Bank of America Investment Banking Pitch Book

Preliminary Indication of Interest Received

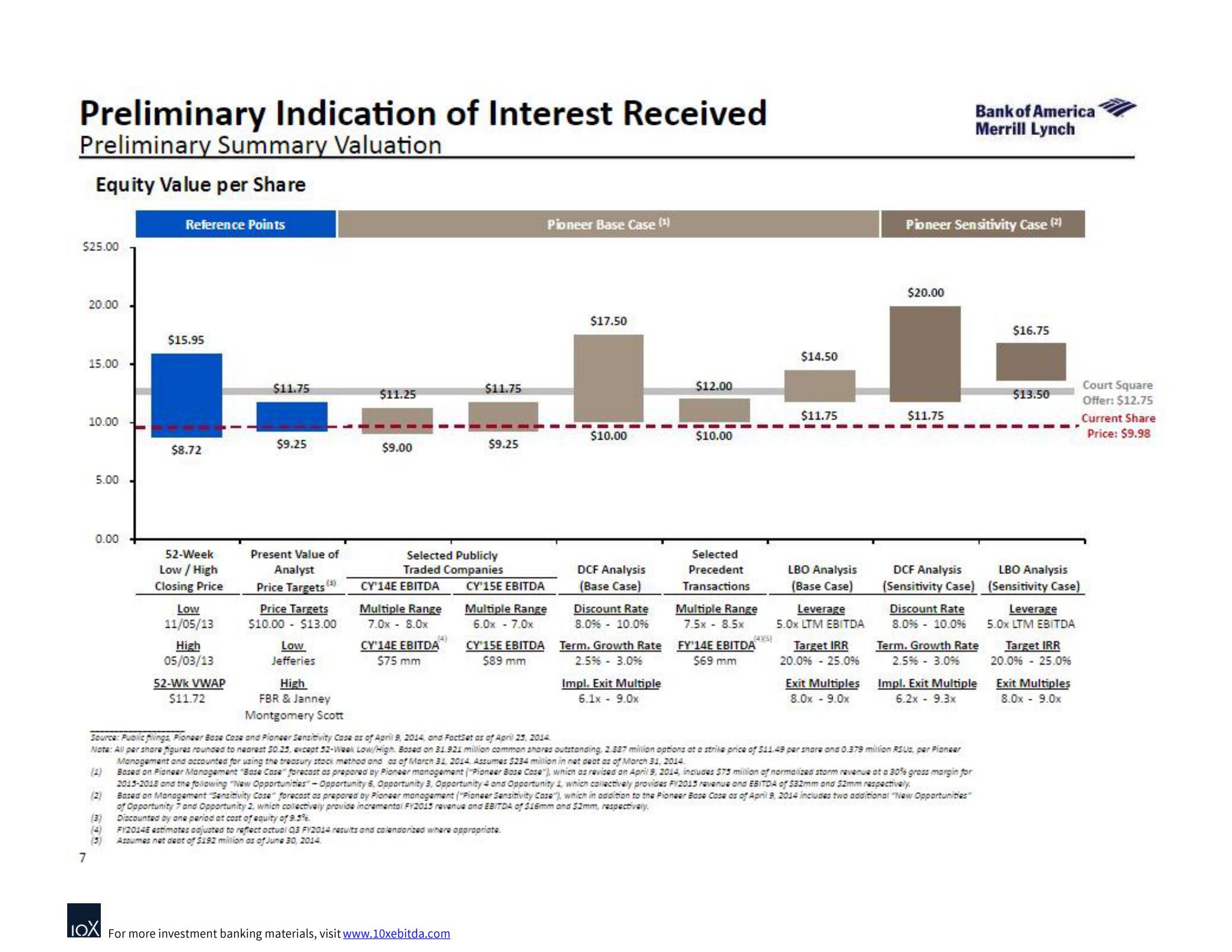

Preliminary Summary Valuation

Equity Value per Share

$25.00

7

20.00

15.00

10.00

5.00

0.00

H

T

(2)

(3)

(4)

(5)

Reference Points

$15.95

$8.72

52-Week

Low / High

Closing Price

Low

11/05/13

High

05/03/13

52-Wk VWAP

$11.72

$11.75

$9.25

Present Value of

Analyst

Price Targets (3)

Price Targets

$10.00 $13.00

Low

Jefferies

High

FBR & Janney

Montgomery Scott

$11.25

$9.00

CY'14E EBITDA

Multiple Range

7.0x - 8.0x

CY'14E EBITDA

$75 mm

$11.75

Selected Publicly

Traded Companies

$9.25

LOX For more investment banking materials, visit www.10xebitda.com

Pioneer Base Case (¹)

CY'15E EBITDA

Multiple Range

6.0x - 7.0x

CY'15E EBITDA

$89 mm

FY2014E estimates adjusted to reflect actual Q3 Fy2014 results and calendarized where appropriate.

Assumes net debt of $192 million as of June 30, 2014

$17.50

$10.00

DCF Analysis

(Base Case)

Discount Rate

8.0% 10.0%

Term. Growth Rate

2.5% - 3.0%

Impl. Exit Multiple

6.1x - 9.0x

$12.00

$10.00

Selected

Precedent

Transactions

Multiple Range

75x - 8.5x

FY'14E EBITDA

$69 mm

$14.50

$11.75

LBO Analysis

(Base Case)

Leverage

5.0x LTM EBITDA

Target IRR

20.0% - 25.0%

Exit Multiples

8.0x - 9.0x

Pioneer Sensitivity Case (2)

$20.00

Source: Public filings, Pioneer Base Case and Pioneer Sensitivity Case as of April 9, 2014, and FactSet as of April 25, 2014.

Note: All per share figures rounded to nearest 50.25, except 52-Week Low/Hign. Based on 31.921 million common shares outstanding, 2.537 million options at a strike price of $11.49 per share and 0.379 million RSUs, per Pioneer

Management and accounted for using the treasury stock method and as of March 31, 2014. Assumes $234 million in net debt as of March 31, 2014.

Based on Pioneer Management "Base Case" forecast as prepared by Pioneer management ("Pioneer Bose Cose"), which as revised on April 9, 2014, includes $75 milion of normalized storm revenue at a 30% grass margin for

2015-2018 and the following "New Opportunities"-Opportunity 6, Opportunity 3, Opportunity 4 and Opportunity 1, which collectively provides FY2015 revenue and EBITDA of 532mm and 52mm respectively.

Based on Management Sensitivity Cose" forecast as prepared by Pioneer management ("Pioneer Sensitivity Case"), which in addition to the Pioneer Base Cose as of April 9, 2014 includes two additional "New Opportunities"

of Opportunity 7 and Opportunity 2, which collectively provide incremental FY2015 revenue and EBITDA of $16mm and $2mm, respectively.

Discounted by one period at cost of equity of 9.5%.

$11.75

Bank of America

Merrill Lynch

DCF Analysis

(Sensitivity Case)

Discount Rate

8.0% - 10.0%

Term. Growth Rate

2.5% - 3.0%

Impl. Exit Multiple

6.2x - 9.3x

$16.75

$13.50

LBO Analysis

(Sensitivity Case)

Leverage

5.0x LTM EBITDA

Target IRR

20.0% - 25.0%

Exit Multiples

8.0x - 9.0x

Court Square

Offer: $12.75

Current Share

Price: $9.98View entire presentation