Credit Suisse Investment Banking Pitch Book

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

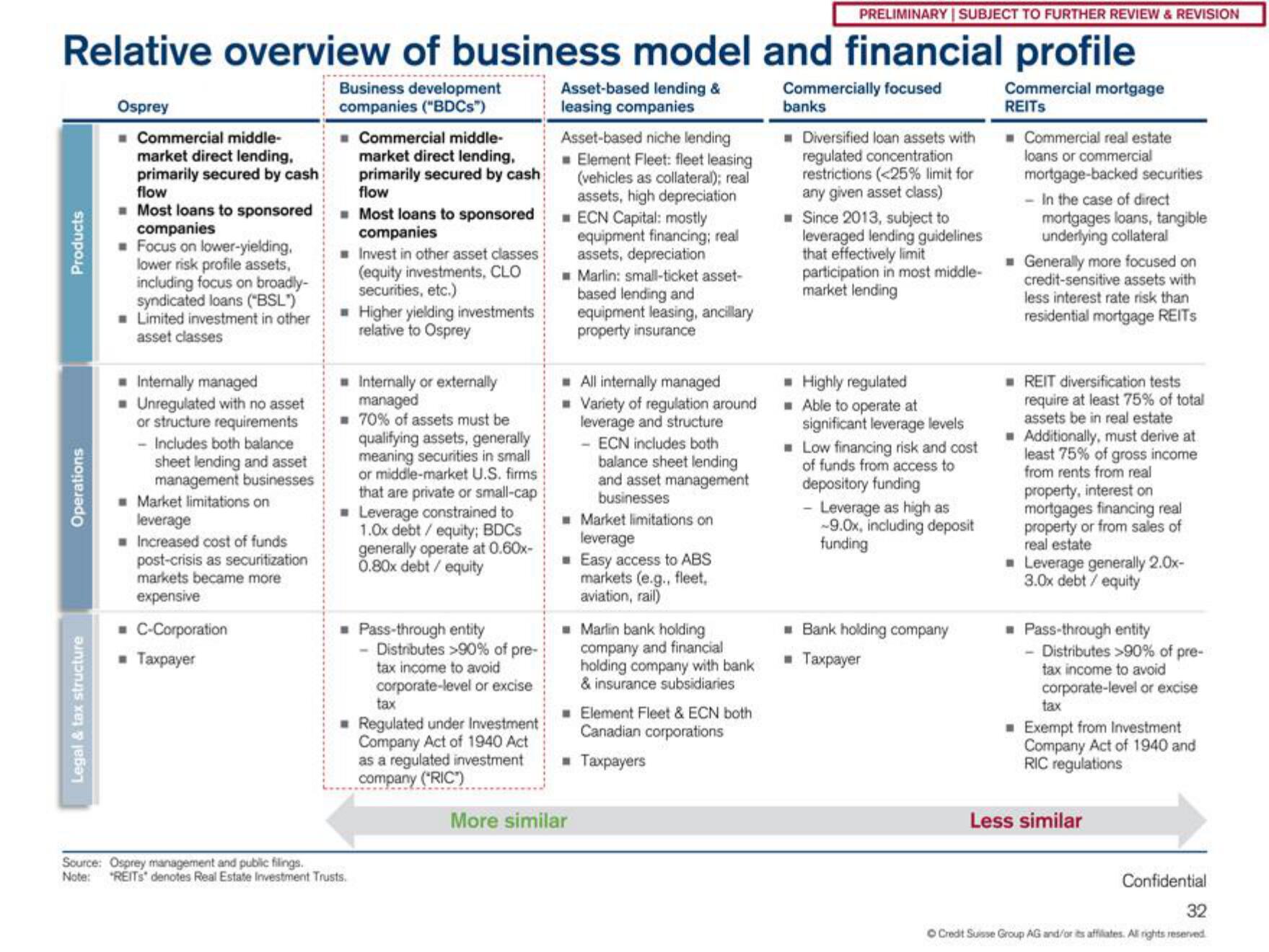

Relative overview of business model and financial profile

Osprey

Asset-based lending &

leasing companies

Commercially focused

banks

Products

Operations

Legal & tax structure

Commercial middle-

market direct lending,

primarily secured by cash

flow

■ Most loans to sponsored

companies

■ Focus on lower-yielding,

lower risk profile assets,

including focus on broadly-

syndicated loans (BSL)

■ Limited investment in other

asset classes

Internally managed

■ Unregulated with no asset

or structure requirements

- Includes both balance

sheet lending and asset

management businesses

■ Market limitations on

leverage

Increased cost of funds

post-crisis as securitization

markets became more

expensive

C-Corporation

■ Taxpayer

Business development

companies ("BDCs")

Commercial middle-

market direct lending,

primarily secured by cash

flow

Most loans to sponsored

companies

Invest in other asset classes

(equity investments, CLO

securities, etc.)

Source: Osprey management and public filings.

Note: "REITS denotes Real Estate Investment Trusts.

Higher yielding investments

relative to Osprey

Internally or externally

managed

■ 70% of assets must be

qualifying assets, generally

meaning securities in small

or middle-market U.S. firms

that are private or small-cap

Leverage constrained to

1.0x debt / equity; BDCs

generally operate at 0.60x-

0.80x debt / equity

Pass-thro entity

- Distributes >90% of pre-

tax income to avoid

corporate-level or excise

tax

Regulated under Investment

Company Act of 1940 Act

as a regulated investment

company ("RIC")

Asset-based niche lending

Element Fleet: fleet leasing

(vehicles as collateral); real

assets, high depreciation

■ ECN Capital: mostly

equipment financing; real

assets, depreciation

Marlin: small-ticket asset-

based lending and

equipment leasing, ancillary

property insurance

All internally managed

Variety of regulation around

leverage and structure

- ECN includes both

balance sheet lending

and asset management

businesses

Market limitations on

leverage

Easy access to ABS

markets (e.g., fleet,

aviation, rail)

☐ Marlin bank lding

company and financial

holding company with bank

& insurance subsidiaries

■ Element Fleet & ECN both

Canadian corporations

■ Taxpayers

More similar

■ Diversified loan assets with

regulated concentration

restrictions (<25% limit for

any given asset class)

■ Since 2013, subject to

leveraged lending guidelines

that effectively limit

participation in most middle-

market lending

Highly regulated

■ Able to operate at

significant leverage levels

☐ Low financing risk and cost

of funds from access to

depository funding

- Leverage as high as

-9.0x, including deposit

funding

Bank holding company

■ Taxpayer

Commercial mortgage

REITS

Commercial real estate

loans or commercial

mortgage-backed securities

- In the case of direct

mortgages loans, tangible

underlying collateral

Generally more focused on

credit-sensitive assets with

less interest rate risk than

residential mortgage REITS

■ REIT diversification tests

require at least 75% of total

assets be in real estate

Additionally, must derive at

least 75% of gross income

from rents from real

property, interest on

mortgages financing real

property or from sales of

real estate

☐ Leverage generally 2.0x-

3.0x debt / equity

Pass-through entity

- Distributes >90% of pre-

tax income to avoid

corporate-level or excise

tax

■ Exempt from Investment

Company Act of 1940 and

RIC regulations

Less similar

Confidential

32

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation