Benson Hill Investor Presentation Deck

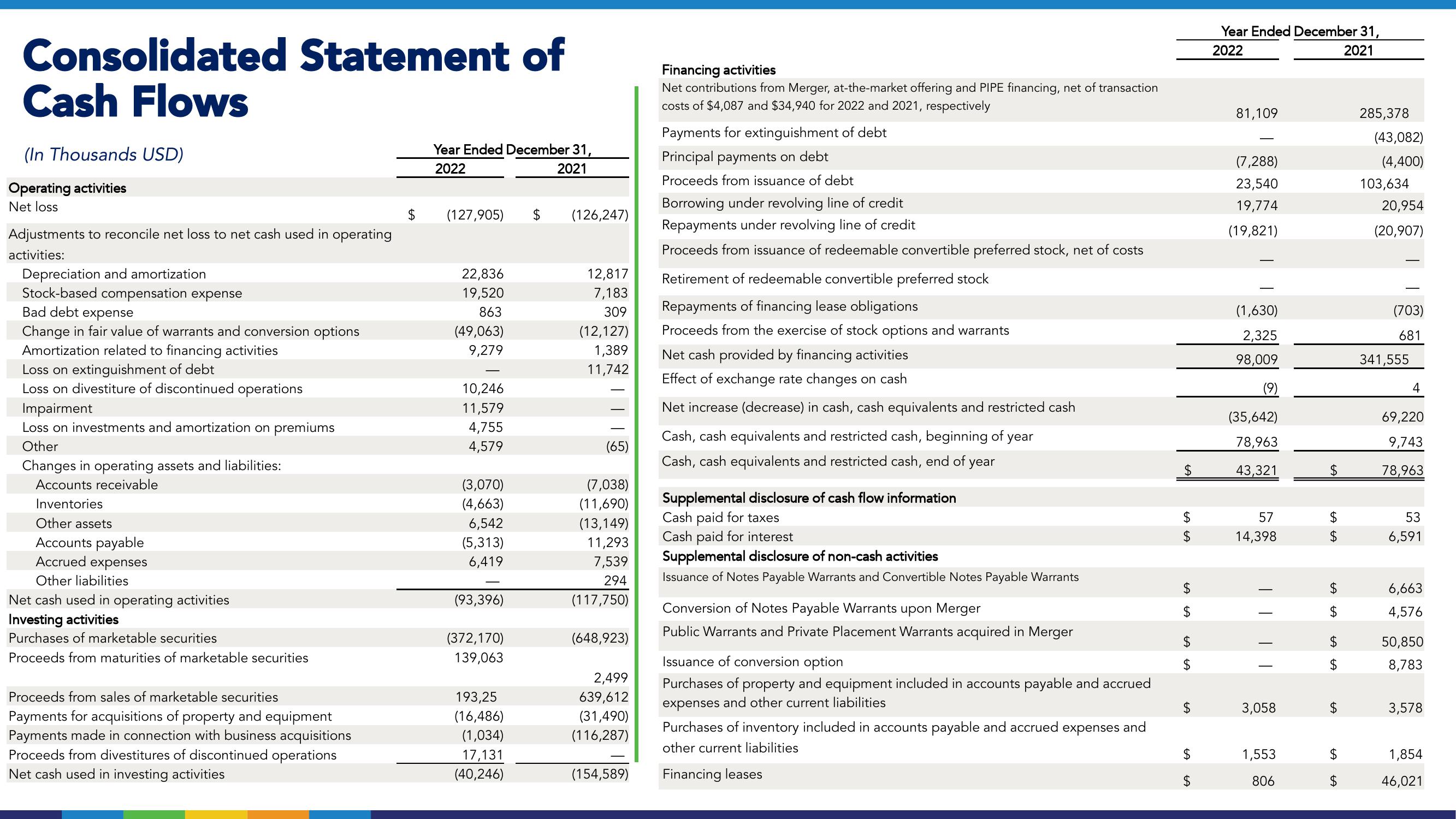

Consolidated Statement of

Cash Flows

(In Thousands USD)

Operating activities

Net loss

Adjustments to reconcile net loss to net cash used in operating

activities:

Depreciation and amortization

Stock-based compensation expense

Bad debt

expense

Change in fair value of warrants and conversion options

Amortization related to financing activities

Loss on extinguishment of debt

Loss on divestiture of discontinued operations

Impairment

Loss on investments and amortization on premiums

Other

Changes in operating assets and liabilities:

Accounts receivable

Inventories

Other assets

Accounts payable

Accrued expenses

Other liabilities

Net cash used in operating activities

Investing activities

Purchases of marketable securities

Proceeds from maturities of marketable securities

Proceeds from sales of marketable securities

Payments for acquisitions of property and equipment

Payments made in connection with business acquisitions

Proceeds from divestitures of discontinued operations

Net cash used in investing activities

Year Ended December 31,

2022

2021

(127,905) $

22,836

19,520

863

(49,063)

9,279

10,246

11,579

4,755

4,579

(3,070)

(4,663)

6,542

(5,313)

6,419

(93,396)

(372,170)

139,063

193,25

(16,486)

(1,034)

17,131

(40,246)

(126,247)

12,817

7,183

309

(12,127)

1,389

11,742

(65)

(7,038)

(11,690)

(13,149)

11,293

7,539

294

(117,750)

(648,923)

2,499

639,612

(31,490)

(116,287)

(154,589)

Financing activities

Net contributions from Merger, at-the-market offering and PIPE financing, net of transaction

costs of $4,087 and $34,940 for 2022 and 2021, respectively

Payments for extinguishment of debt

Principal payments on debt

Proceeds from issuance of debt

Borrowing under revolving line of credit

Repayments under revolving line of credit

Proceeds from issuance of redeemable convertible preferred stock, net of costs

Retirement of redeemable convertible preferred stock

Repayments of financing lease obligations

Proceeds from the exercise of stock options and warrants

Net cash provided by financing activities

Effect of exchange rate changes on cash

Net increase (decrease) in cash, cash equivalents and restricted cash

Cash, cash equivalents and restricted cash, beginning of

year

Cash, cash equivalents and restricted cash, end of year

Supplemental disclosure of cash flow information

Cash paid for taxes

Cash paid for interest

Supplemental disclosure of non-cash activities

Issuance of Notes Payable Warrants and Convertible Notes Payable Warrants

Conversion of Notes Payable Warrants upon Merger

Public Warrants and Private Placement Warrants acquired in Merger

Issuance of conversion option

Purchases of property and equipment included in accounts payable and accrued

expenses and other current liabilities

Purchases of inventory included in accounts payable and accrued expenses and

other current liabilities

Financing leases

$

$

LA LA

$

LA

$

$

$

A

LA

Year Ended December 31,

2022

2021

81,109

(7,288)

23,540

19,774

(19,821)

(1,630)

2,325

98,009

(9)

(35,642)

78,963

43,321

57

14,398

||||

3,058

1,553

806

$

$

LA LA

$

LA

$

tA

$

+A

$

$

AA

$

LA

$

LA

tA

$

285,378

(43,082)

(4,400)

103,634

20,954

(20,907)

(703)

681

341,555

4

69,220

9,743

78,963

53

6,591

6,663

4,576

50,850

8,783

3,578

1,854

46,021View entire presentation