Nauticus SPAC Presentation Deck

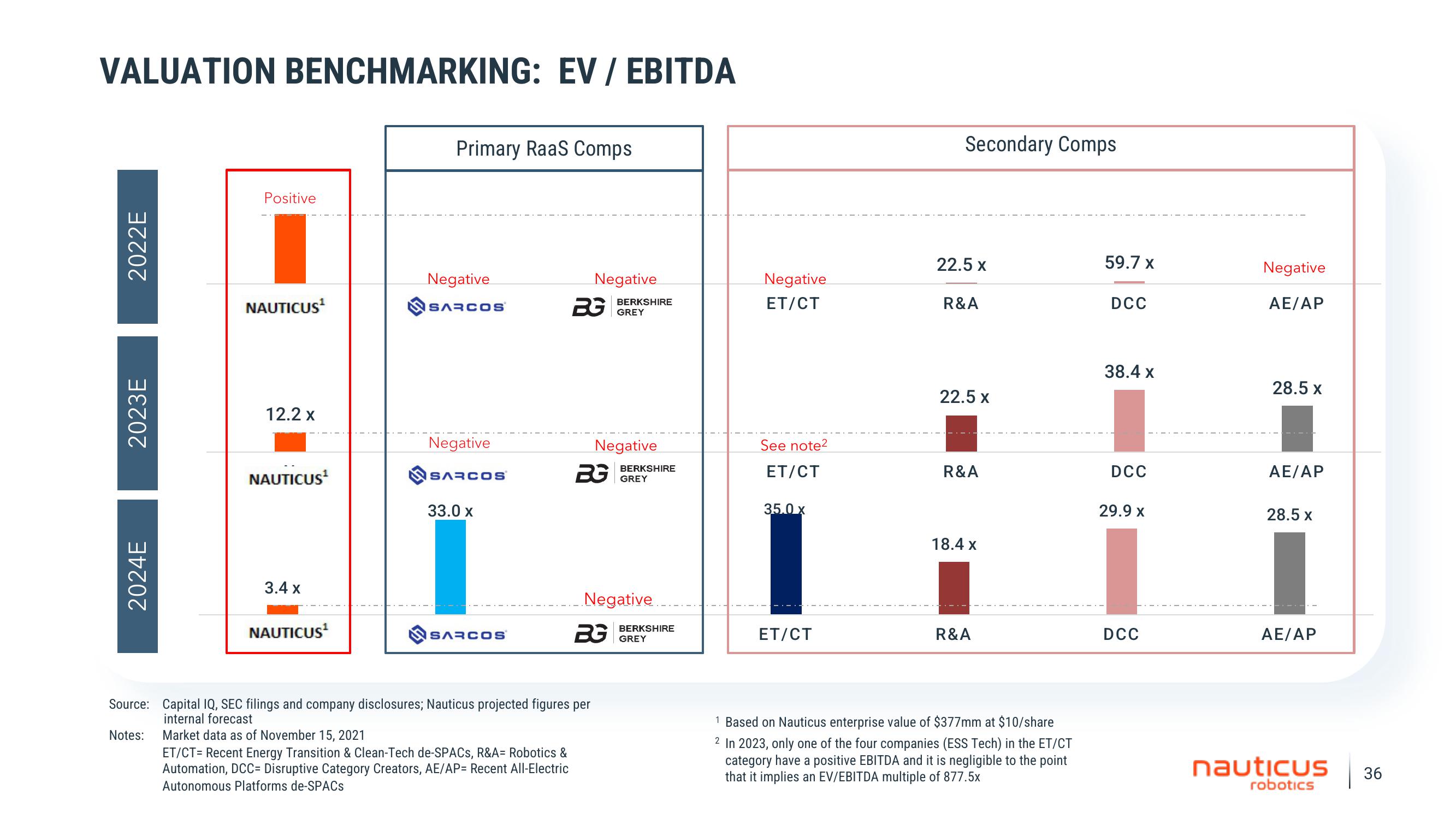

VALUATION BENCHMARKING: EV / EBITDA

2022E

2023E

2024E

Positive

NAUTICUS¹

12.2 x

NAUTICUS¹

3.4 x

NAUTICUS¹

Primary RaaS Comps

Negative

sAacos

Negative

sAacos

33.0 x

sAacos

Negative

BG

BG

Source: Capital IQ, SEC filings and company disclosures; Nauticus projected figures per

internal forecast

Notes:

Market data as of November 15, 2021

ET/CT= Recent Energy Transition & Clean-Tech de-SPACS, R&A= Robotics &

Automation, DCC= Disruptive Category Creators, AE/AP= Recent All-Electric

Autonomous Platforms de-SPACS

BERKSHIRE

GREY

Negative

BERKSHIRE

GREY

Negative

BG

BERKSHIRE

GREY

Negative

ET/CT

See note2

ET/CT

35.0 x

ET/CT

Secondary Comps

22.5 x

R&A

22.5 x

R&A

18.4 x

R&A

1 Based on Nauticus enterprise value of $377mm at $10/share

2 In 2023, only one of the four companies (ESS Tech) in the ET/CT

category have a positive EBITDA and it is negligible to the point

that it implies an EV/EBITDA multiple of 877.5x

59.7 x

DCC

38.4 x

DCC

29.9 x

DCC

Negative

AE/AP

28.5 x

AE/AP

28.5 x

AE/AP

nauticus

robotics

36View entire presentation