Cyxtera SPAC Presentation Deck

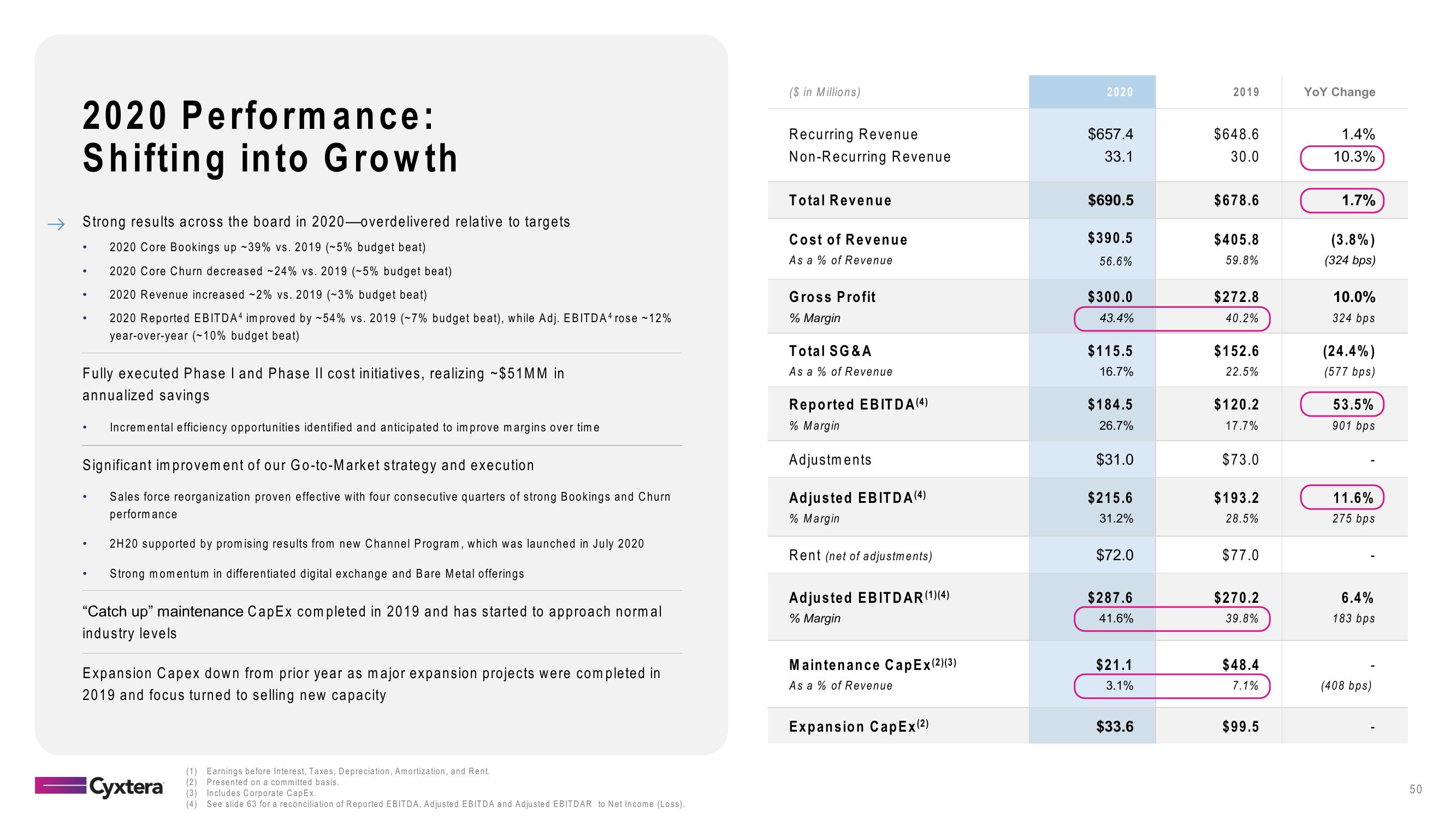

2020 Performance:

Shifting into Growth

Strong results across the board in 2020-overdelivered relative to targets

2020 Core Bookings up -39% vs. 2019 (~5% budget beat)

2020 Core Churn decreased -24% vs. 2019 (~5% budget beat)

2020 Revenue increased -2% vs. 2019 (-3% budget beat)

2020 Reported EBITDA4 improved by -54% vs. 2019 (-7% budget beat), while Adj. EBITDA4 rose -12%

year-over-year (~10% budget beat)

●

●

●

Fully executed Phase I and Phase II cost initiatives, realizing ~$51MM in

annualized savings

Incremental efficiency opportunities identified and anticipated to improve margins over time

Significant improvement of our Go-to-Market strategy and execution

Sales force reorganization proven effective with four consecutive quarters of strong Bookings and Churn

performance

●

2H20 supported by promising results from new Channel Program, which was launched in July 2020

Strong momentum in differentiated digital exchange and Bare Metal offerings

"Catch up" maintenance CapEx completed in 2019 and has started to approach normal

industry levels

Expansion Capex down from prior year as major expansion projects were completed in

2019 and focus turned to selling new capacity

Cyxtera

(1) Earnings before Interest, Taxes, Depreciation, Amortization, and Rent.

(2) Presented on a committed basis.

(3) Includes Corporate CapEx.

(4) See slide 63 for a reconciliation of Reported EBITDA, Adjusted EBITDA and Adjusted EBITDAR to Net Income (Loss).

($ in Millions)

Recurring Revenue

Non-Recurring Revenue

Total Revenue

Cost of Revenue

As a % of Revenue

Gross Profit

% Margin

Total SG&A

As a % of Revenue

Reported EBITDA (4)

% Margin

Adjustments

Adjusted EBITDA (4)

% Margin

Rent (net of adjustments)

Adjusted EBITDAR (1)(4)

% Margin

Maintenance CapEx (2) (3)

As a % of Revenue

Expansion CapEx (²)

2020

$657.4

33.1

$690.5

$390.5

56.6%

$300.0

43.4%

$115.5

16.7%

$184.5

26.7%

$31.0

$215.6

31.2%

$72.0

$287.6

41.6%

$21.1

3.1%

$33.6

2019

$648.6

30.0

$678.6

$405.8

59.8%

$272.8

40.2%

$152.6

22.5%

$120.2

17.7%

$73.0

$193.2

28.5%

$77.0

$270.2

39.8%

$48.4

7.1%

$99.5

YOY Change

1.4%

10.3%

1.7%

(3.8%)

(324 bps)

10.0%

324 bps

(24.4%)

(577 bps)

53.5%

901 bps

11.6%

275 bps

6.4%

183 bps

(408 bps)

50View entire presentation