Main Street Capital Investor Day Presentation Deck

Follow-on Investment Case Studies

Gamber-Johnson

Company Description

Leading supplier of rugged mounting systems

that safely secure mobile communication

systems, computers, and other electronic

equipment in fleet vehicles, public safety

vehicles, forklifts, and other mobility applications

Initial Transaction

Management buyout/corporate carve out

Company's management team sought a financial

partner that shared management's vision of

investing in the future growth of the business

Acquisition Strategy / Rationale

Two-pronged acquisition strategy:

Diversify end market exposure

■ Strengthen competitive position

Completed five acquisitions providing exposure

to new end markets, geographic regions,

customers, and products

■

■

PMT

LIND

-

Representative Acquisitions

Primary competitor of mobile mounting

solutions in the Canadian market

Provided

additional

manufacturing

capabilities to produce bent metal products

in-house

■

■

$40.5

$15.5

$25.0

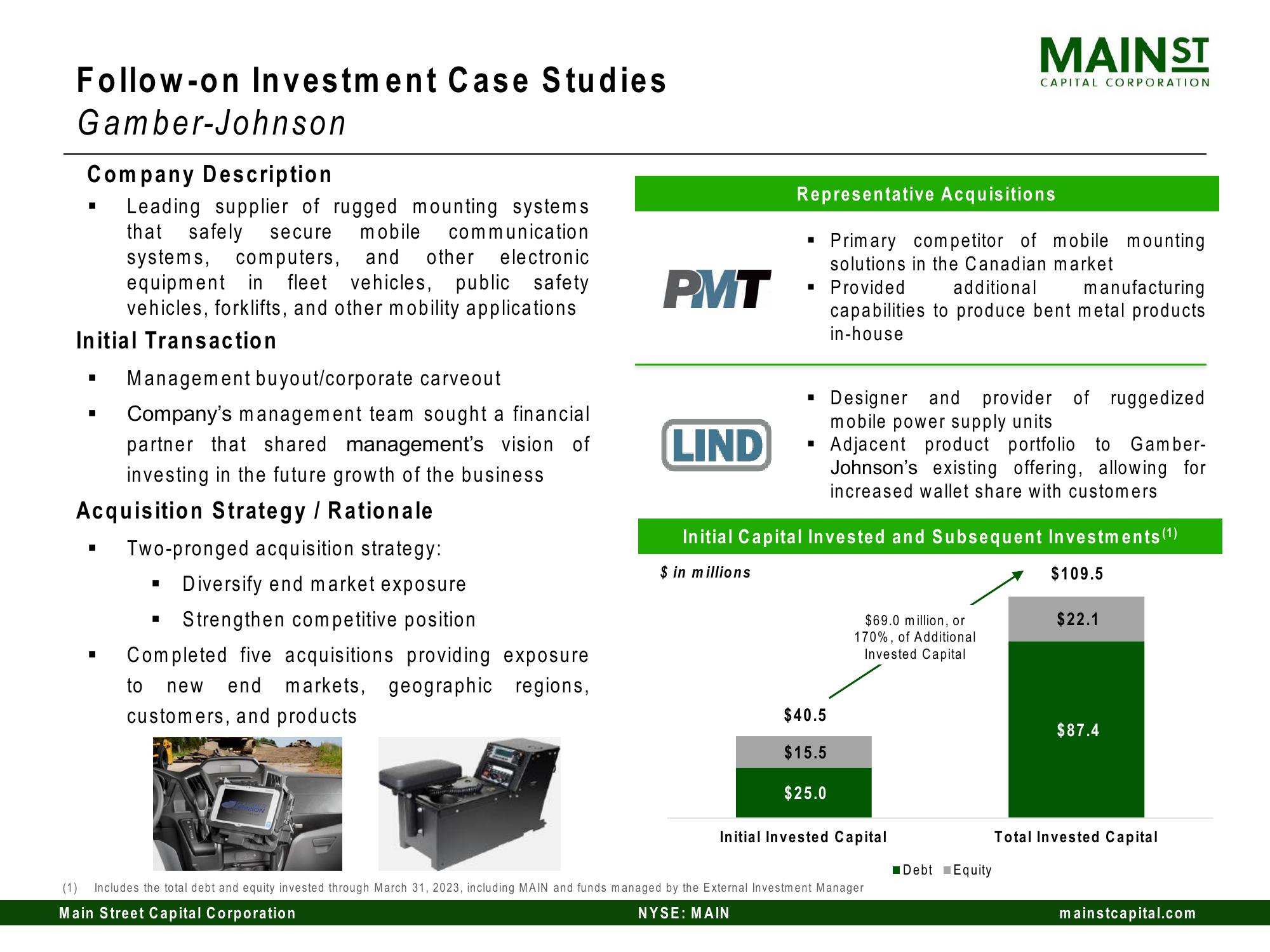

Initial Capital Invested and Subsequent Investments (¹)

$ in millions

$109.5

Designer and provider of ruggedized

mobile power supply units

Adjacent product portfolio to Gamber-

Johnson's existing offering, allowing for

increased wallet share with customers

$69.0 million, or

170%, of Additional

Invested Capital

Initial Invested Capital

MAIN ST

(1) Includes the total debt and equity invested through March 31, 2023, including MAIN and funds managed by the External Investment Manager

Main Street Capital Corporation

NYSE: MAIN

CAPITAL CORPORATION

■Debt

Equity

$22.1

$87.4

Total Invested Capital

mainstcapital.comView entire presentation