Q2 2018 Fixed Income Investor Conference Call

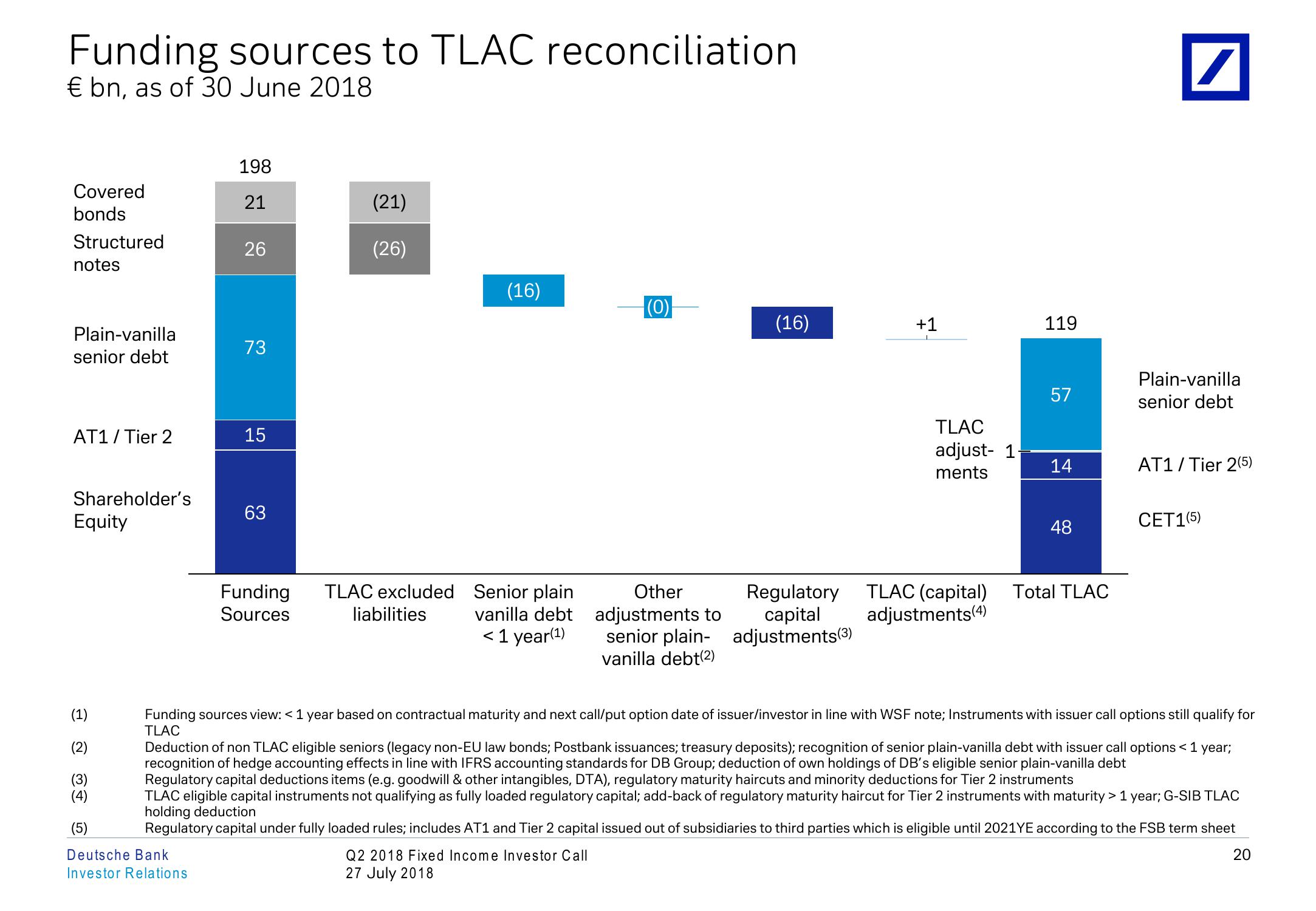

Funding sources to TLAC reconciliation.

€ bn, as of 30 June 2018

198

Covered

21

(21)

bonds

Structured

26

(26)

notes

(16)

(0)

(16)

+1

119

Plain-vanilla

73

senior debt

AT1 / Tier 2

15

Shareholder's

Equity

83

63

Funding

Sources

TLAC excluded Senior plain

liabilities

vanilla debt

< 1 year(1)

Other

adjustments to

senior plain-

vanilla debt(2)

Regulatory

capital

adjustments (3)

Plain-vanilla

57

senior debt

TLAC

adjust-1-

ments

14

AT1 Tier 2(5)

CET1(5)

48

TLAC (capital)

adjustments(4)

Total TLAC

(1)

(2)

(3)

(4)

(5)

Funding sources view: < 1 year based on contractual maturity and next call/put option date of issuer/investor in line with WSF note; Instruments with issuer call options still qualify for

TLAC

Deduction of non TLAC eligible seniors (legacy non-EU law bonds; Postbank issuances; treasury deposits); recognition of senior plain-vanilla debt with issuer call options < 1 year;

recognition of hedge accounting effects in line with IFRS accounting standards for DB Group; deduction of own holdings of DB's eligible senior plain-vanilla debt

Regulatory capital deductions items (e.g. goodwill & other intangibles, DTA), regulatory maturity haircuts and minority deductions for Tier 2 instruments

TLAC eligible capital instruments not qualifying as fully loaded regulatory capital; add-back of regulatory maturity haircut for Tier 2 instruments with maturity > 1 year; G-SIB TLAC

holding deduction

Regulatory capital under fully loaded rules; includes AT1 and Tier 2 capital issued out of subsidiaries to third parties which is eligible until 2021YE according to the FSB term sheet

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

20View entire presentation