DocGo SPAC Presentation Deck

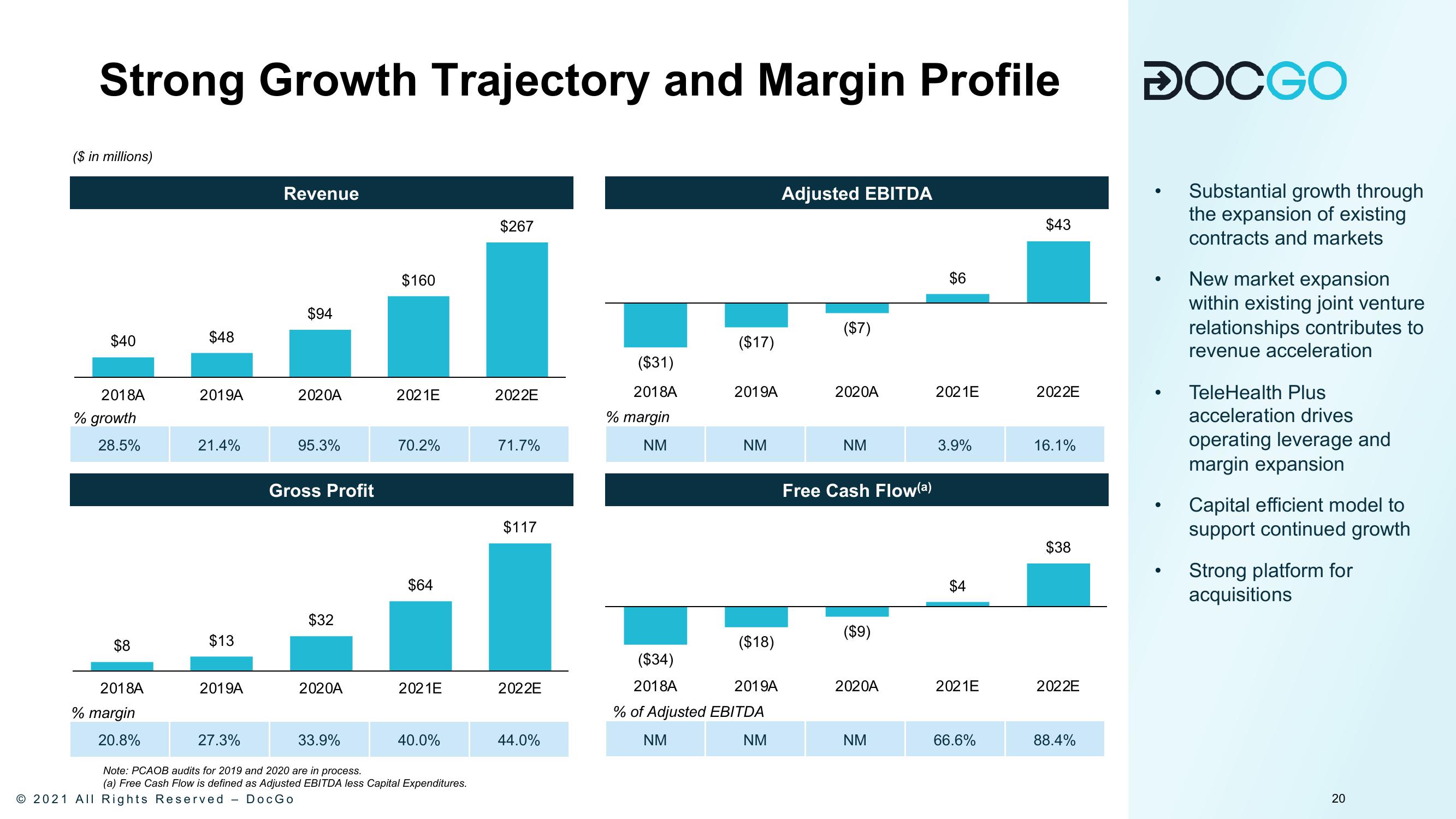

Strong Growth Trajectory and Margin Profile

($ in millions)

$40

2018A

% growth

28.5%

$8

2018A

% margin

20.8%

$48

2019A

21.4%

$13

2019A

27.3%

Revenue

$94

2020A

© 2021 All Rights Reserved - DocGo

95.3%

Gross Profit

$32

2020A

33.9%

$160

2021E

70.2%

$64

2021E

40.0%

Note: PCAOB audits for 2019 and 2020 are in process.

(a) Free Cash Flow is defined as Adjusted EBITDA less Capital Expenditures.

$267

2022E

71.7%

$117

2022E

44.0%

($31)

2018A

% margin

NM

($17)

2019A

NM

($18)

($34)

2018A

2019A

% of Adjusted EBITDA

NM

NM

Adjusted EBITDA

($7)

2020A

NM

Free Cash Flow(a)

($9)

2020A

NM

$6

2021E

3.9%

$4

2021E

66.6%

$43

2022E

16.1%

$38

2022E

88.4%

DOCGO

●

●

●

Substantial growth through

the expansion of existing

contracts and markets

New market expansion

within existing joint venture

relationships contributes to

revenue acceleration

TeleHealth Plus

acceleration drives

operating leverage and

margin expansion

Capital efficient model to

support continued growth

Strong platform for

acquisitions

20View entire presentation