Credit Suisse Investment Banking Pitch Book

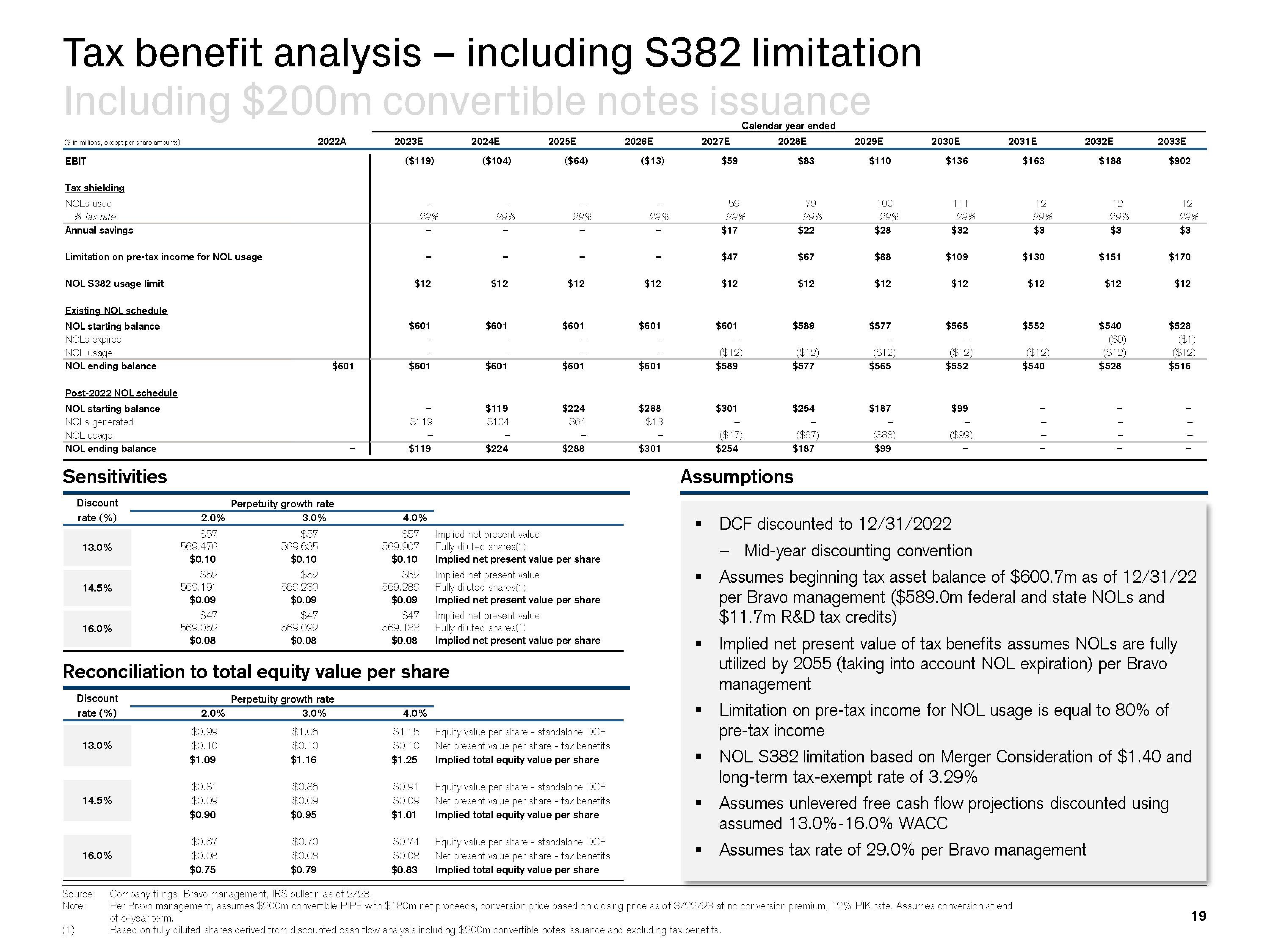

Tax benefit analysis - including S382 limitation

Including $200m convertible notes issuance

Calendar year ended

2028E

2024E

$83

($ in millions, except per share amounts)

EBIT

Tax shielding

NOLS used

% tax rate

Annual savings

Limitation on pre-tax income for NOL usage

NOL S382 usage limit

Existing NOL schedule

NOL starting balance

NOLS expired

NOL usage

NOL ending balance

Post-2022 NOL schedule

NOL starting balance

NOLS generated

NOL usage

NOL ending balance

Sensitivities

Discount

rate (%)

13.0%

14.5%

16.0%

Discount

rate (%)

13.0%

14.5%

16.0%

2.0%

Source:

Note:

(1)

$57

569.476

$0.10

$52

569.191

$0.09

$47

569.052

$0.08

2.0%

$0.99

$0.10

$1.09

$0.81

$0.09

$0.90

2022A

$0.67

$0.08

$0.75

Perpetuity growth rate

3.0%

$57

569.635

$0.10

$52

569.230

$0.09

$47

569.092

$0.08

$1.06

$0.10

$1.16

$601

$0.86

$0.09

$0.95

$0.70

$0.08

$0.79

2023E

($119)

Reconciliation to total equity value per share

Perpetuity growth rate

3.0%

29%

$12

$601

$601

$119

$119

569.907

$0.10

$52

569.289

$0.09

$47

569.133

$0.08

($104)

29%

$12

$0.74

$0.08

$0.83

$601

$601

$119

$104

$224

2025E

($64)

29%

$12

$601

4.0%

$57 Implied net present value

Fully diluted shares(1)

Implied net present value per share

$601

$224

$64

$288

Implied net present value

Fully diluted shares(1)

Implied net present value per share

Implied net present value

Fully diluted shares(1)

Implied net present value per share

4.0%

$1.15 Equity value per share standalone DCF

$0.10 Net present value per share - tax benefits

$1.25 Implied total equity value per share

$0.91 Equity value per share - standalone DCF

$0.09 Net present value per share - tax benefits

$1.01 Implied total equity value per share

Equity value per share standalone DCF

Net present value per share - tax benefits

Implied total equity value per share

2026E

($13)

29%

$12

$601

$601

$288

$13

$301

2027E

■

■

■

$59

■

59

29%

$17

$47

$12

$601

($12)

$589

$301

($47)

$254

Assumptions

79

29%

-

$22

$67

$12

$589

($12)

$577

$254

($67)

$187

2029E

$110

100

29%

$28

$88

$12

$577

($12)

$565

$187

($88)

$99

2030E

$136

111

29%

$32

$109

$12

$565

($12)

$552

$99

($99)

DCF discounted to 12/31/2022

Mid-year discounting convention

2031 E

$163

12

29%

$3

$130

$12

$552

Company filings, Bravo management, IRS bulletin as of 2/23.

Per Bravo management, assumes $200m convertible PIPE with $180m net proceeds, conversion price based on closing price as of 3/22/23 at no conversion premium, 12% PIK rate. Assumes conversion at end

of 5-year term.

Based on fully diluted shares derived from discounted cash flow analysis including $200m convertible notes issuance and excluding tax benefits.

($12)

$540

2032E

$188

12

29%

$3

$151

$12

$540

($0)

($12)

$528

2033E

$902

$170

12

29%

$3

$528

$12

Limitation on pre-tax income for NOL usage is equal to 80% of

pre-tax income

$516

Assumes beginning tax asset balance of $600.7m as of 12/31/22

per Bravo management ($589.0m federal and state NOLs and

$11.7m R&D tax credits)

Implied net present value of tax benefits assumes NOLs are fully

utilized by 2055 (taking into account NOL expiration) per Bravo

management

($1)

($12)

Assumes unlevered free cash flow projections discounted using

assumed 13.0%-16.0% WACC

Assumes tax rate of 29.0% per Bravo management

NOL S382 limitation based on Merger Consideration of $1.40 and

long-term tax-exempt rate of 3.29%

19View entire presentation