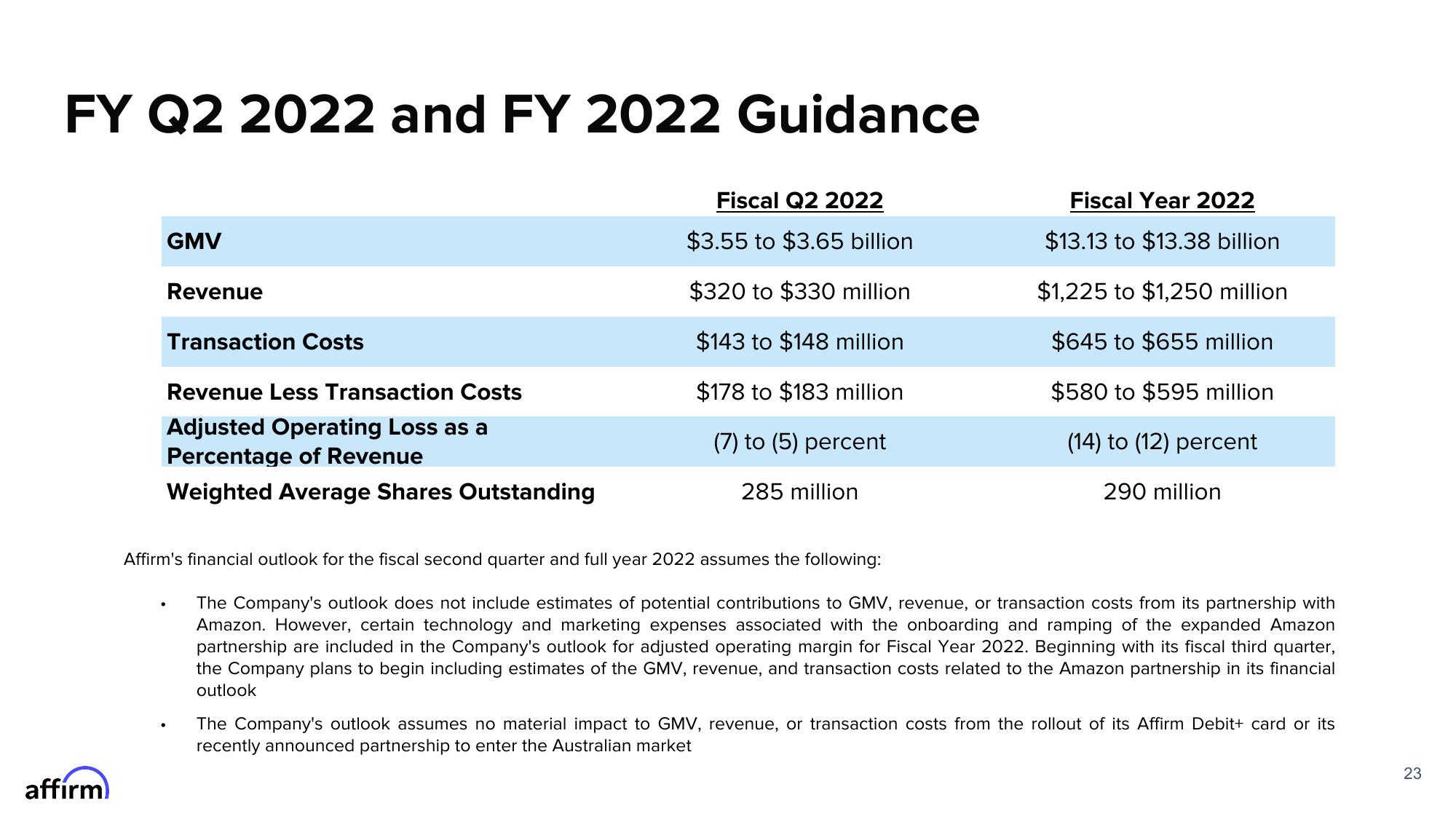

FY Q2 2022 and FY 2022 Guidance

Fiscal Q2 2022

$3.55 to $3.65 billion

$320 to $330 million

$143 to $148 million

$178 to $183 million

(7) to (5) percent

285 million

affirm

GMV

Revenue

Transaction Costs

Revenue Less Transaction Costs

Adjusted Operating Loss as a

Percentage of Revenue

Weighted Average Shares Outstanding

Fiscal Year 2022

$13.13 to $13.38 billion

$1,225 to $1,250 million

$645 to $655 million

$580 to $595 million

(14) to (12) percent

290 million

Affirm's financial outlook for the fiscal second quarter and full year 2022 assumes the following:

The Company's outlook does not include estimates of potential contributions to GMV, revenue, or transaction costs from its partnership with

Amazon. However, certain technology and marketing expenses associated with the onboarding and ramping of the expanded Amazon

partnership are included in the Company's outlook for adjusted operating margin for Fiscal Year 2022. Beginning with its fiscal third quarter,

the Company plans to begin including estimates of the GMV, revenue, and transaction costs related to the Amazon partnership in its financial

outlook

The Company's outlook assumes no material impact to GMV, revenue, or transaction costs from the rollout of its Affirm Debit+ card or its

recently announced partnership to enter the Australian market

23View entire presentation