Third Point Management Activist Presentation Deck

M&A OPPORTUNITY

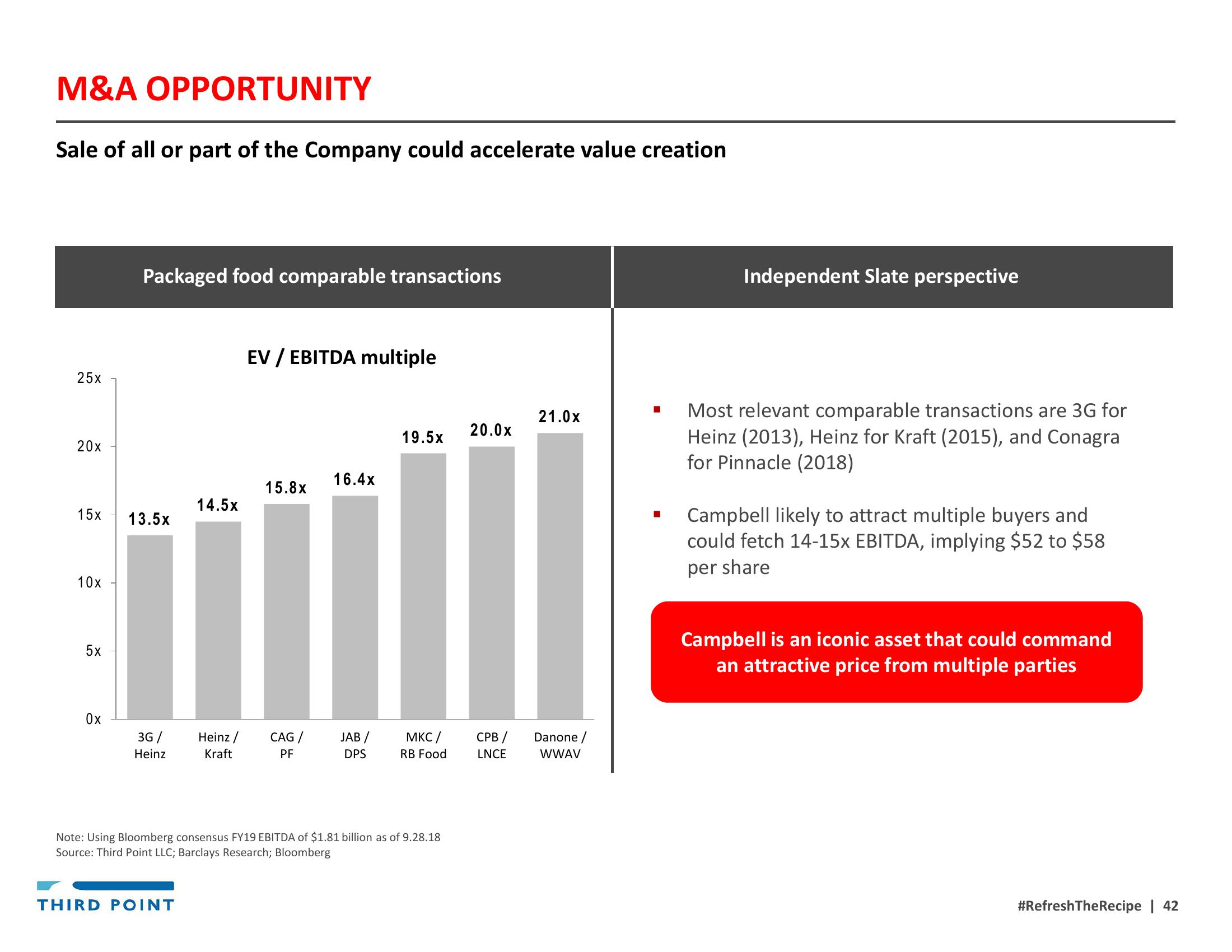

Sale of all or part of the Company could accelerate value creation

25x

20x

15x

10x

5x

Ox

Packaged food comparable transactions

13.5x

3G/

Heinz

14.5x

THIRD POINT

Heinz /

Kraft

EV / EBITDA multiple

15.8x

CAG /

PF

16.4x

JAB /

DPS

19.5x

MKC /

RB Food

Note: Using Bloomberg consensus FY19 EBITDA of $1.81 billion as of 9.28.18

Source: Third Point LLC; Barclays Research; Bloomberg

20.0x

CPB /

LNCE

21.0x

Danone /

WWAV

■

■

Independent Slate perspective

Most relevant comparable transactions are 3G for

Heinz (2013), Heinz for Kraft (2015), and Conagra

for Pinnacle (2018)

Campbell likely to attract multiple buyers and

could fetch 14-15x EBITDA, implying $52 to $58

per share

Campbell is an iconic asset that could command

an attractive price from multiple parties

#RefreshTheRecipe | 42View entire presentation