Evercore Investment Banking Pitch Book

For

Reference Only

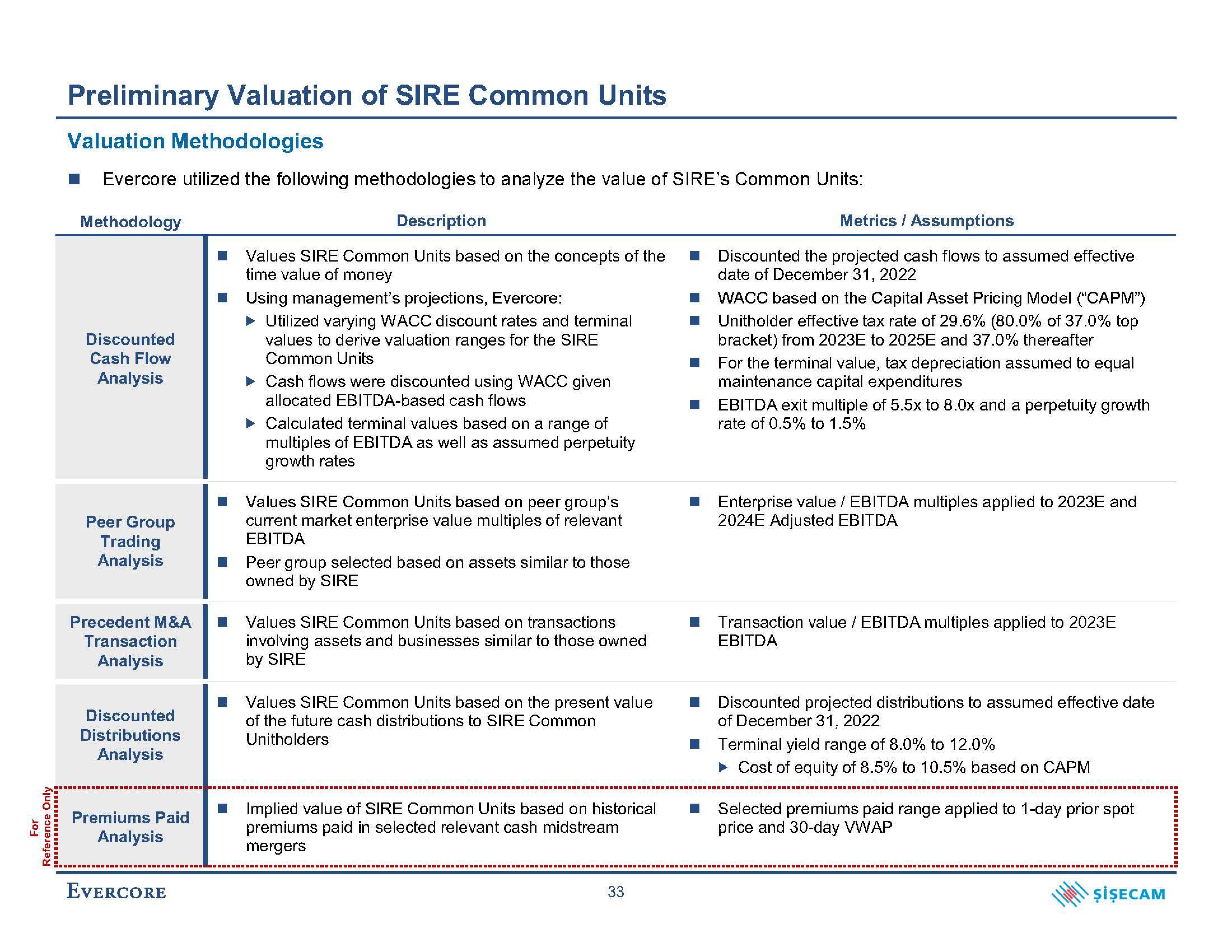

Preliminary Valuation of SIRE Common Units

Valuation Methodologies

Evercore utilized the following methodologies to analyze the value of SIRE's Common Units:

Methodology

Discounted

Cash Flow

Analysis

Peer Group

Trading

Analysis

Precedent M&A

Transaction

Analysis

Discounted

Distributions

Analysis

Premiums Paid

Analysis

EVERCORE

Description

Values SIRE Common Units based on the concepts of the

time value of money

Using management's projections, Evercore:

► Utilized varying WACC discount rates and terminal

values to derive valuation ranges for the SIRE

Common Units

► Cash flows were discounted using WACC given

allocated EBITDA-based cash flows

► Calculated terminal values based on a range of

multiples of EBITDA as well as assumed perpetuity

growth rates

Values SIRE Common Units based on peer group's

current market enterprise value multiples of relevant

EBITDA

Peer group selected based on assets similar to those

owned by SIRE

Values SIRE Common Units based on transactions

involving assets and businesses similar to those owned

by SIRE

Values SIRE Common Units based on the present value

of the future cash distributions to SIRE Common

Unitholders

Implied value of SIRE Common Units based on historical

premiums paid in selected relevant cash midstream

mergers

‒‒‒‒‒‒‒‒‒‒

33

■

■

Metrics / Assumptions

Discounted the projected cash flows to assumed effective

date of December 31, 2022

■

WACC based on the Capital Asset Pricing Model ("CAPM")

Unitholder effective tax rate of 29.6% (80.0% of 37.0% top

bracket) from 2023E to 2025E and 37.0% thereafter

For the terminal value, tax depreciation assumed to equal

maintenance capital expenditures

EBITDA exit multiple of 5.5x to 8.0x and a perpetuity growth

rate of 0.5% to 1.5%

■ Enterprise value / EBITDA multiples applied to 2023E and

2024E Adjusted EBITDA

Transaction value / EBITDA multiples applied to 2023E

EBITDA

Discounted projected distributions to assumed effective date

of December 31, 2022

Terminal yield range of 8.0% to 12.0%

► Cost of equity of 8.5% to 10.5% based on CAPM

Selected premiums paid range applied to 1-day prior spot

price and 30-day VWAP

‒‒‒‒‒

ŞİŞECAMView entire presentation