J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

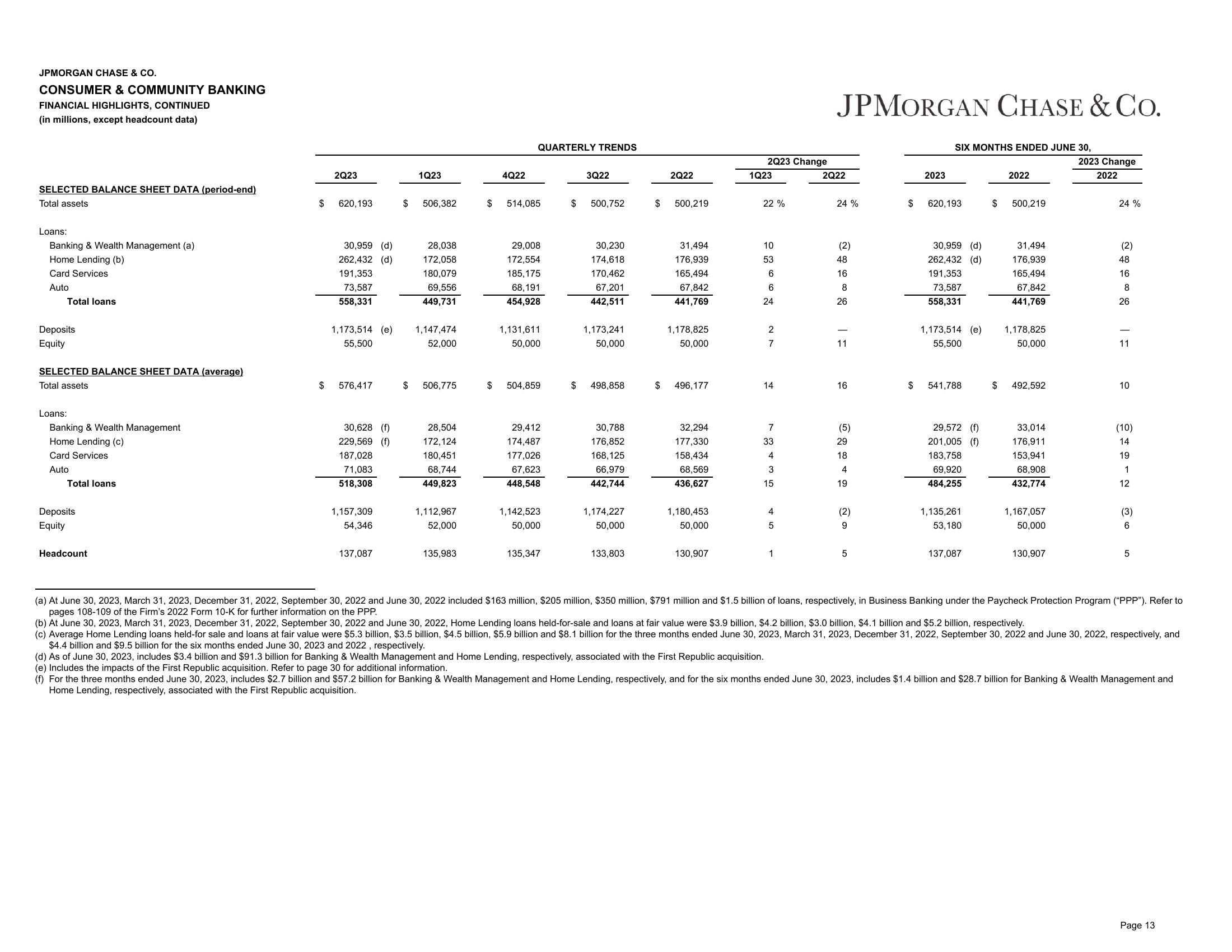

CONSUMER & COMMUNITY BANKING

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except headcount data)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans:

Banking & Wealth Management (a)

Home Lending (b)

Card Services

Auto

Total loans

Deposits

Equity

SELECTED BALANCE SHEET DATA (average)

Total assets

Loans:

Banking & Wealth Management

Home Lending (c)

Card Services

Auto

Total loans

Deposits

Equity

Headcount

2Q23

$ 620,193

$

30,959 (d)

262,432 (d)

191,353

73,587

558,331

576,417

30,628 (f)

229,569 (f)

187,028

71,083

518,308

1,173,514 (e) 1,147,474

55,500

52,000

1,157,309

54,346

1Q23

137,087

$ 506,382

28,038

172,058

180,079

69,556

449,731

$ 506,775

28,504

172,124

180,451

68,744

449,823

1,112,967

52,000

135,983

4Q22

QUARTERLY TRENDS

$ 514,085

29,008

172,554

185,175

68,191

454,928

1,131,611

50,000

$ 504,859

29,412

174,487

177,026

67,623

448,548

1,142,523

50,000

135,347

$

3Q22

500,752

30,230

174,618

170,462

67,201

442,511

1,173,241

50,000

$ 498,858

30,788

176,852

168,125

66,979

442,744

1,174,227

50,000

133,803

$

2Q22

500,219

31,494

176,939

165,494

67,842

441,769

1,178,825

50,000

$ 496,177

32,294

177,330

158,434

68,569

436,627

1,180,453

50,000

130,907

2Q23 Change

1Q23

22 %

10

53

6

6

24

2

7

14

7

33

4

3

15

4

5

1

JPMORGAN CHASE & Co.

2Q22

24%

(2)

48

16

8

26

11

16

(5)

29

18

4

19

(2)

9

5

2023

SIX MONTHS ENDED JUNE 30,

$ 620,193

30,959 (d)

262,432 (d)

191,353

73,587

558,331

1,173,514 (e)

55,500

$ 541,788

29,572 (f)

201,005 (f)

183,758

69,920

484,255

1,135,261

53,180

137,087

2022

$ 500,219

$

31,494

176,939

165,494

67,842

441,769

1,178,825

50,000

492,592

33,014

176,911

153,941

68,908

432,774

1,167,057

50,000

130,907

2023 Change

2022

24 %

(2)

48

16

8

26

11

10

(10)

14

19

1

12

(3)

6

5

(a) At June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022 included $163 million, $205 million, $350 million, $791 million and $1.5 billion of loans, respectively, in Business Banking under the Paycheck Protection Program ("PPP"). Refer to

pages 108-109 of the Firm's 2022 Form 10-K for further information on the PPP.

(b) At June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, Home Lending loans held-for-sale and loans at fair value were $3.9 billion, $4.2 billion, $3.0 billion, $4.1 billion and $5.2 billion, respectively.

(c) Average Home Lending loans held-for sale and loans at fair value were $5.3 billion, $3.5 billion, $4.5 billion, $5.9 billion and $8.1 billion for the three months ended June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, respectively, and

$4.4 billion and $9.5 billion for the six months ended June 30, 2023 and 2022, respectively.

(d) As of June 30, 2023, includes $3.4 billion and $91.3 billion for Banking & Wealth Management and Home Lending, respectively, associated with the First Republic acquisition.

(e) Includes the impacts of the First Republic acquisition. Refer to page 30 for additional information.

(f) For the three months ended June 30, 2023, includes $2.7 billion and $57.2 billion for Banking & Wealth Management and Home Lending, respectively, and for the six months ended June 30, 2023, includes $1.4 billion and $28.7 billion for Banking & Wealth Management and

Home Lending, respectively, associated with the First Republic acquisition.

Page 13View entire presentation