Baird Investment Banking Pitch Book

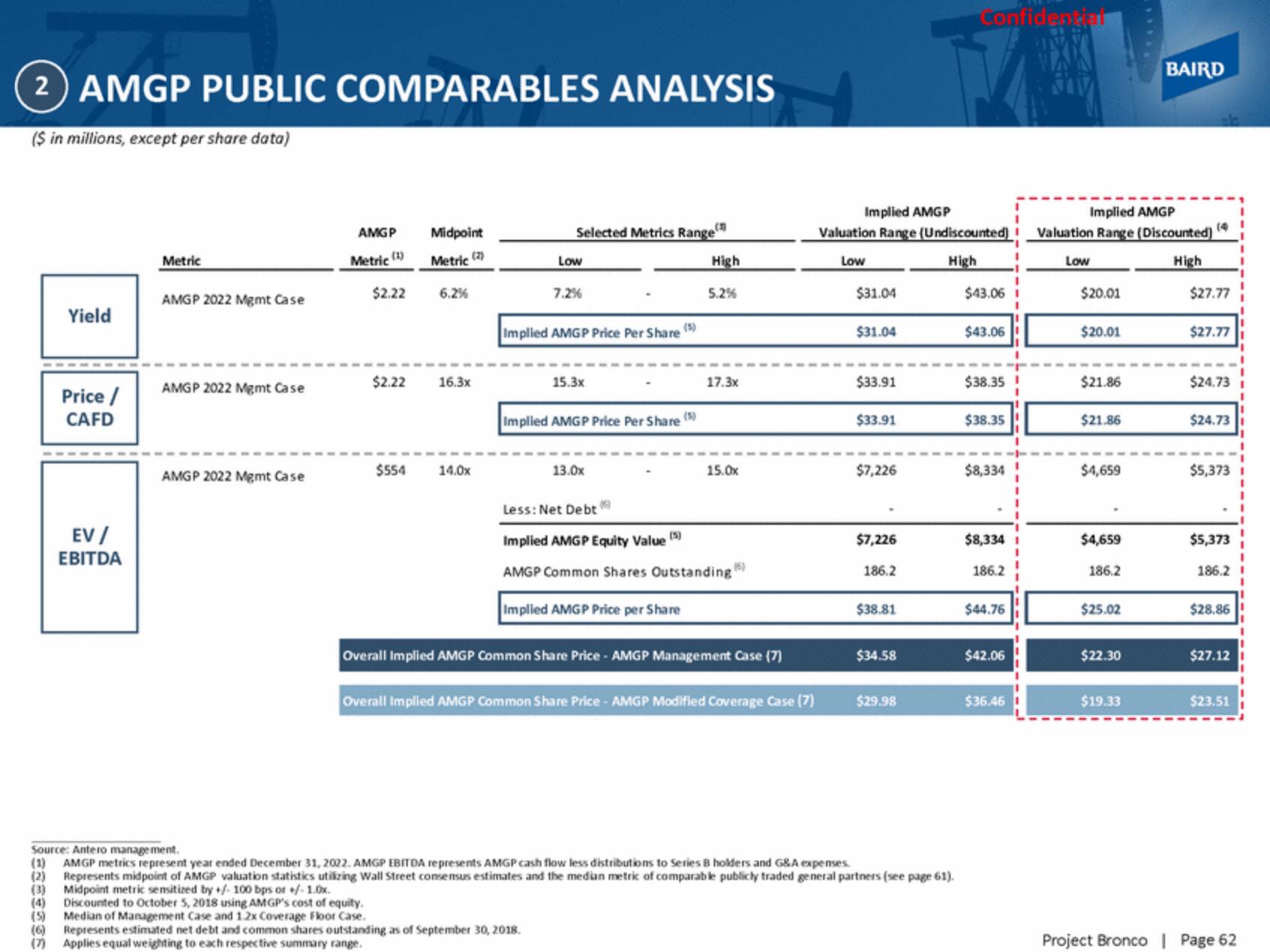

2 AMGP PUBLIC COMPARABLES ANALYSIS

($ in millions, except per share data)

Yield

Price /

CAFD

EV/

EBITDA

Metric

AMGP 2022 Mgmt Case

AMGP 2022 Mgmt Case

AMGP 2022 Mgmt Case

AMGP

Metric (1)

$2.22

$2.22

Midpoint

Metric (2)

6.2%

16.3x

$554 14.0x

Selected Metrics Range

Low

7.2%

Implied AMGP Price Per Share

15.3x

(5)

Implied AMGP Price Per Share (5)

13.0x

High

5.2%

17.3x

15.0x

Less: Net Debt

Implied AMGP Equity Value (5)

AMGP Common Shares Outstanding (5)

Implied AMGP Price per Share

Overall Implied AMGP Common Share Price - AMGP Management Case (7)

Overall Implied AMGP Common Share Price - AMGP Modified Coverage Case (7)

Implied AMGP

Valuation Range (Undiscounted)

High

Low

$31.04

$31.04

$33.91

$33.91

$7,226

$7,226

186.2

$38.81

$34.58

$29.98

Confidential

Source: Antero management.

(1) AMGP metrics represent year ended December 31, 2022. AMGP EBITDA represents AMGP cash flow less distributions to Series 8 holders and G&A expenses.

(2)

Represents midpoint of AMGP valuation statistics utilizing Wall Street consensus estimates and the median metric of comparable publicly traded general partners (see page 61).

Midpoint metric sensitized by +/- 100 bps or +/-1.0x.

(3)

(4) Discounted to October 5, 2018 using AMGP's cost of equity.

(5) Median of Management Case and 1.2x Coverage Floor Case.

(6) Represents estimated net debt and common shares outstanding as of September 30, 2018.

(7)

Applies equal weighting to each respective summary range.

$43.06

$43.06

$38.35

$38.35

$8,334

$8,334

186.2

$44.76

$42.06

$36.46

Implied AMGP

Valuation Range (Discounted)

Low

High

$20.01

$20.01

$21.86

$21.86

$4,659

$4,659

186.2

$25.02

$22.30

BAIRD

$19.33

(4

$27.77

$27.77

$24.73

$24.73

$5,373

$5,373

186.2

$28.86

$27.12

$23.51

Project Bronco | Page 62View entire presentation