Hanmi Financial Results Presentation Deck

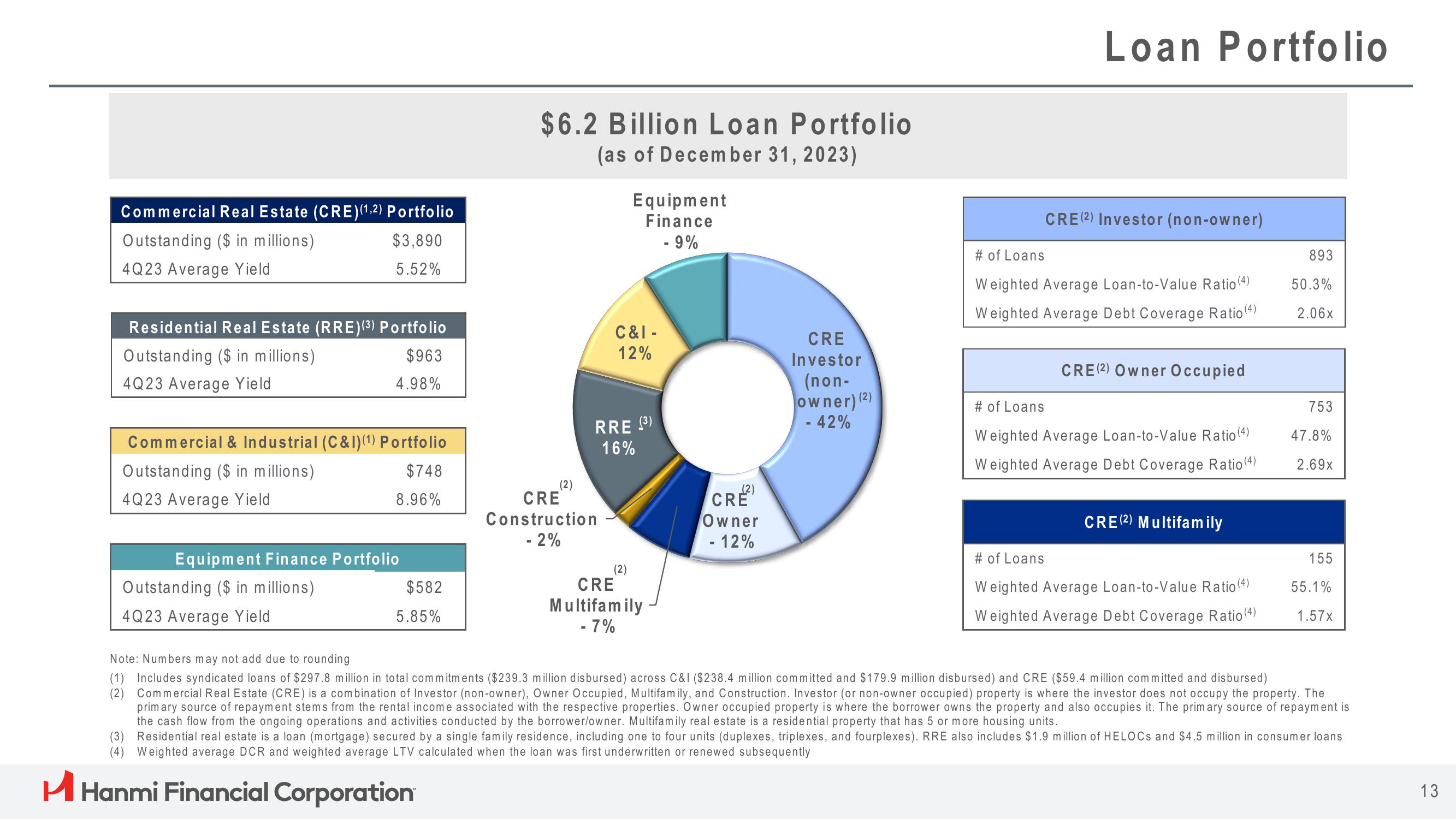

Commercial Real Estate (CRE) (1,2) Portfolio

Outstanding ($ in millions)

$3,890

4Q23 Average Yield

5.52%

Residential Real Estate (RRE) (³) Portfolio

Outstanding ($ in millions)

$963

4Q23 Average Yield

4.98%

Commercial & Industrial (C&I) (¹) Portfolio

Outstanding ($ in millions)

$748

4Q23 Average Yield

8.96%

Equipment Finance Portfolio

Outstanding ($ in millions)

4Q23 Average Yield

$582

5.85%

$6.2 Billion Loan Portfolio

(as of December 31, 2023)

Equipment

Finance

- 9%

(2)

CRE

Construction

- 2%

C&I-

12%

RRE (3)

16%

(2)

CRE

Multifamily

-7%

(2)

CRE

Owner

- 12%

CRE

Investor

(non-

owner) (2)

- 42%

Loan Portfolio

CRE (2) Investor (non-owner)

# of Loans

Weighted Average Loan-to-Value Ratio (4)

Weighted Average Debt Coverage Ratio (4)

CRE (2) Owner Occupied

# of Loans

Weighted Average Loan-to-Value Ratio (4)

Weighted Average Debt Coverage Ratio (4)

CRE (2) Multifamily

# of Loans

Weighted Average Loan-to-Value Ratio (4)

Weighted Average Debt Coverage Ratio (4)

893

50.3%

2.06x

753

47.8%

2.69x

155

55.1%

1.57x

Note: Numbers may not add due to rounding

(1) Includes syndicated loans of $297.8 million in total commitments ($239.3 million disbursed) across C&I ($238.4 million committed and $179.9 million disbursed) and CRE ($59.4 million committed and disbursed)

(2) Commercial Real Estate (CRE) is a combination of Investor (non-owner), Owner Occupied, Multifamily, and Construction. Investor (or non-owner occupied) property is where the investor does not occupy the property. The

primary source of repayment stems from the rental income associated with the respective properties. Owner occupied property is where the borrower owns the property and also occupies it. The primary source of repayment is

the cash flow from the ongoing operations and activities conducted by the borrower/owner. Multifamily real estate is a residential property that has 5 or more housing units.

(3) Residential real estate is a loan (mortgage) secured by a single family residence, including one to four units (duplexes, triplexes, and fourplexes). RRE also includes $1.9 million of HELOCs and $4.5 million in consumer loans

(4) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently

H Hanmi Financial Corporation

13View entire presentation