Evercore Investment Banking Pitch Book

Financial Analysis

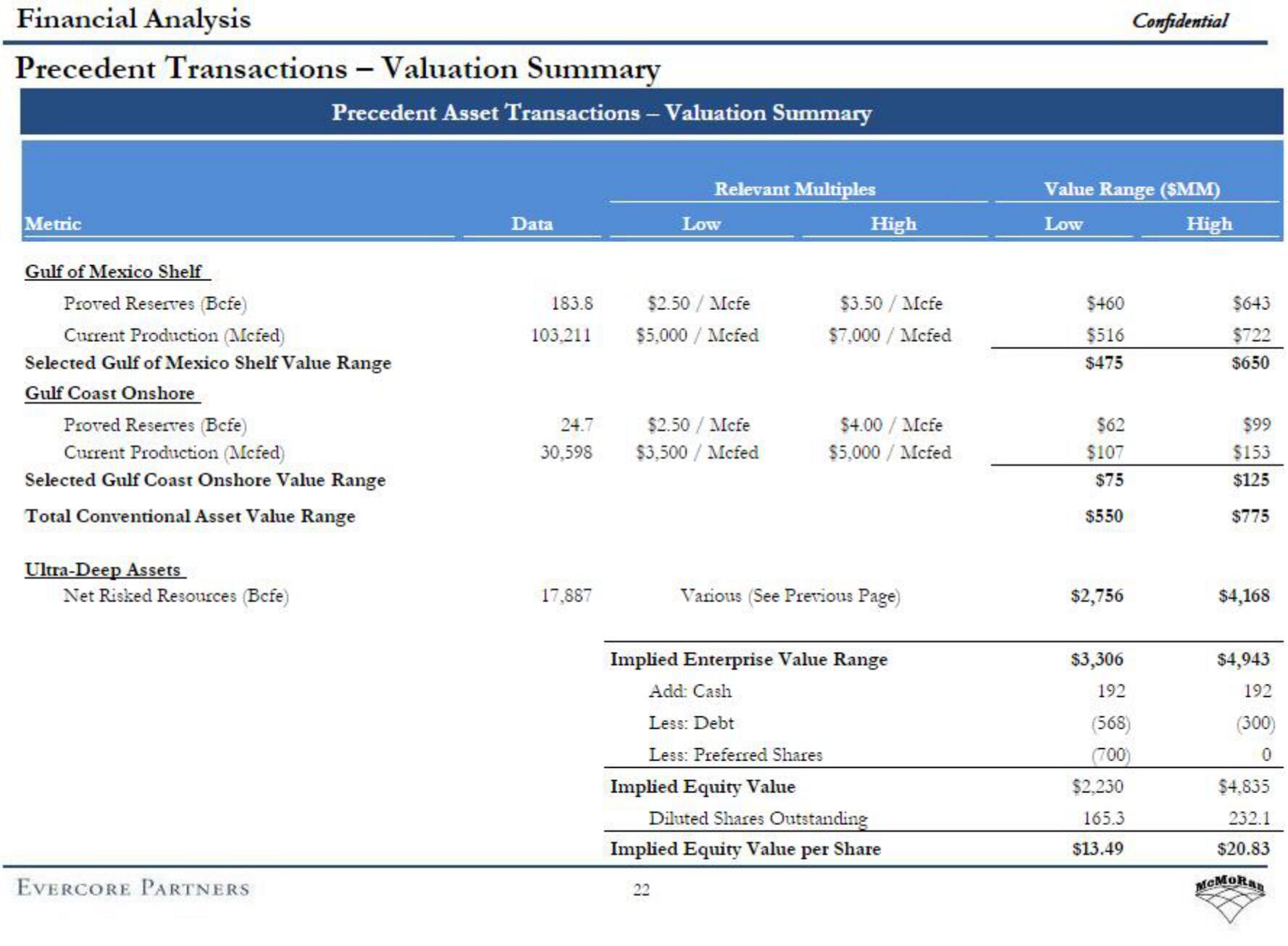

Precedent Transactions - Valuation Summary

Metric

Gulf of Mexico Shelf

Proved Reserves (Bcfe)

Current Production (Mcfed)

Selected Gulf of Mexico Shelf Value Range

Gulf Coast Onshore

Proved Reserves (Bcfe)

Current Production (Mcfed)

Selected Gulf Coast Onshore Value Range

Total Conventional Asset Value Range

Ultra-Deep Assets

Precedent Asset Transactions - Valuation Summary

Net Risked Resources (Bcfe)

EVERCORE PARTNERS

Data

183.8

3.211

24.7

30,598

17,887

Relevant Multiples

Low

$2.50/Mcfe

$5,000/Mcf

$2.50 / Mcfe

$3,500/Mcfed

22

High

Implied Equity Value

$3.50/Mcfe

$7,000/Mcfed

$4.00 / Mcfe

$5,000/Mcfed

Various (See Previous Page)

Implied Enterprise Value Range

Add: Cash

Less: Debt

Less: Preferred Shares

Diluted Shares Outstanding

Implied Equity Value per Share

Value Range ($MM)

Low

High

$460

$516

$475

$62

$107

$75

$550

$2,756

$3,306

192

(568)

(700)

Confidential

$2.230

165.3

$13.49

$643

$722

$650

$99

$153

$125

$775

$4,168

$4,943

192

(300)

0

$4,835

232.1

$20.83

MCMoRanView entire presentation