MP Materials Results Presentation Deck

Stage I Operating Metrics

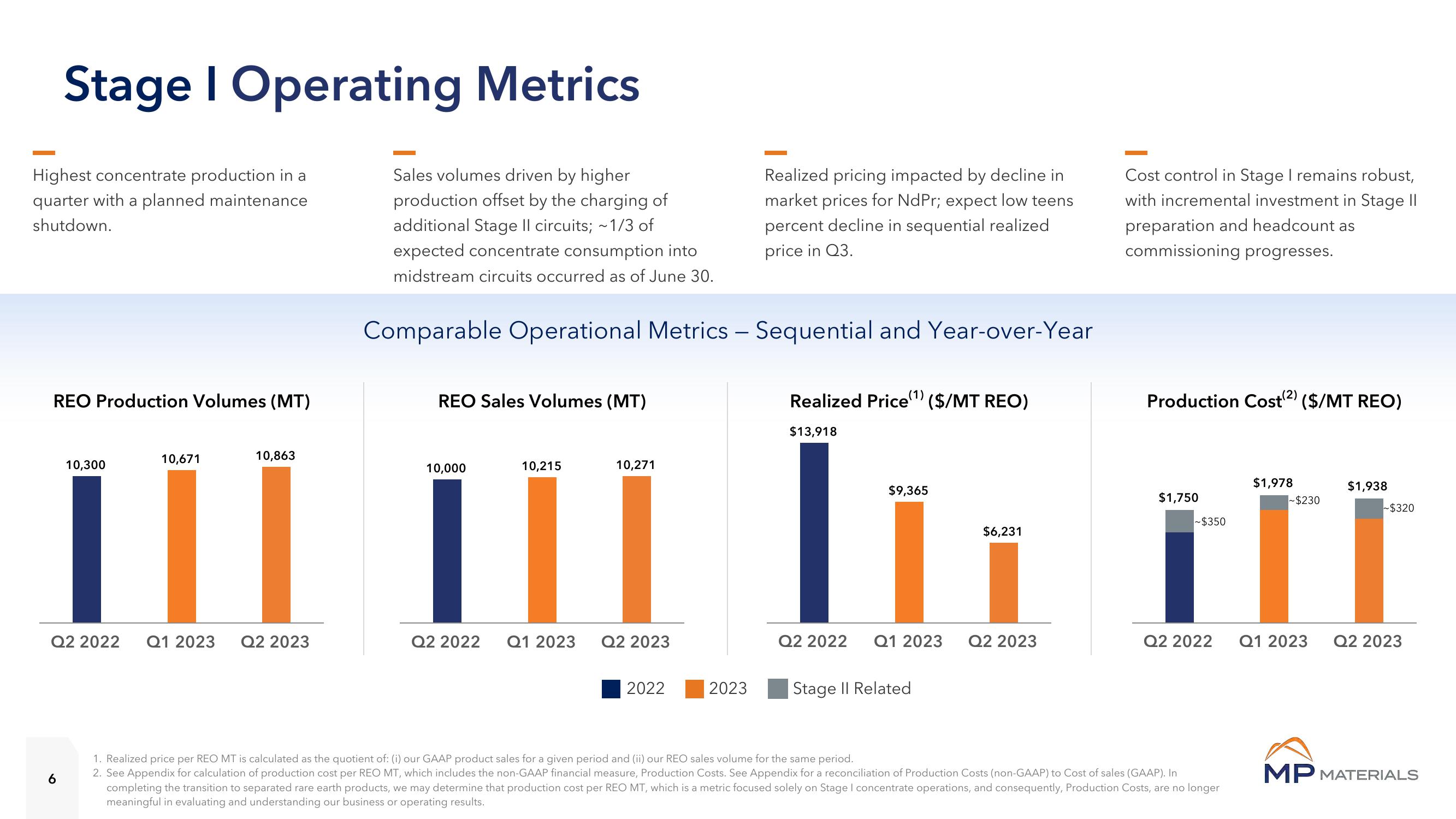

Highest concentrate production in a

quarter with a planned maintenance

shutdown.

REO Production Volumes (MT)

10,300

6

10,671

10,863

Q2 2022 Q1 2023 Q2 2023

Sales volumes driven by higher

production offset by the charging of

additional Stage Il circuits; ~1/3 of

expected concentrate consumption into

midstream circuits occurred as of June 30.

Comparable Operational Metrics – Sequential and Year-over-Year

REO Sales Volumes (MT)

10,000

10,215

11

Q2 2022 Q1 2023

10,271

Q2 2023

2022

2023

Realized pricing impacted by decline in

market prices for NdPr; expect low teens

percent decline in sequential realized

price in Q3.

Realized Price(¹) ($/MT REO)

$13,918

$9,365

Q2 2022 Q1 2023

Stage II Related

$6,231

Q2 2023

Cost control in Stage I remains robust,

with incremental investment in Stage II

preparation and headcount as

commissioning progresses.

Production Cost(²) ($/MT REO)

$1,750

~$350

Q2 2022

1. Realized price per REO MT is calculated as the quotient of: (i) our GAAP product sales for a given period and (ii) our REO sales volume for the same period.

2. See Appendix for calculation of production cost per REO MT, which includes the non-GAAP financial measure, Production Costs. See Appendix for a reconciliation of Production Costs (non-GAAP) to Cost of sales (GAAP). In

completing the transition to separated rare earth products, we may determine that production cost per REO MT, which is a metric focused solely on Stage I concentrate operations, and consequently, Production Costs, are no longer

meaningful in evaluating and understanding our business or operating results.

$1,978

-$230

$1,938

~$320

Q1 2023 Q2 2023

MP MATERIALSView entire presentation