Antero Midstream Partners Mergers and Acquisitions Presentation Deck

AR Share Repurchase Considerations

.

.

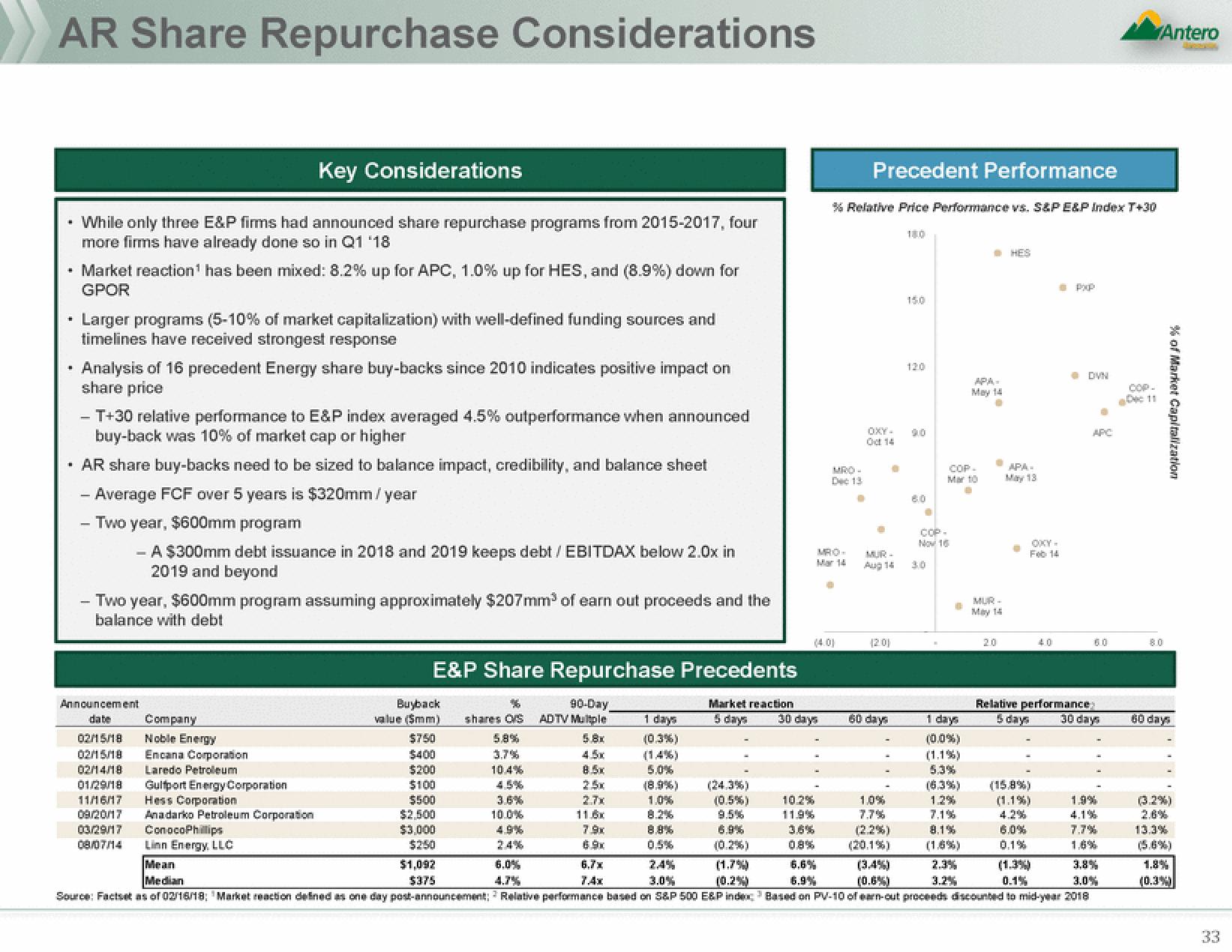

Key Considerations

While only three E&P firms had announced share repurchase programs from 2015-2017, four

more firms have already done so in Q1 '18

Market reaction has been mixed: 8.2% up for APC, 1.0% up for HES, and (8.9%) down for

GPOR

Larger programs (5-10% of market capitalization) with well-defined funding sources and

timelines have received strongest response

Analysis of 16 precedent Energy share buy-backs since 2010 indicates positive impact on

share price

- T+30 relative performance to E&P index averaged 4.5% outperformance when announced

buy-back was 10% of market cap or higher

• AR share buy-backs need to be sized to balance impact, credibility, and balance sheet

- Average FCF over 5 years is $320mm / year

Two year, $600mm program

- A $300mm debt issuance in 2018 and 2019 keeps debt / EBITDAX below 2.0x in

2019 and beyond

- Two year, $600mm program assuming approximately $207mm³ of earn out proceeds and the

balance with debt

Announcement

date

02/15/18

02/15/18

02/14/18

01/29/18

11/06/17

09/20/17

03/29/17

08/07/14

Company

Noble Energy

Encana Corporation

Laredo Petroleum

Gulfport Energy Corporation

Hess Corporation

Anadarko Petroleum Corporation

ConocoPhillips

Linn Energy, LLC

E&P Share Repurchase Precedents

%6

shares OFS

5.8%

Market reaction

5 days

30 days

3.7%

10.4%

4.5%

3.6%

10.0%

Buyback

value ($mm)

$750

$400

$200

$100

$500

$2.500

$3,000

$250

4.9%

24%

$1,092

$375

90-Day

ADTV Multple

5.8x

6.0%

4.7%

8.5x

2.7x

11.6x

7.9x

6.9x

1 days

(0.3%)

6.7x

7.4x

5.0%

(8.9%)

1.0%

8.2%

8.8%

(24.3%)

(0.5%)

9.5%

10.2%

11.9%

3.6%

0.8%

6.6%

% Relative Price Performance vs. S&P E&P Index T+30

Dec 13

MRO-

Precedent Performance

B

OXY-

Oct 14

101

MUR-

Aug 14

(2.0)

60 days

@

1,0%

7.7%

(2,2%)

(20.1%)

15.0

120

9.0

60

0

COP-

Mar 10

B

COP-

Nov 16

0

1 days

(0,0%)

(1.1%)

5.3%

(5.3%)

1.2%

8.1%

@HES

APA-

May 14

MUR-

May 14

20

APA-

Mly: 13.

·

Feb 14

40

(15.8%)

(1.1%)

4.2%

6.0%

0.1%

PXP

(0.2%)

(1.7%)

(3.4%)

(1.3%)

3.0%

Mean

Median

Source: Factset as of 02/16/18; Market reaction defined as one day post-announcement: Relative performance based on S&P 500 E&P index Based on PV-10 of earn-out proceeds discounted to mid-year 2018

(0.2%)

(0.6%)

3.2%

0.1%

APC

Relative performance

5 days

30 days

00

4.1%

7.7%

1.6%

3.8%

3.0%

COP.

Dec 11

Antero

% of Market Capitalization

60 days

(3.2%)

13.3%

1.8%

(0.3%)

33View entire presentation