Meta Shareholder Engagement Presentation Deck

Shareholder Proposals

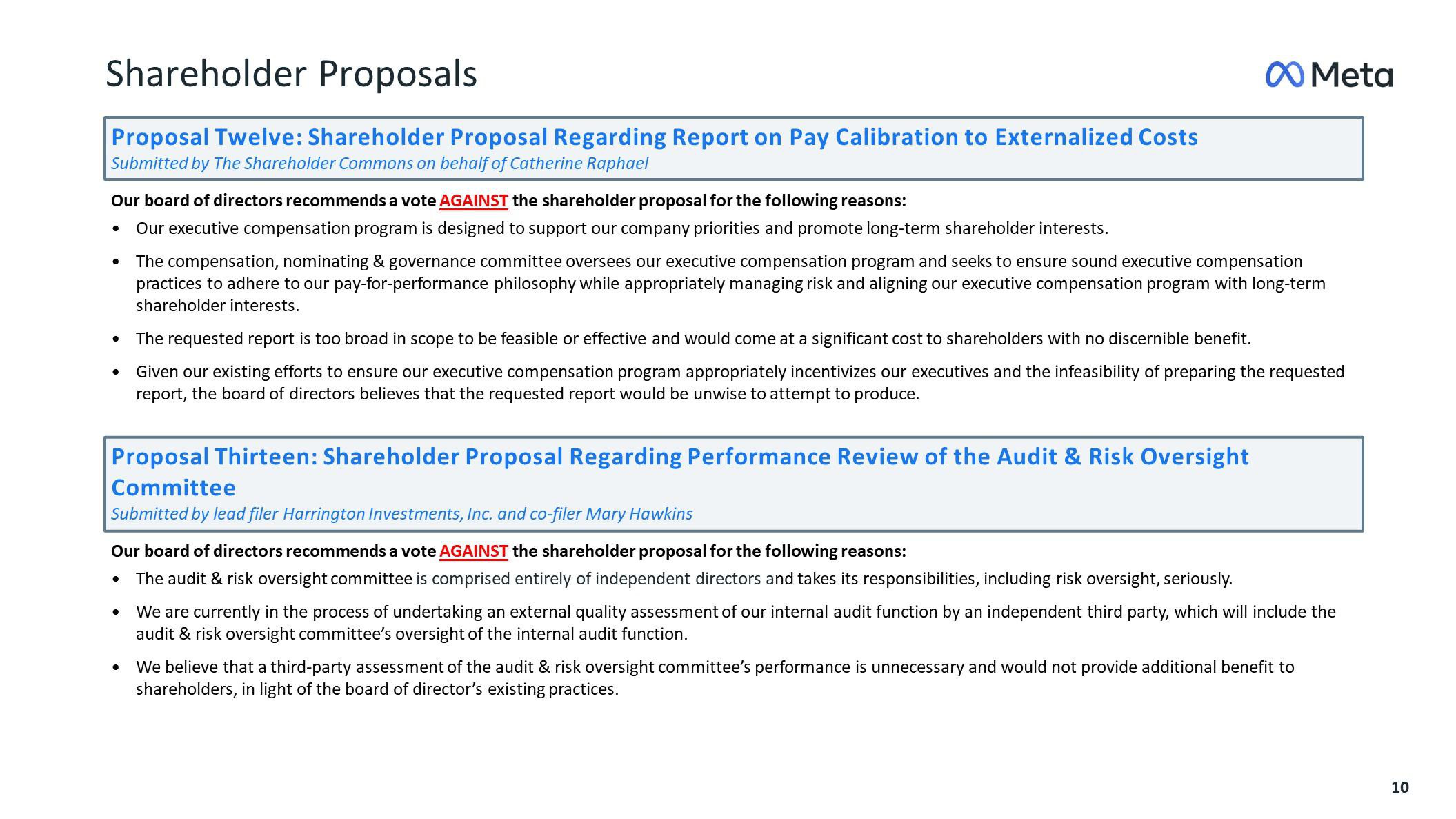

Proposal Twelve: Shareholder Proposal Regarding Report on Pay Calibration to Externalized Costs

Submitted by The Shareholder Commons on behalf of Catherine Raphael

Our board of directors recommends a vote AGAINST the shareholder proposal for the following reasons:

Our executive compensation program is designed to support our company priorities and promote long-term shareholder interests.

●

●

●

●

Proposal Thirteen: Shareholder Proposal Regarding Performance Review of the Audit & Risk Oversight

Committee

Submitted by lead filer Harrington Investments, Inc. and co-filer Mary Hawkins

Our board of directors recommends a vote AGAINST the shareholder proposal for the following reasons:

The audit & risk oversight committee is comprised entirely of independent directors and takes its responsibilities, including risk oversight, seriously.

●

●

The compensation, nominating & governance committee oversees our executive compensation program and seeks to ensure sound executive compensation

practices to adhere to our pay-for-performance philosophy while appropriately managing risk and aligning our executive compensation program with long-term

shareholder interests.

Meta

The requested report is too broad in scope to be feasible or effective and would come at a significant cost to shareholders with no discernible benefit.

Given our existing efforts to ensure our executive compensation program appropriately incentivizes our executives and the infeasibility of preparing the requested

report, the board of directors believes that the requested report would be unwise to attempt to produce.

We are currently in the process of undertaking an external quality assessment of our internal audit function by an independent third party, which will include the

audit & risk oversight committee's oversight of the internal audit function.

We believe that a third-party assessment of the audit & risk oversight committee's performance is unnecessary and would not provide additional benefit to

shareholders, in light of the board of director's existing practices.

10View entire presentation