Antofagasta Results Presentation Deck

2022 Guidance

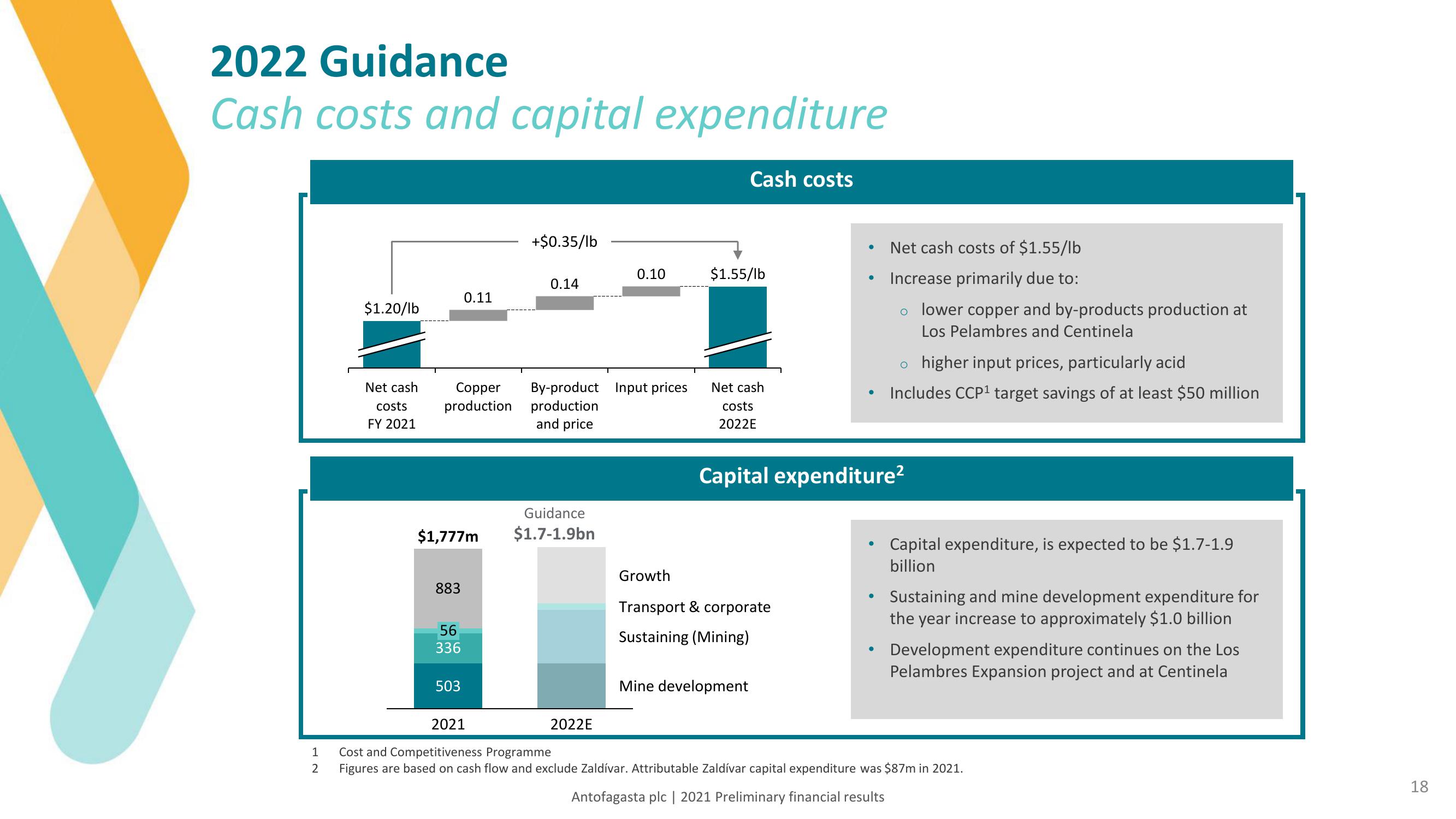

Cash costs and capital expenditure

1

2

$1.20/lb

Net cash

costs

FY 2021

$1,777m

883

0.11

56

336

Copper By-product Input prices

production

production

and price

503

+$0.35/lb

0.14

Guidance

$1.7-1.9bn

0.10

2022E

Cash costs

$1.55/lb

Net cash

costs

2022E

Growth

Transport & corporate

Sustaining (Mining)

Mine development

●

Net cash costs of $1.55/lb

Increase primarily due to:

o lower copper and by-products production at

Los Pelambres and Centinela

Capital expenditure²

o higher input prices, particularly acid

Includes CCP¹ target savings of at least $50 million

Capital expenditure, is expected to be $1.7-1.9

billion

Sustaining and mine development expenditure for

the year increase to approximately $1.0 billion

Development expenditure continues on the Los

Pelambres Expansion project and at Centinela

2021

Cost and Competitiveness Programme

Figures are based on cash flow and exclude Zaldívar. Attributable Zaldívar capital expenditure was $87m in 2021.

Antofagasta plc | 2021 Preliminary financial results

18View entire presentation