XP Inc Results Presentation Deck

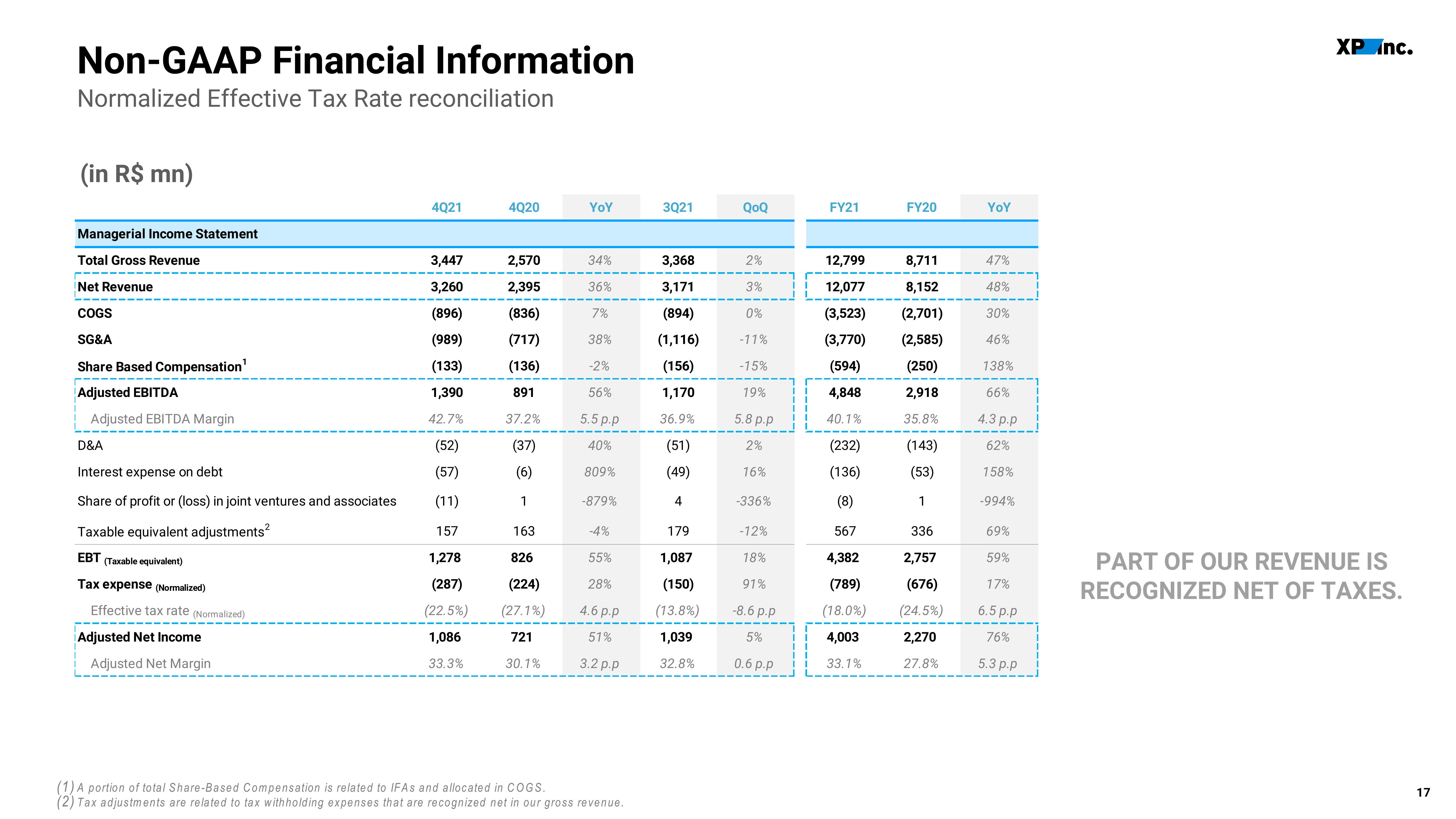

Non-GAAP Financial Information

Normalized Effective Tax Rate reconciliation

(in R$ mn)

Managerial Income Statement

Total Gross Revenue

Net Revenue

COGS

SG&A

Share Based Compensation¹

Adjusted EBITDA

Adjusted EBITDA Margin

D&A

Interest expense on debt

Share of profit or (loss) in joint ventures and associates

Taxable equivalent adjustments²

EBT (Taxable equivalent)

Tax expense (Normalized)

Effective tax rate (Normalized)

Adjusted Net Income

Adjusted Net Margin

4Q21

3,447

3,260

(896)

(989)

(133)

1,390

42.7%

(52)

(57)

(11)

157

1,278

(287)

(22.5%)

1,086

33.3%

4Q20

2,570

2,395

(836)

(717)

(136)

891

37.2%

(37)

(6)

1

163

826

(224)

(27.1%)

721

30.1%

YoY

34%

36%

7%

38%

-2%

56%

5.5 p.p

40%

809%

-879%

-4%

55%

28%

4.6 p.p

51%

3.2 p.p

A portion of total Share-Based Compensation is related to IFAs and allocated in COGS.

(2) Tax adjustments are related to tax withholding expenses that are recognized net in our gross revenue.

3Q21

3,368

3,171

(894)

(1,116)

(156)

1,170

36.9%

(51)

(49)

4

179

1,087

(150)

(13.8%)

1,039

32.8%

QoQ

2%

3%

0%

-11%

-15%

19%

5.8 p.p

2%

16%

-336%

-12%

18%

91%

-8.6 p.p

5%

0.6 p.p

FY21

12,799

12,077

(3,523)

(3,770)

(594)

4,848

40.1%

(232)

(136)

(8)

567

4,382

(789)

(18.0%)

4,003

33.1%

FY20

8,711

8,152

(2,701)

(2,585)

(250)

2,918

35.8%

(143)

(53)

1

336

2,757

(676)

(24.5%)

2,270

27.8%

YoY

47%

48%

30%

46%

138%

66%

4.3 p.p

62%

158%

-994%

69%

59%

17%

6.5 p.p

76%

5.3 p.p

XP Inc.

PART OF OUR REVENUE IS

RECOGNIZED NET OF TAXES.

17View entire presentation