SmileDirectClub Investor Presentation Deck

Marketing & selling.

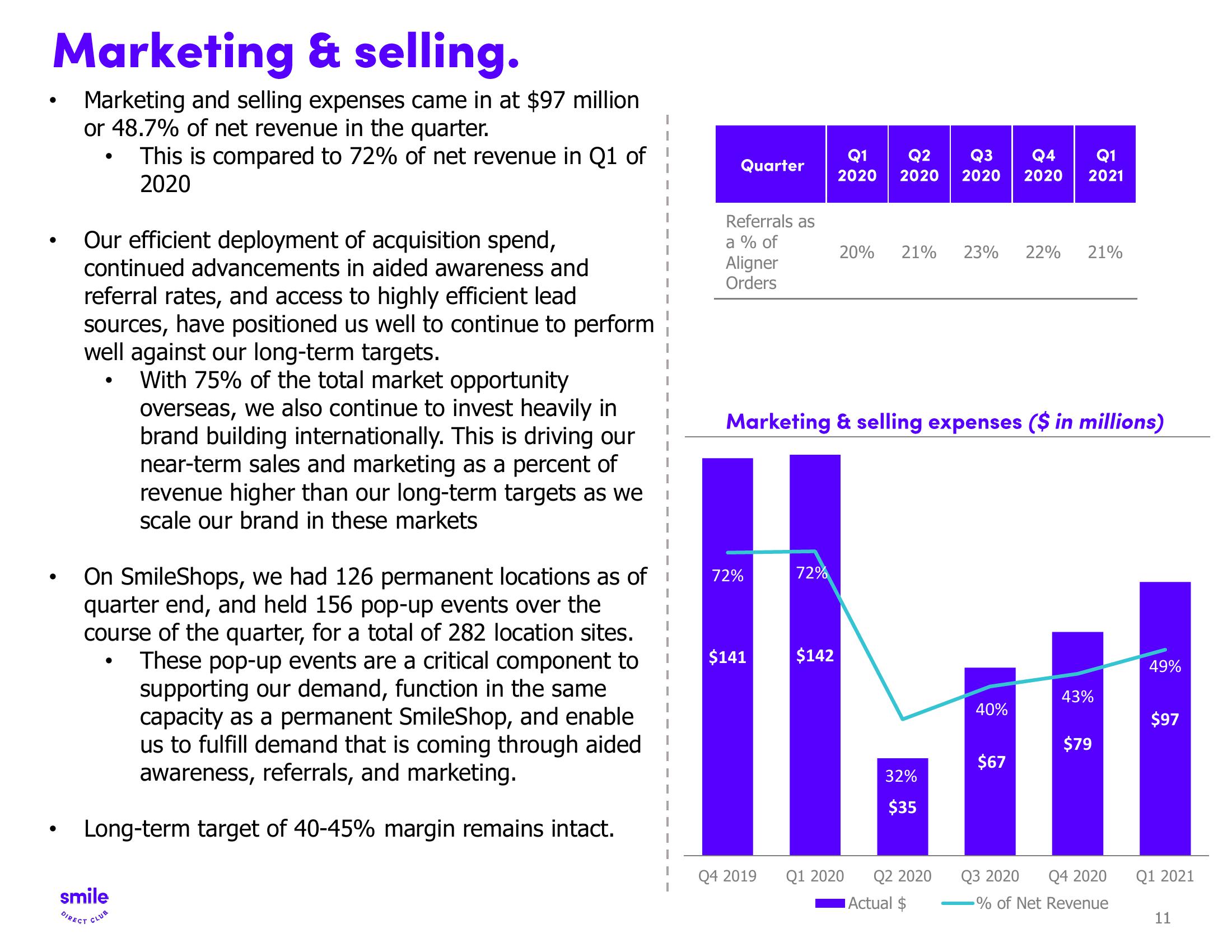

Marketing and selling expenses came in at $97 million

or 48.7% of net revenue in the quarter.

●

●

Our efficient deployment of acquisition spend,

continued advancements in aided awareness and

referral rates, and access to highly efficient lead

sources, have positioned us well to continue to perform

well against our long-term targets.

With 75% of the total market opportunity

overseas, we also continue to invest heavily in

brand building internationally. This is driving our

near-term sales and marketing as a percent of

revenue higher than our long-term targets as we

scale our brand in these markets

●

This is compared to 72% of net revenue in Q1 of

2020

On SmileShops, we had 126 permanent locations as of

quarter end, and held 156 pop-up events over the

course of the quarter, for a total of 282 location sites.

These pop-up events are a critical component to

supporting our demand, function in the same

capacity as a permanent SmileShop, and enable

us to fulfill demand that is coming through aided

awareness, referrals, and marketing.

Long-term target of 40-45% margin remains intact.

smile

DIRECT CLUB

Quarter

Referrals as

a % of

Aligner

Orders

72%

$141

Marketing & selling expenses ($ in millions)

Q4 2019

72%

Q1 Q2 Q3 Q4

2020 2020 2020 2020

$142

20% 21% 23% 22% 21%

Q1 2020

32%

$35

Q2 2020

Actual $

40%

Q1

2021

$67

Q3 2020

43%

$79

Q4 2020

% of Net Revenue

49%

$97

Q1 2021

11View entire presentation