Otonomo SPAC Presentation Deck

Transaction Summary

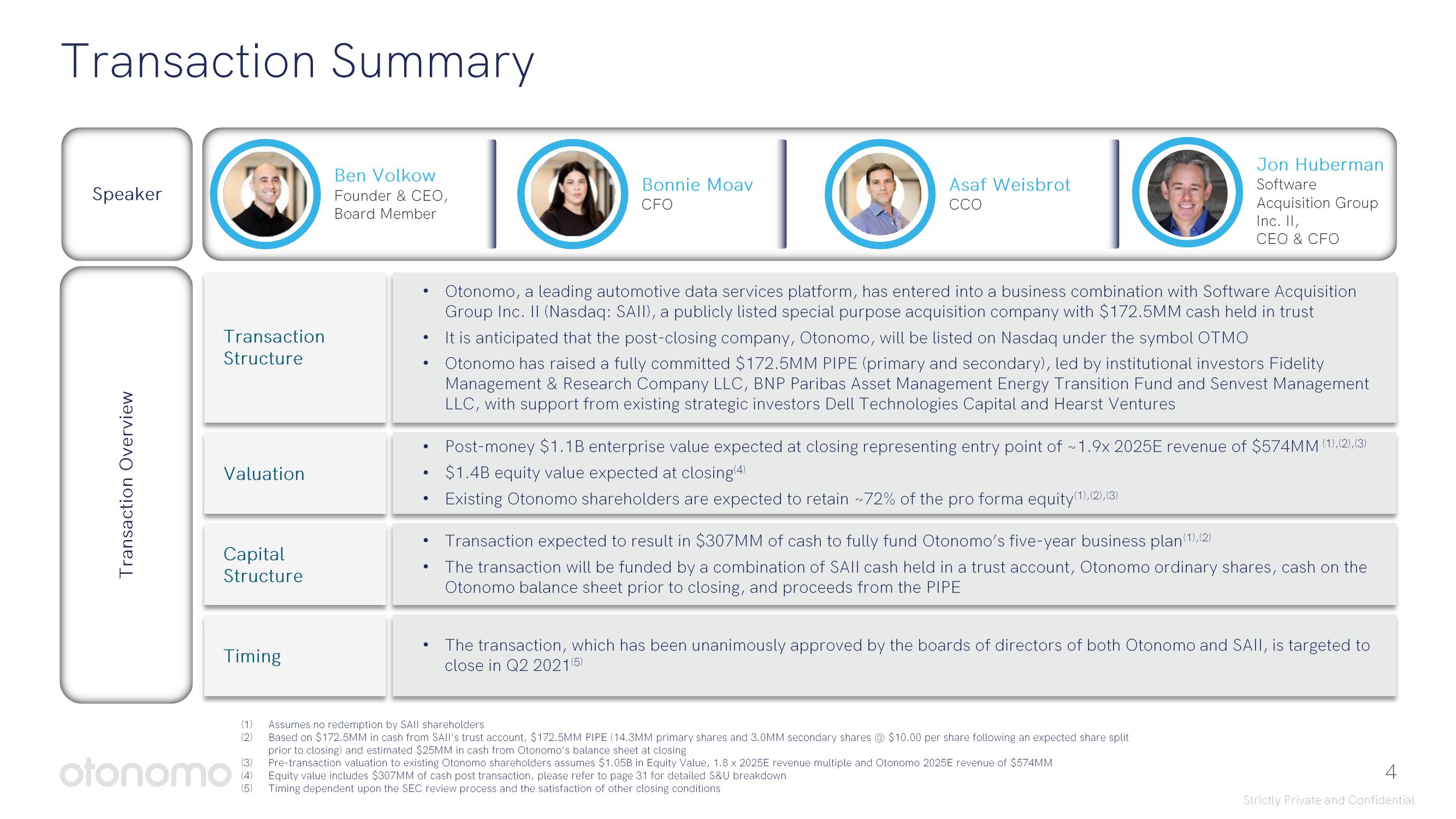

Speaker

Transaction Overview

Transaction

Structure

Valuation

Capital

Structure

Timing

otonomo

(1)

(2)

(3)

(4)

(5)

Ben Volkow

Founder & CEO,

Board Member

●

●

●

●

●

●

●

Bonnie Moav

CFO

Asaf Weisbrot

CCO

Jon Huberman

Software

Acquisition Group

Inc. II,

CEO & CFO

Otonomo, a leading automotive data services platform, has entered into a business combination with Software Acquisition

Group Inc. II (Nasdaq: SAII), a publicly listed special purpose acquisition company with $172.5MM cash held in trust

It is anticipated that the post-closing company, Otonomo, will be listed on Nasdaq under the symbol OTMO

Otonomo has raised a fully committed $172.5MM PIPE (primary and secondary), led by institutional investors Fidelity

Management & Research Company LLC, BNP Paribas Asset Management Energy Transition Fund and Senvest Management

LLC, with support from existing strategic investors Dell Technologies Capital and Hearst Ventures

Post-money $1.1B enterprise value expected at closing representing entry point of ~1.9x 2025E revenue of $574MM (1), (2),(3)

$1.4B equity value expected at closing(4)

Existing Otonomo shareholders are expected to retain ~72% of the pro forma equity(1), (2), (3)

Transaction expected to result in $307MM of cash to fully fund Otonomo's five-year business plan (1), (2)

The transaction will be funded by a combination of SAll cash held in a trust account, Otonomo ordinary shares, cash on the

Otonomo balance sheet prior to closing, and proceeds from the PIPE

The transaction, which has been unanimously approved by the boards of directors of both Otonomo and SAII, is targeted to

close in Q2 2021(5)

Assumes no redemption by SAII shareholders

Based on $172.5MM in cash from SAII's trust account, $172.5MM PIPE (14.3MM primary shares and 3.0MM secondary shares @ $10.00 per share following an expected share split

prior to closing) and estimated $25MM in cash from Otonomo's balance sheet at closing

Pre-transaction valuation to existing Otonomo shareholders assumes $1.05B in Equity Value, 1.8 x 2025E revenue multiple and Otonomo 2025E revenue of $574MM

Equity value includes $307MM of cash post transaction, please refer to page 31 for detailed S&U breakdown

Timing dependent upon the SEC review process and the satisfaction of other closing conditions

4

Strictly Private and ConfidentialView entire presentation