Nextdoor SPAC Presentation Deck

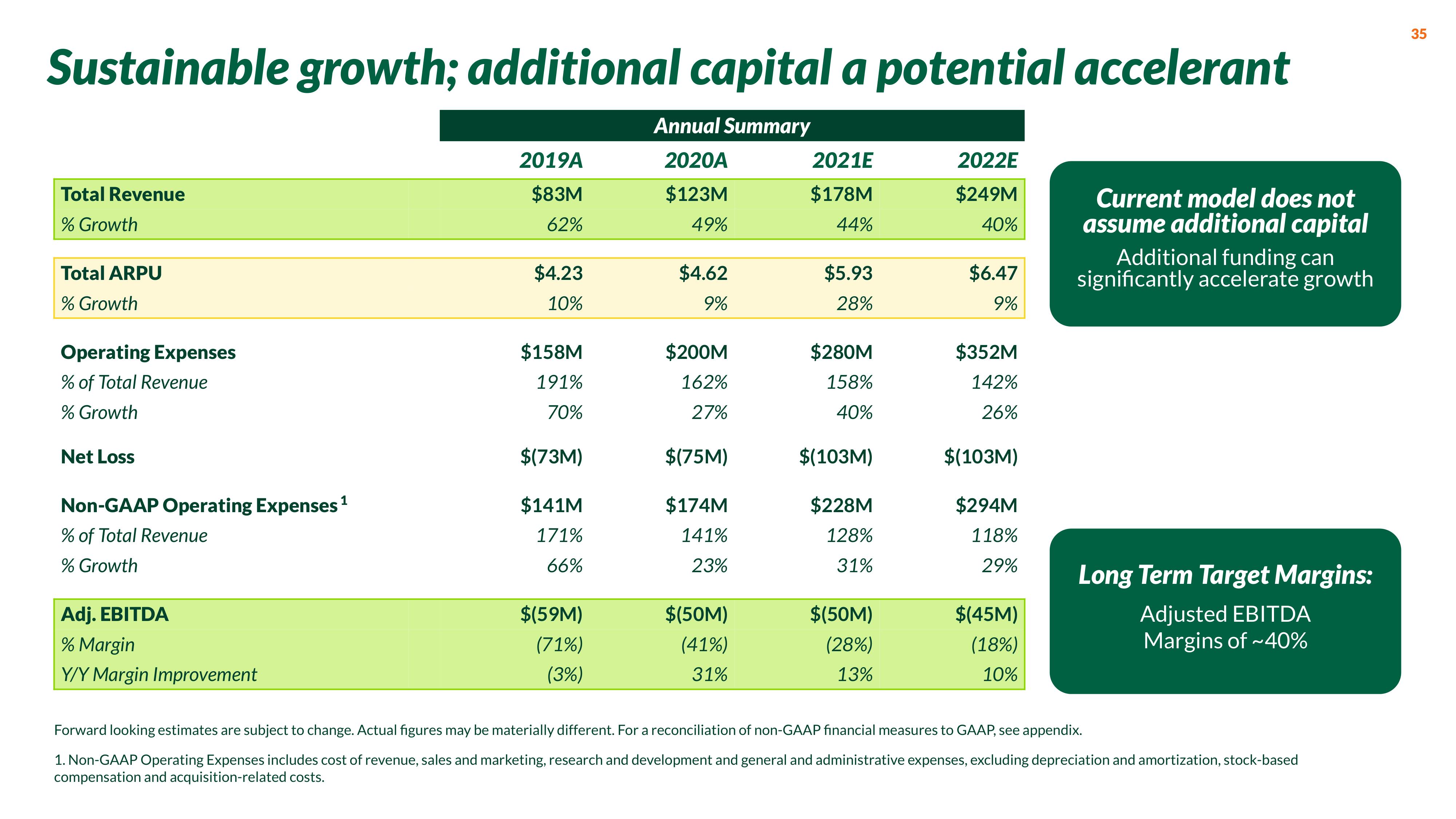

Sustainable growth; additional capital a potential accelerant

Annual Summary

2020A

$123M

49%

Total Revenue

% Growth

Total ARPU

% Growth

Operating Expenses

% of Total Revenue

% Growth

Net Loss

Non-GAAP Operating Expenses ¹

1

% of Total Revenue

% Growth

Adj. EBITDA

% Margin

Y/Y Margin Improvement

2019A

$83M

62%

$4.23

10%

$158M

191%

70%

$(73M)

$141M

171%

66%

$(59M)

(71%)

(3%)

$4.62

9%

$200M

162%

27%

$(75M)

$174M

141%

23%

$(50M)

(41%)

31%

2021E

$178M

44%

$5.93

28%

$280M

158%

40%

$(103M)

$228M

128%

31%

$(50M)

(28%)

13%

2022E

$249M

40%

$6.47

9%

$352M

142%

26%

$(103M)

$294M

118%

29%

$(45M)

(18%)

10%

Current model does not

assume additional capital

Additional funding can

significantly accelerate growth

Long Term Target Margins:

Adjusted EBITDA

Margins of ~40%

Forward looking estimates are subject to change. Actual figures may be materially different. For a reconciliation of non-GAAP financial measures to GAAP, see appendix.

1. Non-GAAP Operating Expenses includes cost of revenue, sales and marketing, research and development and general and administrative expenses, excluding depreciation and amortization, stock-based

compensation and acquisition-related costs.

35View entire presentation