Ocado Results Presentation Deck

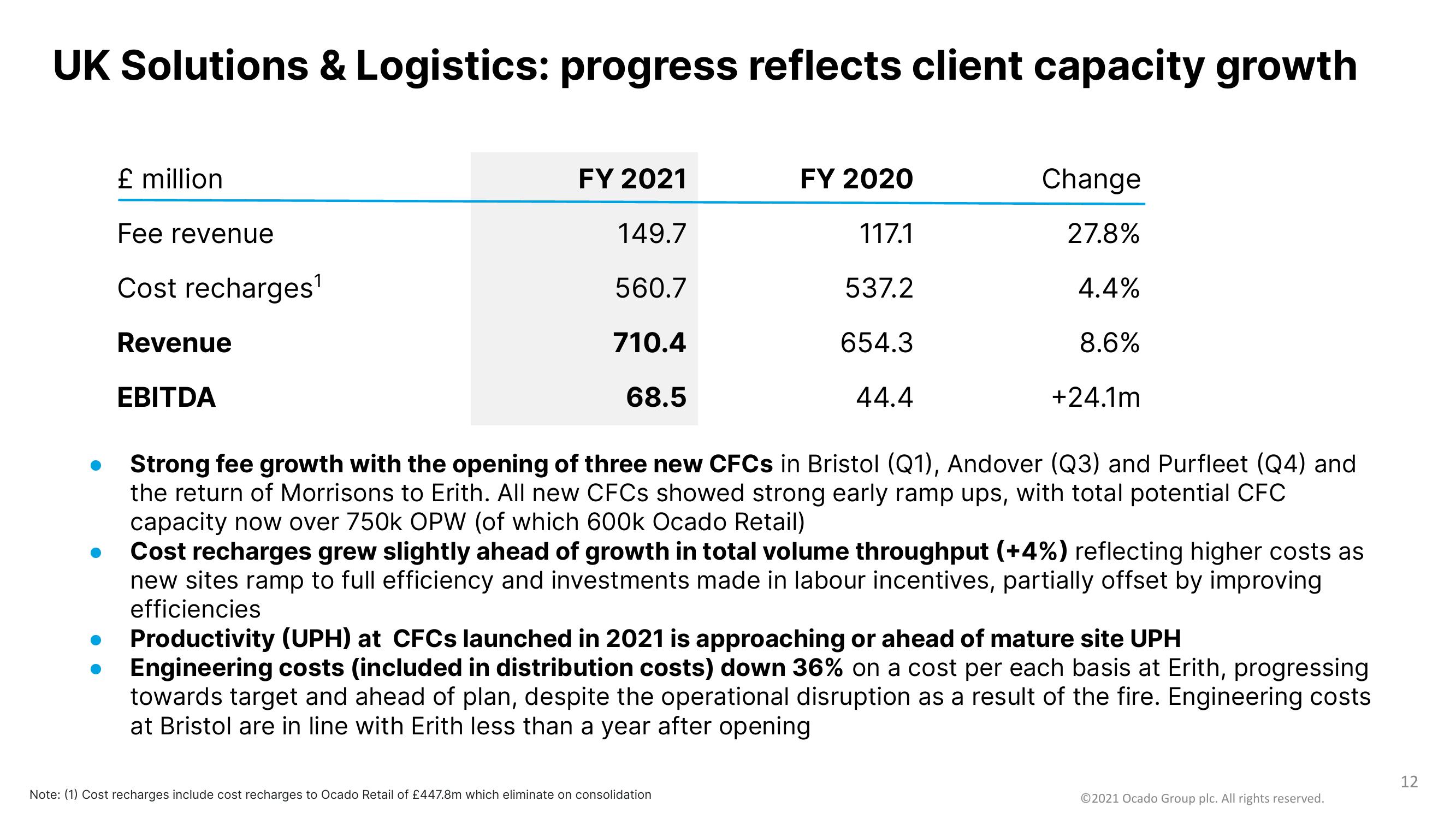

UK Solutions & Logistics: progress reflects client capacity growth

£ million

Fee revenue

Cost recharges¹

Revenue

EBITDA

FY 2021

149.7

560.7

710.4

68.5

FY 2020

117.1

537.2

654.3

44.4

Change

27.8%

4.4%

8.6%

+24.1m

Strong fee growth with the opening of three new CFCs in Bristol (Q1), Andover (Q3) and Purfleet (Q4) and

the return of Morrisons to Erith. All new CFCs showed strong early ramp ups, with total potential CFC

capacity now over 750k OPW (of which 600k Ocado Retail)

Cost recharges grew slightly ahead of growth in total volume throughput (+4%) reflecting higher costs as

new sites ramp to full efficiency and investments made in labour incentives, partially offset by improving

efficiencies

Note: (1) Cost recharges include cost recharges to Ocado Retail of £447.8m which eliminate on consolidation

Productivity (UPH) at CFCs launched in 2021 is approaching or ahead of mature site UPH

Engineering costs (included in distribution costs) down 36% on a cost per each basis at Erith, progressing

towards target and ahead of plan, despite the operational disruption as a result of the fire. Engineering costs

at Bristol are in line with Erith less than a year after opening

Ⓒ2021 Ocado Group plc. All rights reserved.

12View entire presentation