Antero Midstream Partners Mergers and Acquisitions Presentation Deck

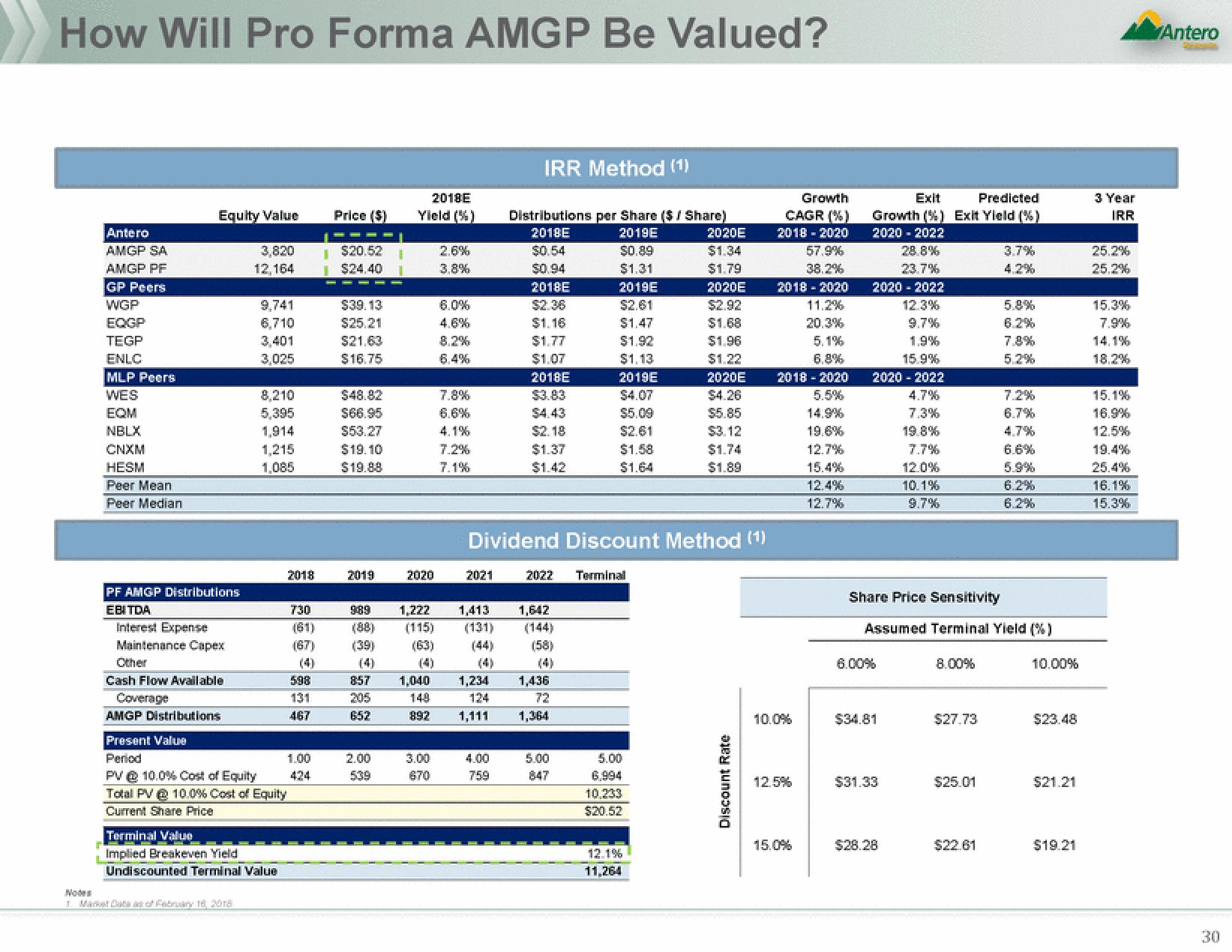

How Will Pro Forma AMGP Be Valued?

Node

Antero

AMGP SA

AMGP PF

GP Peers

WGP

EQGP

TEGP

ENLC

MLP Peers

WES

EQM

NBLX

CNXM

HESM

Peer Mean

Peer Median

Equity Value

PF AMGP Distributions

EBITDA

Interest Expense

Maintenance Capex

Cash Flow Available

Coverage

AMGP Distributions

3,820

12,164

9,741

6,710

3,401

3,025

8,210

5,395

1,914

1,215

1,085

Present Value

Period

PV @ 10.0% Cost of Equity

Total PV @ 10.0 % Cost of Equity

Current Share Price

Terminal Value

Implied Breakeven Yield

Undiscounted Terminal Value

2018

730

(61)

(67)

598

131

467

1.00

424

Price ($)

$20.52

$24.40

$39.13

$25.21

$21.63

$16.75

$48.82

$66.95

$53.27

$19.10

$19.88

2019

(39)

2018E

Yield (%)

2020

2.00

539

857 1,040

205

148

652

892

2.6%

3.8%

3.00

670

6.0%

4.6%

8.2%

6,4%

7.8%

6.6%

4.1%

7.2%

7.1%

2021

IRR Method (1)

989 1,222 1,413 1,642

(115)

(131)

(144)

(63)

(44)

(58)

1,234

124

1,111

Distributions per Share ($ / Share)

2018E

2019E

$0.89

$1.31

2019E

4.00

759

$0.54

$0.94

2018E

$2.36

$1.16

$1.77

$1.07

2018E

$3.83

$2.18

$1.37

$1.42

Dividend Discount Method (1)

2022 Terminal

$2.61

$1.47

$1.92

$1.13

2019E

$4.07

$5.09

$2.61

$1.58

$1.64

1,436

72

1,364

5.00

847

5.00

6.994

10,233

$20.52

2020E

$1.34

$1.79

2020E

$2.92

$1.68

12.1%

11,264

$1.96

$1.22

2020E

$4.26

$5.85

$3.12

$1.74

$1.89

Discount Rate

Growth

CAGR (%)

2018 - 2020

57.9%

38,2%

2018-2020

11.2%

20.3%

5.1%

6.8%

2018-2020

5.5%

14.9%

19.6%

12.7%

15.4%

12.4%

12.7%

10.0%

12.5%

15.0%

Exit Predicted

Growth (%) Exit Yield (%)

2020-2022

28.8%

23.7%

2020-2022

12.3%

9.7%

1.9%

15.9%

2020-2022

4.7%

7.3%

19.8%

6.00%

$34.81

$31.33

12.0%

10.1%

9.7%

$28.28

Share Price Sensitivity

Assumed Terminal Yield (%)

8.00%

$27.73

$25.01

3.7%

4.2%

$22.61

5.8%

6.2%

7.8%

5.2%

7.2%

6.7%

4.7%

6.6%

6.2%

6.2%

10.00%

$23.48

$21.21

$19.21

3 Year

IRR

25.2%

25.2%

15.3%

7.9%

14.1%

18.2%

15.1%

16.9%

12.5%

19.4%

16.1%

15.3%

Antero

30View entire presentation