BenevolentAI Investor Conference Presentation Deck

H1 2023 Financial highlights

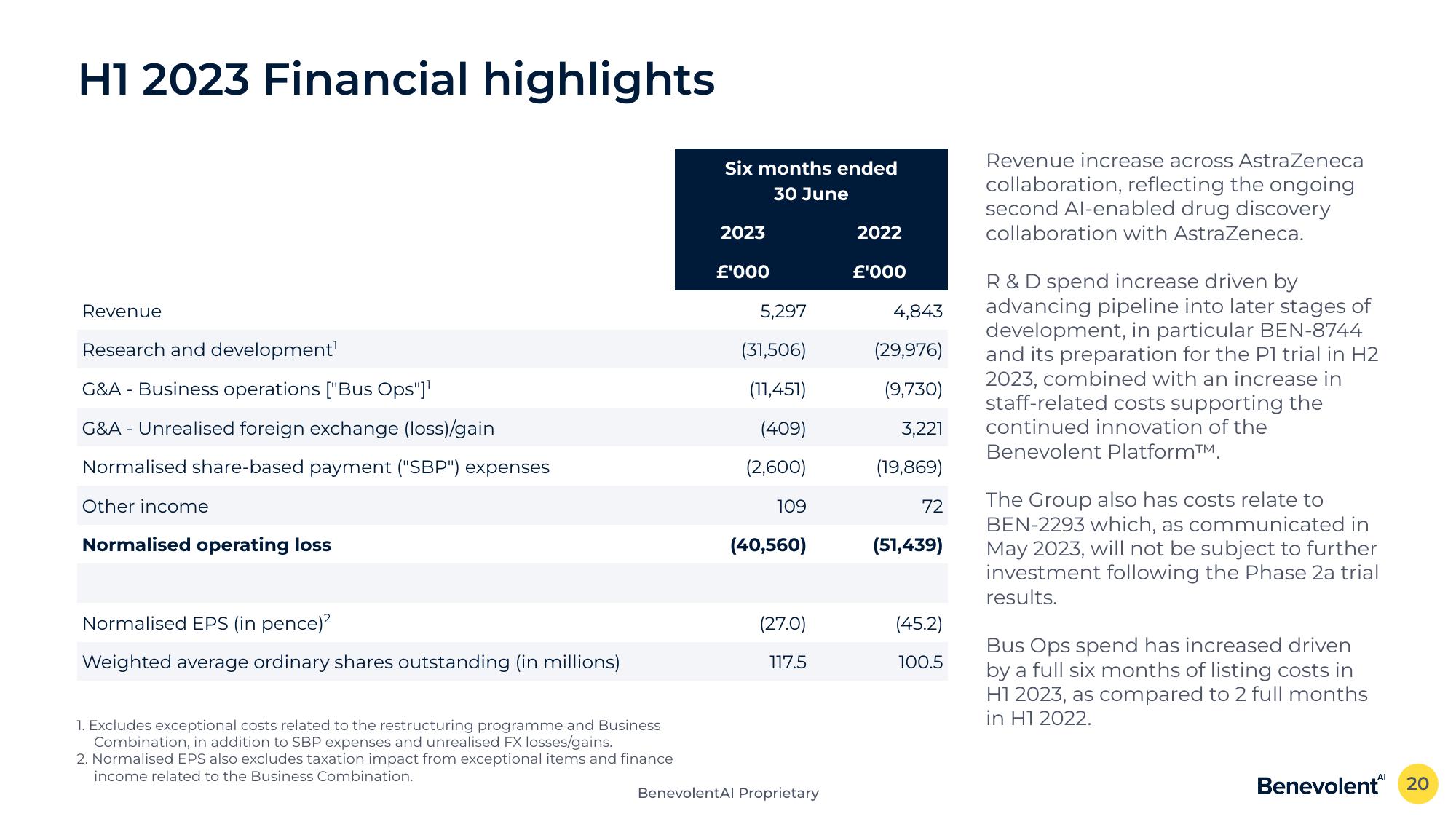

Revenue

Research and development¹

G&A - Business operations ["Bus Ops"]¹

G&A - Unrealised foreign exchange (loss)/gain

Normalised share-based payment ("SBP") expenses

Other income

Normalised operating loss

Normalised EPS (in pence)²

Weighted average ordinary shares outstanding (in millions)

1. Excludes exceptional costs related to the restructuring programme and Business

Combination, in addition to SBP expenses and unrealised FX losses/gains.

2. Normalised EPS also excludes taxation impact from exceptional items and finance

income related to the Business Combination.

Six months ended

30 June

2023

£'000

5,297

(31,506)

(11,451)

(409)

(2,600)

109

(40,560)

(27.0)

117.5

BenevolentAl Proprietary

2022

£'000

4,843

(29,976)

(9,730)

3,221

(19,869)

72

(51,439)

(45.2)

100.5

Revenue increase across AstraZeneca

collaboration, reflecting the ongoing

second Al-enabled drug discovery

collaboration with AstraZeneca.

R & D spend increase driven by

advancing pipeline into later stages of

development, in particular BEN-8744

and its preparation for the P1 trial in H2

2023, combined with an increase in

staff-related costs supporting the

continued innovation of the

Benevolent Platform™.

The Group also has costs relate to

BEN-2293 which, as communicated in

May 2023, will not be subject to further

investment following the Phase 2a trial

results.

Bus Ops spend has increased driven

by a full six months of listing costs in

H1 2023, as compared to 2 full months

in H1 2022.

Benevolent 20View entire presentation