Livent and Allkem to Create a Leading Global Integrated Lithium Chemicals Producer

Transaction Details

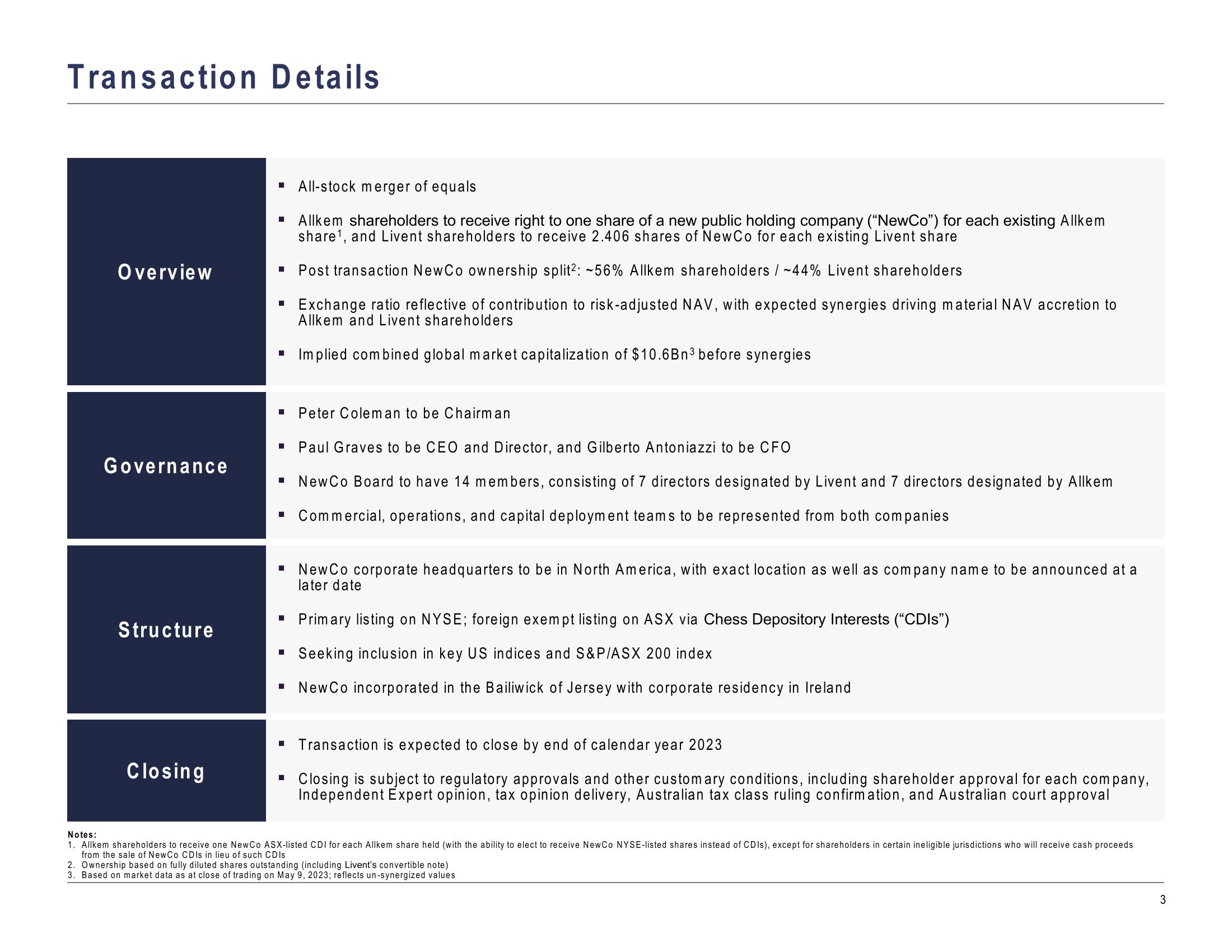

Overview

Governance

Structure

Closing

All-stock merger of equals

■ Allkem shareholders to receive right to one share of a new public holding company ("NewCo") for each existing Allkem

share¹, and Livent shareholders to receive 2.406 shares of New Co for each existing Livent share

▪

Post transaction NewCo ownership split2: -56% Allkem shareholders / ~44% Livent shareholders

■

Exchange ratio reflective of contribution to risk-adjusted NAV, with expected synergies driving material NAV accretion to

Allkem and Livent shareholders

Implied combined global market capitalization of $10.6Bn³ before synergies

Peter Coleman to be Chairman

■ Paul Graves to be CEO and Director, and Gilberto Antoniazzi to be CFO

▪ New Co Board to have 14 members, consisting of 7 directors designated by Livent and 7 directors designated by Allkem

■ Commercial, operations, and capital deployment teams to be represented from both companies

■

▪ New Co corporate headquarters to be in North America, with exact location as well as company name to be announced at a

later date

■ Primary listing on NYSE; foreign exempt listing on ASX via Chess Depository Interests ("CDIs")

■ Seeking inclusion in key US indices and S&P/ASX 200 index

New Co incorporated in the Bailiwick of Jersey with corporate residency in Ireland

■ Transaction is expected to close by end of calendar year 2023

■ Closing is subject to regulatory approvals and other customary conditions, including shareholder approval for each company,

Independent Expert opinion, tax opinion delivery, Australian tax class ruling confirmation, and Australian court approval

Notes:

1. Allkem shareholders to receive one NewCo ASX-listed CDI for each Allkem share held (with the ability to elect to receive NewCo NYSE-listed shares instead of CDIs), except for shareholders in certain ineligible jurisdictions who will receive cash proceeds

from the sale of NewCo CDIs in lieu of such CDIs

2. Ownership based on fully diluted shares outstanding (including Livent's convertible note)

3. Based on market data as at close of trading on May 9, 2023; reflects un-synergized values

3View entire presentation