Connecticut Fund Risk Overview

Fortress Lending Fund lil

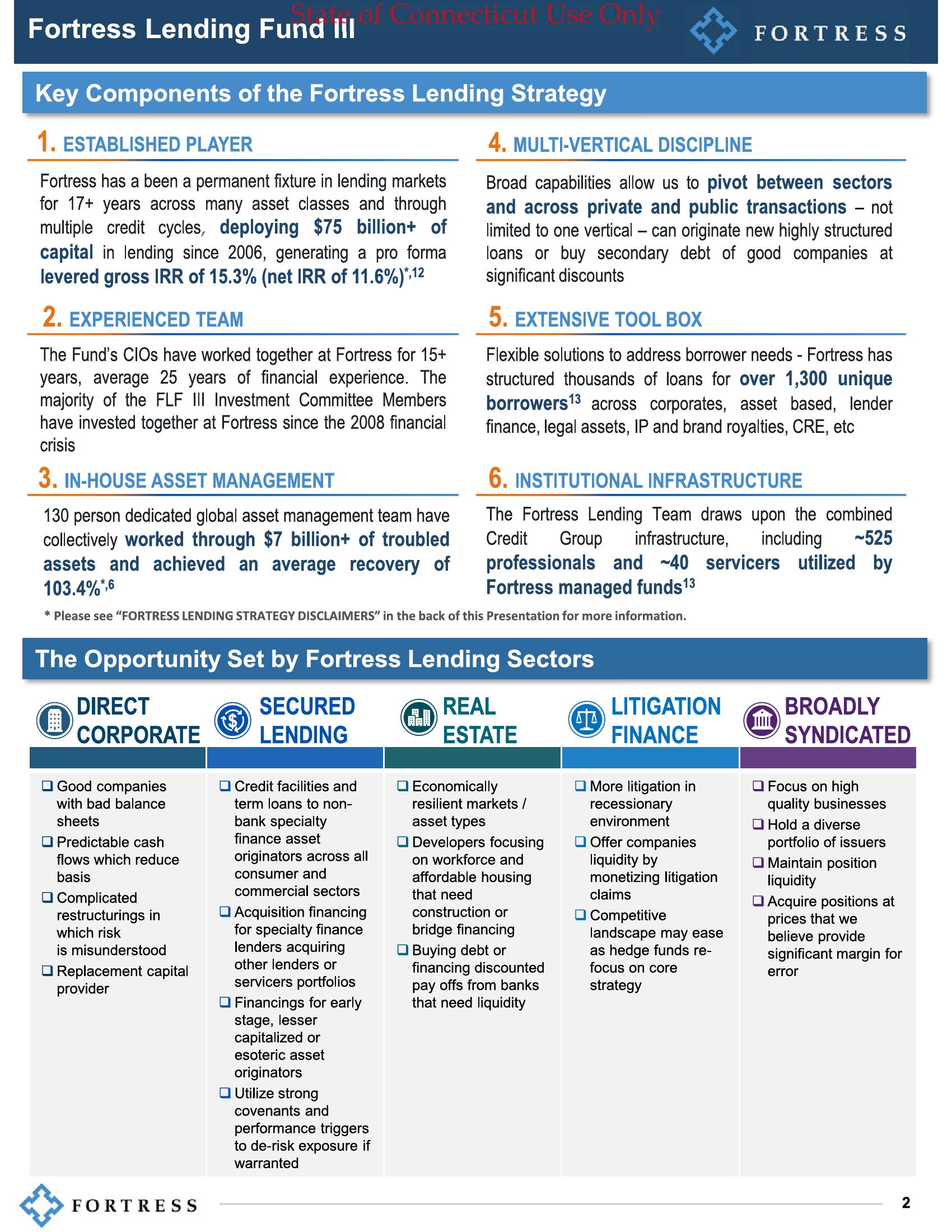

Key Components of the Fortress Lending Strategy

1. ESTABLISHED PLAYER

Fortress has a been a permanent fixture in lending markets

for 17+ years across many asset classes and through

multiple credit cycles, deploying $75 billion+ of

capital in lending since 2006, generating a pro forma

levered gross IRR of 15.3% (net IRR of 11.6%)*,12

2. EXPERIENCED TEAM

The Fund's CIOs have worked together at Fortress for 15+

years, average 25 years of financial experience. The

majority of the FLF III Investment Committee Members

have invested together at Fortress since the 2008 financial

crisis

3. IN-HOUSE ASSET MANAGEMENT

130 person dedicated global asset management team have

collectively worked through $7 billion+ of troubled

assets and achieved an average recovery of

103.4%*,6

DIRECT

CORPORATE

Good companies

with bad balance

sheets

of Connecticut Use Only

* Please see "FORTRESS LENDING STRATEGY DISCLAIMERS" in the back of this Presentation for more information.

Predictable cash

flows which reduce

basis

The Opportunity Set by Fortress Lending Sectors

REAL

ESTATE

Complicated

restructurings in

which risk

is misunderstood

Replacement capital

provider

FORTRESS

SECURED

LENDING

Credit facilities and

term loans to non-

bank specialty

finance asset

originators across all

consumer and

commercial sectors

Acquisition financing

for specialty finance

lenders acquiring

other lenders or

servicers portfolios

Financings for early

stage, lesser

capitalized or

esoteric asset

originators

4. MULTI-VERTICAL DISCIPLINE

Broad capabilities allow us to pivot between sectors

and across private and public transactions - not

limited to one vertical - can originate new highly structured

loans or buy secondary debt of good companies at

significant discounts

Utilize strong

covenants and

performance triggers

to de-risk exposure if

warranted

5. EXTENSIVE TOOL BOX

Flexible solutions to address borrower needs - Fortress has

structured thousands of loans for over 1,300 unique

borrowers ¹3 across corporates, asset based, lender

finance, legal assets, IP and brand royalties, CRE, etc

13

6. INSTITUTIONAL INFRASTRUCTURE

The Fortress Lending Team draws upon the combined

Credit Group infrastructure, including -525

professionals and 40 servicers utilized by

Fortress managed funds 13

Economically

resilient markets /

asset types

Developers focusing

on workforce and

affordable housing

that need

construction or

bridge financing

Buying debt or

financing discounted

pay offs from banks

that need liquidity

44

FORTRESS

LITIGATION

FINANCE

More litigation in

recessionary

environment

Offer companies

liquidity by

monetizing litigation

claims

Competitive

landscape may ease

as hedge funds re-

focus on core

strategy

BROADLY

SYNDICATED

Focus on high

quality businesses

Hold a diverse

portfolio of issuers

Maintain position

liquidity

Acquire positions at

prices that we

believe provide

significant margin for

error

2View entire presentation