Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

MAERSK GROUP

PERFORMANCE

For Q2 2015

Contents

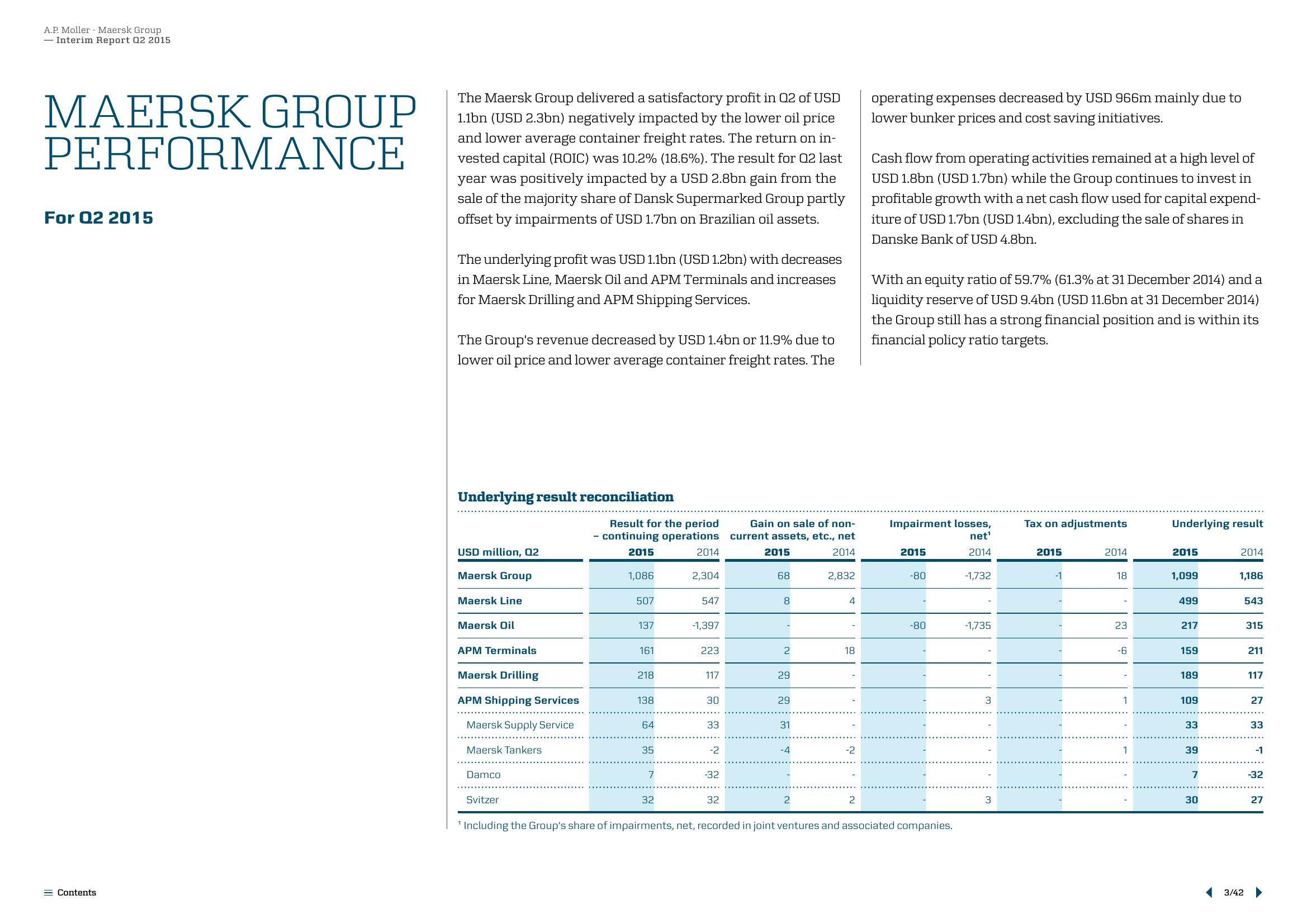

The Maersk Group delivered a satisfactory profit in Q2 of USD

1.1bn (USD 2.3bn) negatively impacted by the lower oil price

and lower average container freight rates. The return on in-

vested capital (ROIC) was 10.2% (18.6%). The result for Q2 last

year was positively impacted by a USD 2.8bn gain from the

sale of the majority share of Dansk Supermarked Group partly

offset by impairments of USD 1.7bn on Brazilian oil assets.

The underlying profit was USD 1.1bn (USD 1.2bn) with decreases

in Maersk Line, Maersk Oil and APM Terminals and increases

for Maersk Drilling and APM Shipping Services.

The Group's revenue decreased by USD 1.4bn or 11.9% due to

lower oil price and lower average container freight rates. The

Underlying result reconciliation

USD million, Q2

Maersk Group

Maersk Line

Maersk Oil

APM Terminals

Maersk Drilling

APM Shipping Services

Maersk Supply Service

Maersk Tankers

Damco

Svitzer

Result for the period

- continuing operations

2015

2014

1,086

507

137

161

218

138

64

35

7

32

2,304

547

-1,397

223

117

30

33

-2

-32

32

Gain on sale of non-

current assets, etc., net

2015

2014

68

8

-

2

29

29

31

-4

2

2,832

4

18

1

-2

2

operating expenses decreased by USD 966m mainly due to

lower bunker prices and cost saving initiatives.

Cash flow from operating activities remained at a high level of

USD 1.8bn (USD 1.7bn) while the Group continues to invest in

profitable growth with a net cash flow used for capital expend-

iture of USD 1.7bn (USD 1.4bn), excluding the sale of shares in

Danske Bank of USD 4.8bn.

With an equity ratio of 59.7% (61.3% at 31 December 2014) and a

liquidity reserve of USD 9.4bn (USD 11.6bn at 31 December 2014)

the Group still has a strong financial position and is within its

financial policy ratio targets.

Impairment losses,

net¹

2014

2015

-80

-80

'Including the Group's share of impairments, net, recorded in joint ventures and associated companies.

-1,732

-1,735

3

3

Tax on adjustments

2015

-1

2014

18

23

-6

1

1

Underlying result

2015

1,099

499

217

159

189

109

33

39

7

30

2014

1,186

3/42

543

315

211

117

27

33

-32

27View entire presentation