Grindr Investor Presentation Deck

19

5

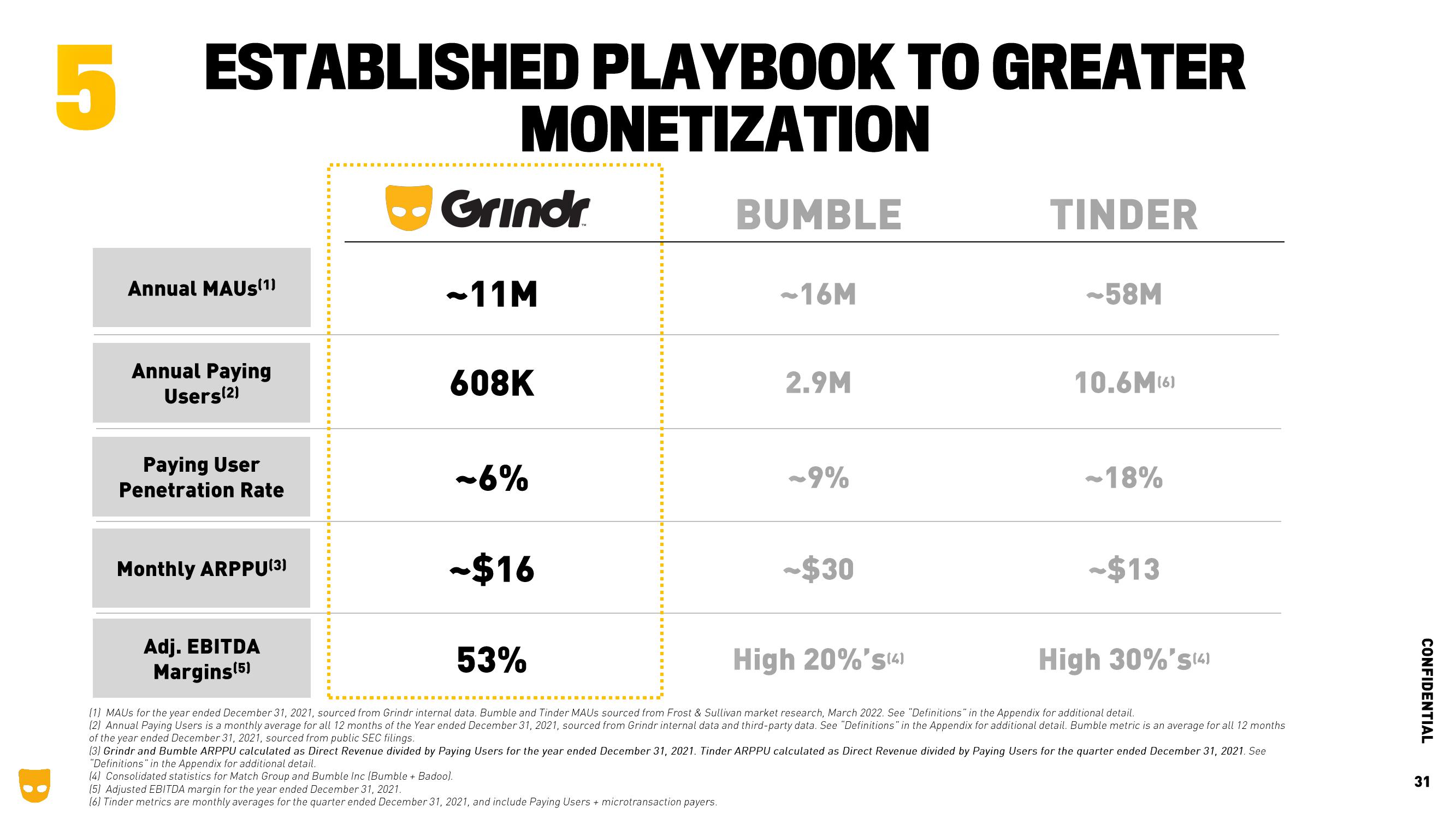

ESTABLISHED PLAYBOOK TO GREATER

MONETIZATION

Annual MAUS(1)

Annual Paying

Users(2)

Paying User

Penetration Rate

Monthly ARPPU(3)

Adj. EBITDA

Margins (5)

I

■

n

W

■

I

·

W

I

■

H

W

1

B

"

■

·

■

I

·

■

W

.

■

Grindr

-11M

608K

~6%

-$16

‒‒‒‒‒‒‒‒‒‒

53%

■

■

H

W

■

■

"

■

H

A

■

H

■

H

D

■

■

"

H

■

■

H

H

■

H

.

H

A

D

D

"

■

H

H

D

M

BUMBLE

-16M

(5) Adjusted EBITDA margin for the year ended December 31, 2021.

(6) Tinder metrics are monthly averages for the quarter ended December 31, 2021, and include Paying Users + microtransaction payers.

2.9M

~9%

-$30

High 20%'s(4)

TINDER

-58M

10.6M(6)

-18%

-$13

High 30%'s(4)

(1) MAUS for the year ended December 31, 2021, sourced from Grindr internal data. Bumble and Tinder MAUS sourced from Frost & Sullivan market research, March 2022. See "Definitions" in the Appendix for additional detail.

(2) Annual Paying Users is a monthly average for all 12 months of the Year ended December 31, 2021, sourced from Grindr internal data and third-party data. See "Definitions" in the Appendix for additional detail. Bumble metric is an average for all 12 months

of the year ended December 31, 2021, sourced from public SEC filings.

(3) Grindr and Bumble ARPPU calculated as Direct Revenue divided by Paying Users for the year ended December 31, 2021. Tinder ARPPU calculated as Direct Revenue divided by Paying Users for the quarter ended December 31, 2021. See

"Definitions" in the Appendix for additional detail.

(4) Consolidated statistics for Match Group and Bumble Inc (Bumble + Badoo).

CONFIDENTIAL

31View entire presentation