Trian Partners Activist Presentation Deck

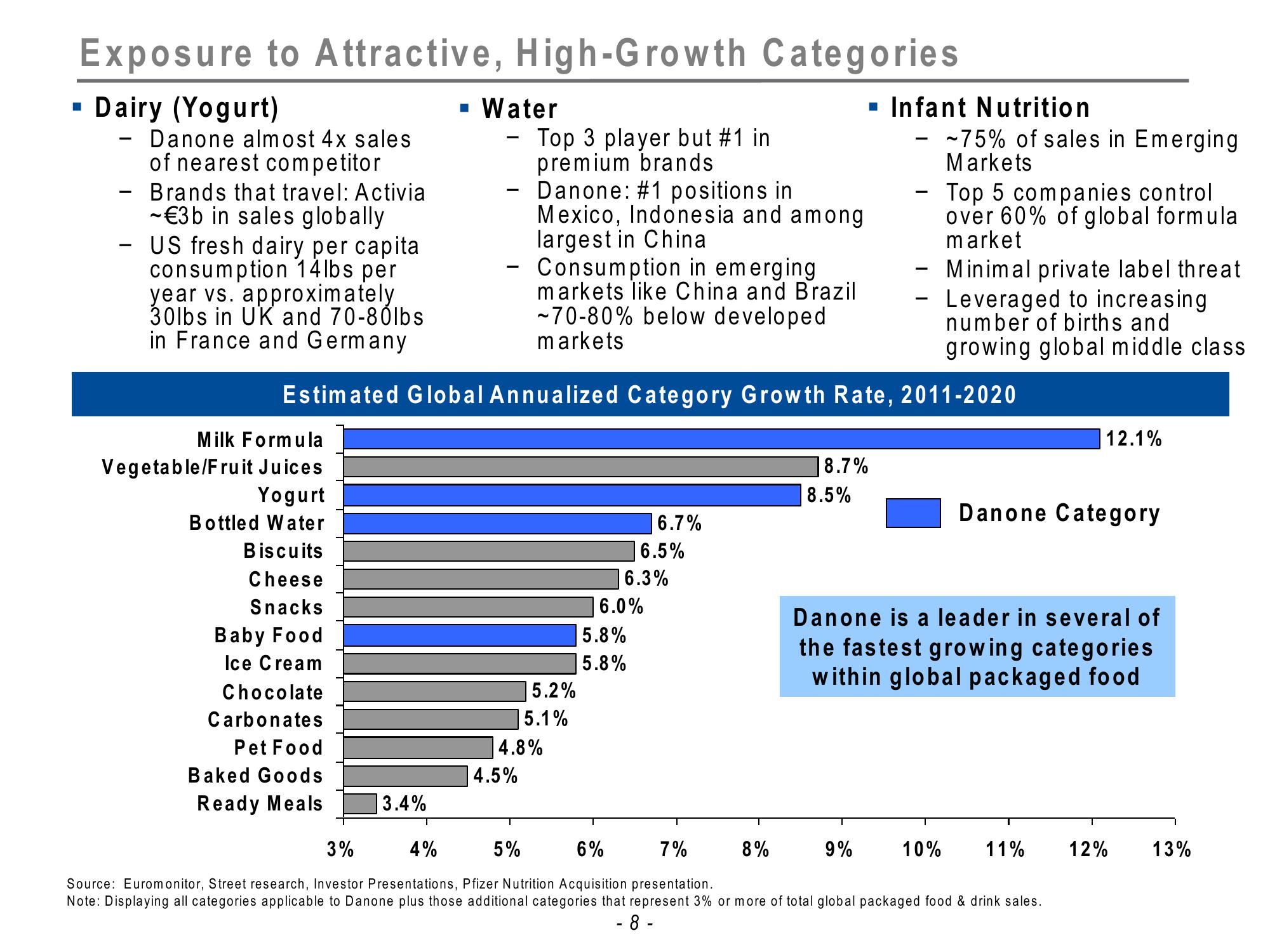

Exposure to Attractive, High-Growth Categories

Dairy (Yogurt)

Danone almost 4x sales

of nearest competitor

- Brands that travel: Activia

-€3b in sales globally

- US fresh dairy per capita

consumption 14lbs per

year vs. approximately

30lbs in UK and 70-80lbs

in France and Germany.

-

Milk Formula

Vegetable/Fruit Juices

Yogurt

Bottled Water

Biscuits

Cheese

Snacks

Baby Food

Ice Cream

Chocolate

Carbonates

Pet Food

Baked Goods

Ready Meals

3.4%

T

▪ Water

-

4%

Top 3 player but #1 in

premium brands

Danone: #1 positions in

Mexico, Indonesia and among

largest in China

Estimated Global Annualized Category Growth Rate, 2011-2020

Consumption in emerging

markets like China and Brazil

~70-80% below developed

markets

4.5%

5.2%

5.1%

4.8%

6.7%

6.5%

6.3%

6.0%

5.8%

5.8%

8.7%

8%

8.5%

▪ Infant Nutrition

-75% of sales in Emerging

Markets

Top 5 companies control.

over 60% of global formula

market

9%

Minimal private label threat

Leveraged to increasing

number of births and

growing global middle class

3%

5%

6%

7%

Source: Euromonitor, Street research, Investor Presentations, Pfizer Nutrition Acquisition presentation.

Note: Displaying all categories applicable to Danone plus those additional categories that represent 3% or more of total global packaged food & drink sales.

- 8 -

12.1%

Danone Category

Danone is a leader in several of

the fastest growing categories

within global packaged food

10% 11% 12% 13%View entire presentation