Tudor, Pickering, Holt & Co Investment Banking

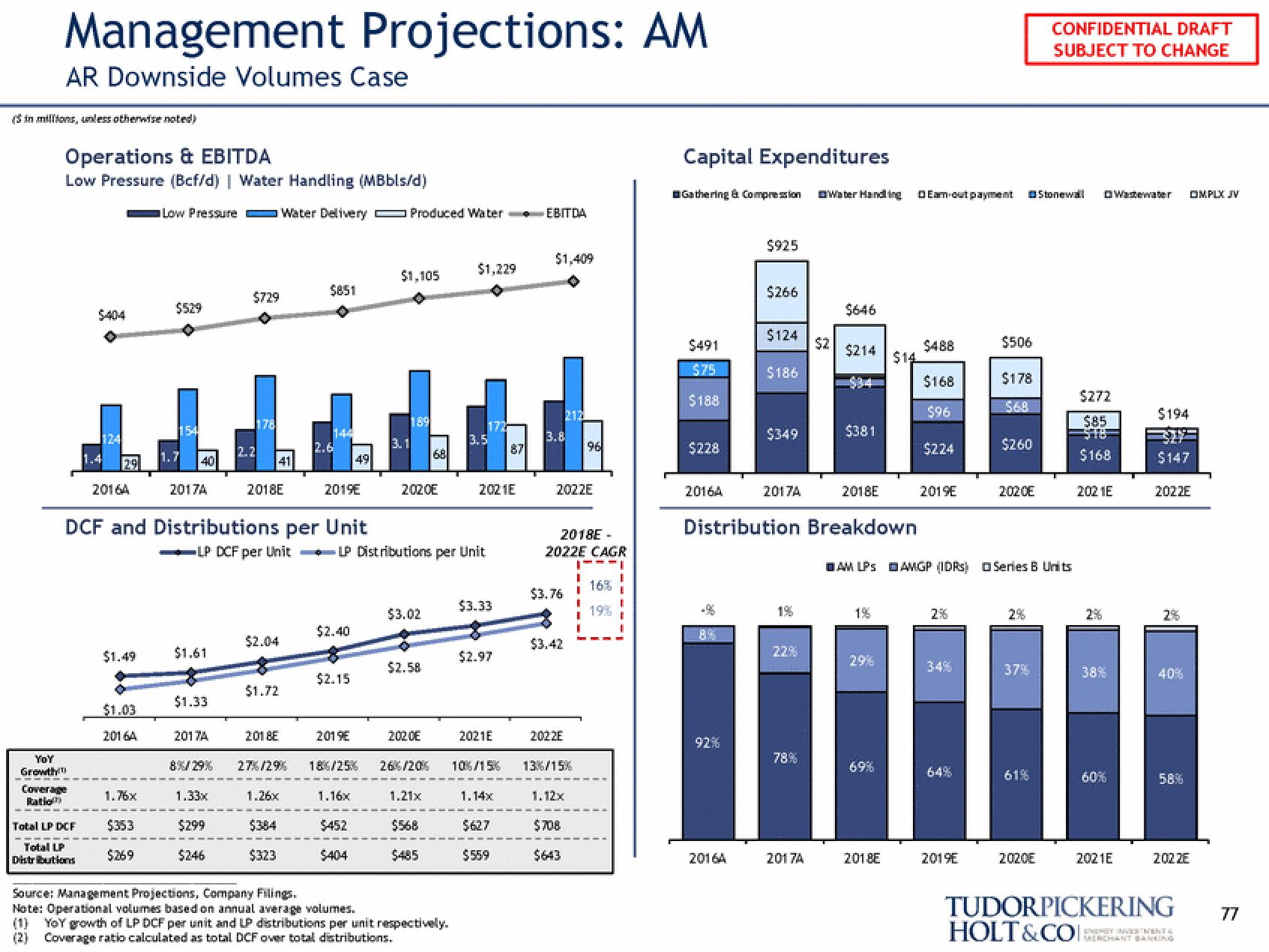

Management Projections: AM

AR Downside Volumes Case

(in millions, unless otherwise noted)

Operations & EBITDA

Low Pressure (Bcf/d) | Water Handling (MBbls/d)

YOY

Growth

Coverage

1.4

Total LP DCF

Total LP

Distributions

124

2016A

$1.49

$1.03

20164

1.76x

Low Pressure Water Delivery Produced Water EBITDA

$353

$269

$529

154

40

2017A

$1.61

$1.33

DCF and Distributions per Unit

LP DCF per Unit

T

1.33x

$729

$299

$246

178

41

2018E

$2.04

2017A

2018E

8%/29% 27%/29%

1.26x

$384

$323

$1.72

$851

2.6

2019E

$2.40

49

$2.15

2019E

18%/25%

1.16x

$452

$404

$1,105

3.1

189

LP Distributions per Unit

2020E

$3.02

$2.58

202.0E

26%/20%

68

1.21x

$568

$485

$1,229

Source: Management Projections, Company Filings.

Note: Operational volumes based on annual average volumes.

YoY growth of LP DCF per unit and LP distributions per unit respectively.

(2) Coverage ratio calculated as total DCF over total distributions.

172

3.5

2021E

$3.33

$2.97

2021E

10%/15%

87

1.14x

$627

$559

T

$1,409

3.8

2022E

2018E-

2022E CAGR

$3.76

$3.42

2022E

13%/15%

1.12x

$708

$643

96

I

I

I

16% I

19% I

Capital Expenditures

Gathering & Compression Water Handling DEam-out payment

$491

$75

$188

$228

2016A

92%

$925

2016A

$266

$124

$186

$349

2017A

22%

78%

$2

2017A

$646

Distribution Breakdown

$214

$381

2018E

1%

29%

$14

69%

2018E

$488

$168

$96

$224

2019E

2%

AM LPS AMGP (IDRS) □Series B Units

34%

64%

$506

2019E

$178

$68

$260

2020E

2%

37%

61%

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

2020E

Stonewall

$272

$85

518-

$168

2021E

2%

38%

60%

Wastewater □MPLX JV

2021E

$194

$147

2022E

2%

40%

58%

202 ZE

TUDORPICKERING

HOLT&COCHANT BANKING

77View entire presentation