Sale of a 19.9% Ownership Interest in NIPSCO

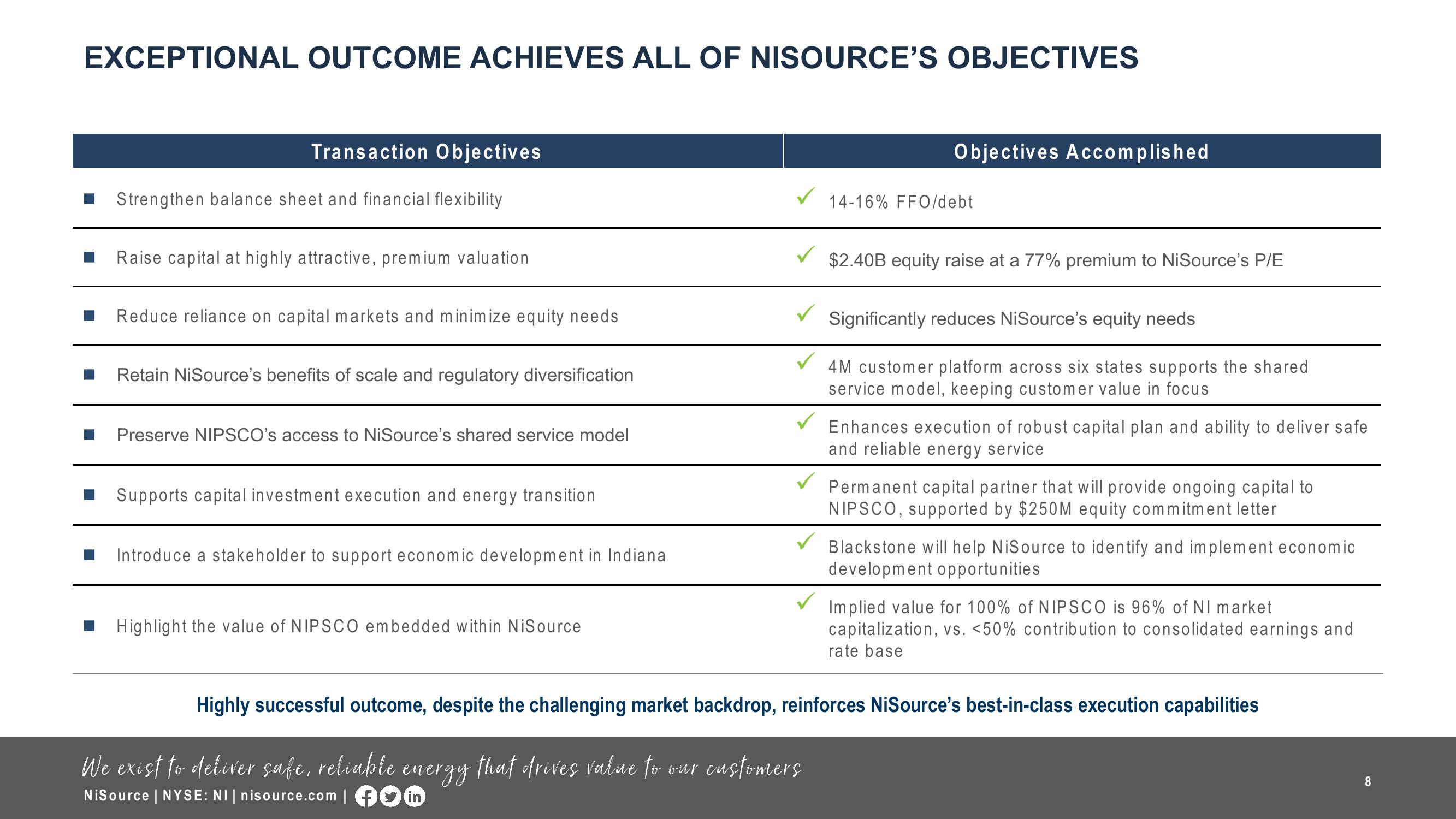

EXCEPTIONAL OUTCOME ACHIEVES ALL OF NISOURCE'S OBJECTIVES

Transaction Objectives

Strengthen balance sheet and financial flexibility

Raise capital at highly attractive, premium valuation

Reduce reliance on capital markets and minimize equity needs

Retain NiSource's benefits of scale and regulatory diversification

Preserve NIPSCO's access to NiSource's shared service model

■ Supports capital investment execution and energy transition

Introduce a stakeholder to support economic development in Indiana

Highlight the value of NIPSCO embedded within NiSource

Objectives Accomplished

We exist to deliver safe, reliable energy that drives value to our customers

NiSource | NYSE: NI| nisource.com | om

14-16% FFO/debt

$2.40B equity raise at a 77% premium to NiSource's P/E

Significantly reduces NiSource's equity needs

4M customer platform across six states supports the shared

service model, keeping customer value in focus

Enhances execution of robust capital plan and ability to deliver safe

and reliable energy service

Permanent capital partner that will provide ongoing capital to

NIPSCO, supported by $250M equity commitment letter

Blackstone will help NiSource to identify and implement economic

development opportunities

Implied value for 100% of NIPSCO is 96% of NI market

capitalization, vs. <50% contribution to consolidated earnings and

rate base

Highly successful outcome, despite the challenging market backdrop, reinforces NiSource's best-in-class execution capabilities

8View entire presentation