Benson Hill Results Presentation Deck

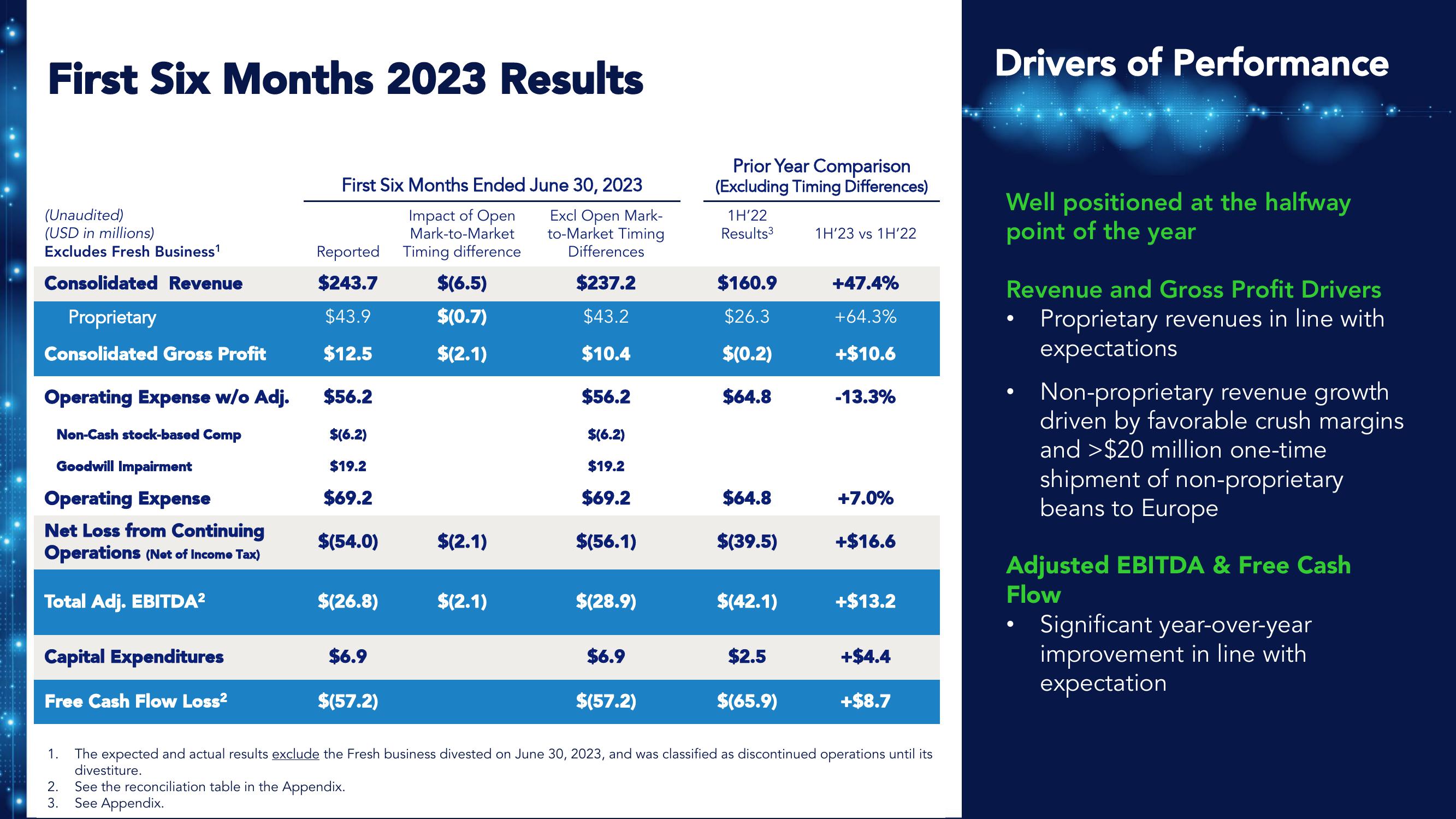

First Six Months 2023 Results

(Unaudited)

(USD in millions)

Excludes Fresh Business¹

Consolidated Revenue

Proprietary

Consolidated Gross Profit

Operating Expense w/o Adj.

Non-Cash stock-based Comp

Goodwill Impairment

Operating Expense

Net Loss from Continuing

Operations (Net of Income Tax)

Total Adj. EBITDA²

Capital Expenditures

Free Cash Flow Loss²

First Six Months Ended June 30, 2023

Impact of Open

Mark-to-Market

Reported Timing difference

$243.7

$43.9

$12.5

1.

$56.2

$(6.2)

$19.2

$69.2

$(54.0)

$(26.8)

$6.9

$(57.2)

$(6.5)

$(0.7)

$(2.1)

$(2.1)

$(2.1)

Excl Open Mark-

to-Market Timing

Differences

$237.2

$43.2

$10.4

$56.2

$(6.2)

$19.2

$69.2

$(56.1)

$(28.9)

$6.9

$(57.2)

Prior Year Comparison

(Excluding Timing Differences)

1H'22

Results 3

$160.9

$26.3

$(0.2)

$64.8

$64.8

$(39.5)

$(42.1)

$2.5

$(65.9)

1H'23 vs 1H'22

+47.4%

+64.3%

+$10.6

-13.3%

+7.0%

+$16.6

+$13.2

+$8.7

The expected and actual results exclude the Fresh business divested on June 30, 2023, and was classified as discontinued operations until its

divestiture.

2. See the reconciliation table in the Appendix.

3.

See Appendix.

Drivers of Performance

Well positioned at the halfway

point of the year

Revenue and Gross Profit Drivers

Proprietary revenues in line with

expectations

●

Non-proprietary revenue growth

driven by favorable crush margins

and >$20 million one-time

shipment of non-proprietary

beans to Europe

Adjusted EBITDA & Free Cash

Flow

Significant year-over-year

improvement in line with

expectationView entire presentation