Hanmi Financial Results Presentation Deck

Securities Portfolio

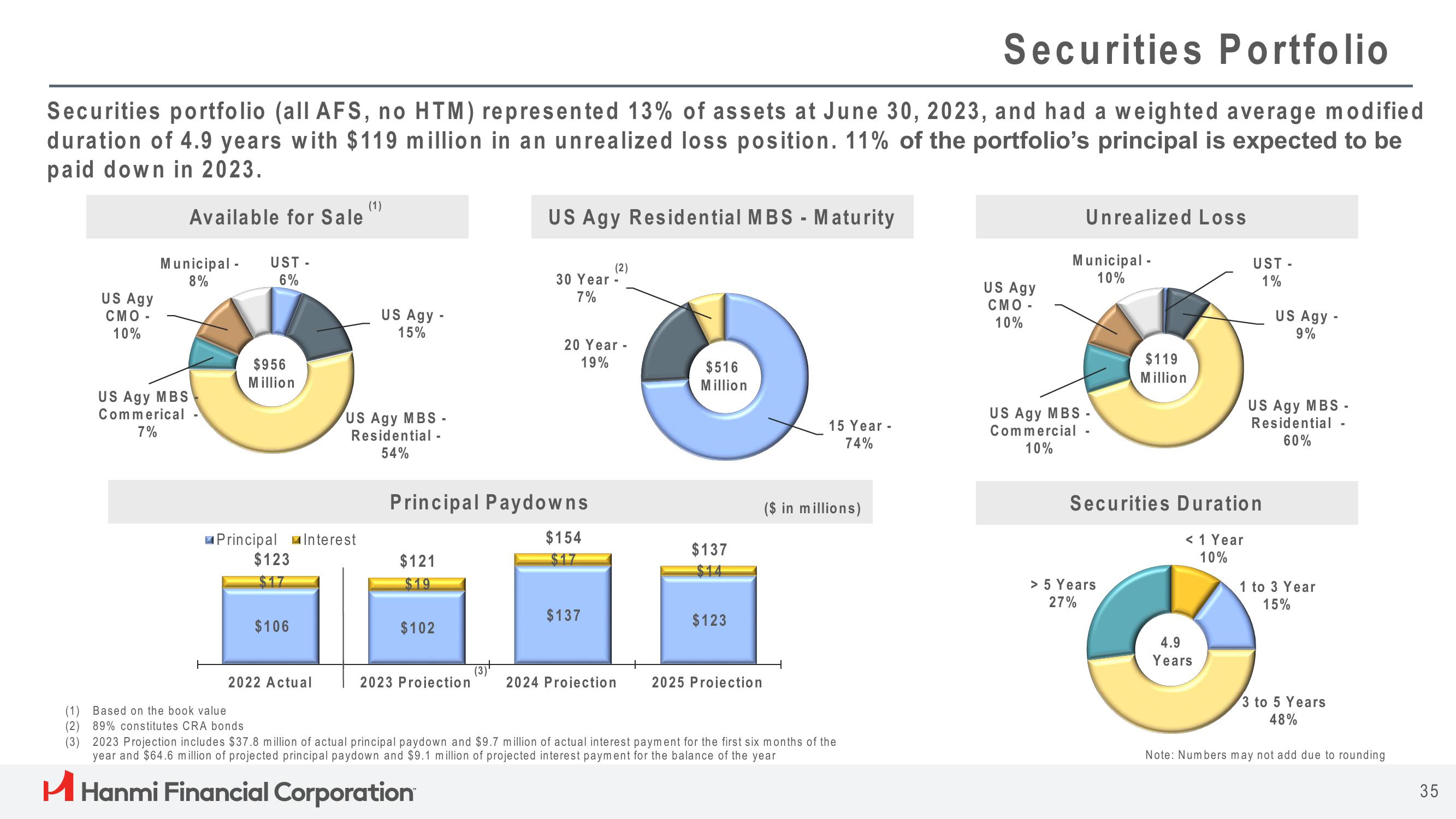

Securities portfolio (all AFS, no HTM) represented 13% of assets at June 30, 2023, and had a weighted average modified

duration of 4.9 years with $119 million in an unrealized loss position. 11% of the portfolio's principal is expected to be

paid down in 2023.

US Agy

CMO -

10%

Available for Sale

Municipal -

8%

US Agy MBS

Commerical

7%

(1) Based on the book value

(2)

UST-

6%

$956

Million

Principal Interest

$123

89% constitutes CRA bonds

$106

2022 Actual

(1)

US Agy -

15%

US Agy MBS -

Residential -

54%

$121

$19

$102

Principal Paydowns

$154

2023 Projection

US Agy Residential MBS - Maturity

(3)

30 Year -

7%

(2)

20 Year -

19%

$137

2024 Projection

$516

Million

$137

$123

2025 Projection

15 Year -

74%

($ in millions)

(3) 2023 Projection includes $37.8 million of actual principal paydown and $9.7 million of actual interest payment for the first six months of the

year and $64.6 million of projected principal paydown and $9.1 million of projected interest payment for the balance of the year

H Hanmi Financial Corporation

US Agy

CMO

10%

Unrealized Loss

Municipal -

10%

US Agy MBS -

Commercial

10%

$119

Million

> 5 Years

27%

UST-

1%

Securities Duration

< 1 Year

10%

4.9

Years

US Agy -

9%

US Agy MBS -

Residential -

60%

1 to 3 Year

15%

3 to 5 Years

48%

Note: Numbers may not add due to rounding

35View entire presentation