AngloAmerican Investor Presentation Deck

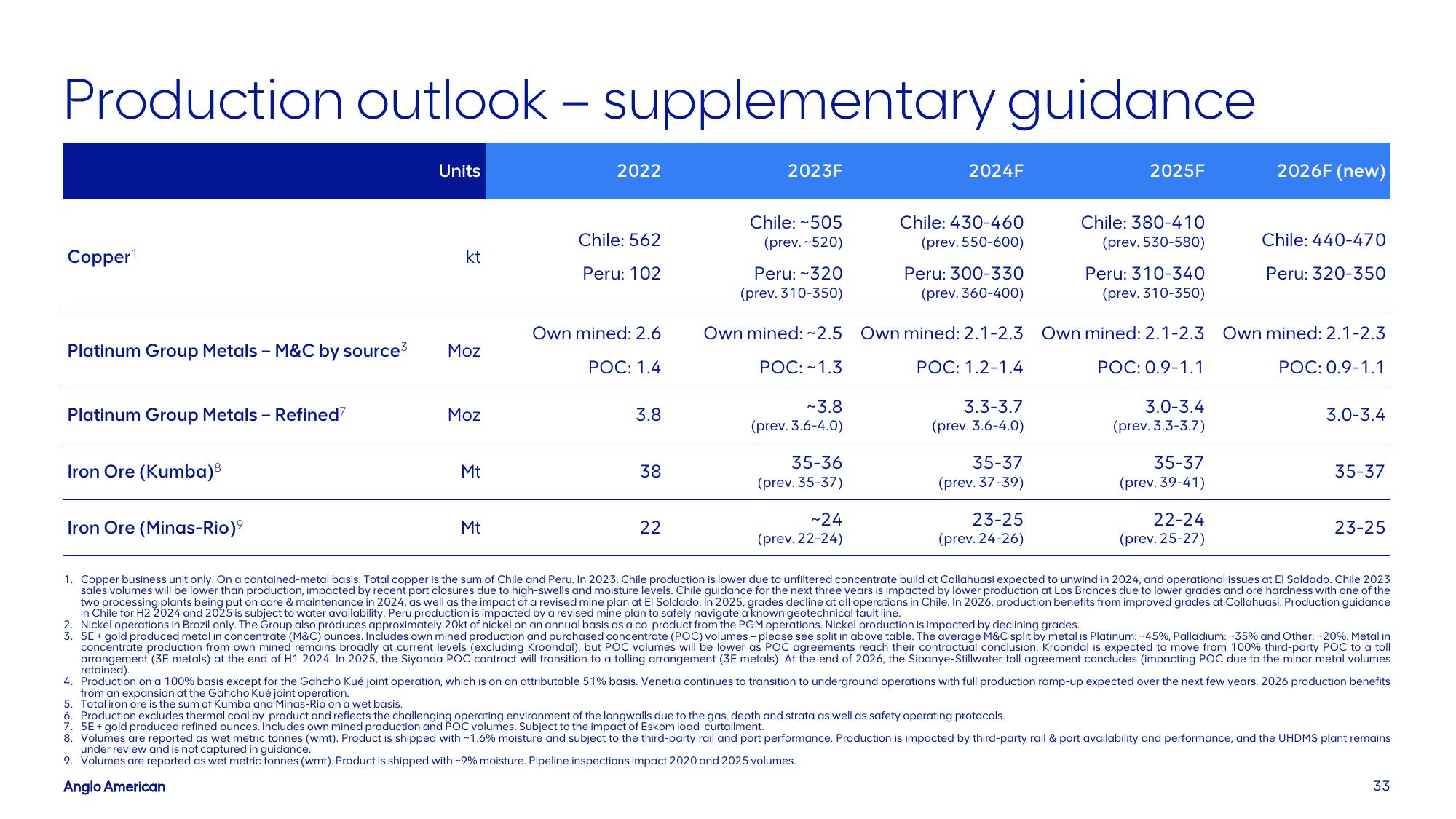

Production outlook - supplementary guidance

Copper¹

Platinum Group Metals - M&C by source³

Platinum Group Metals - Refined

Iron Ore (Kumba)8

Iron Ore (Minas-Rio)⁹

Units

kt

Moz

Moz

Mt

Mt

2022

Chile: 562

Peru: 102

Own mined: 2.6

POC: 1.4

3.8

38

22

2023F

Chile: ~505

(prev.-520)

Peru: ~320

(prev. 310-350)

2024F

-3.8

(prev. 3.6-4.0)

35-36

(prev. 35-37)

~24

(prev. 22-24)

Chile: 430-460

(prev. 550-600)

Peru: 300-330

(prev. 360-400)

2025F

3.3-3.7

(prev. 3.6-4.0)

35-37

(prev. 37-39)

23-25

(prev. 24-26)

Chile: 380-410

(prev. 530-580)

Peru: 310-340

(prev. 310-350)

Own mined: ~2.5 Own mined: 2.1-2.3 Own mined: 2.1-2.3 Own mined: 2.1-2.3

POC: ~1.3

POC: 1.2-1.4

POC: 0.9-1.1

POC: 0.9-1.1

3.0-3.4

(prev. 3.3-3.7)

35-37

(prev. 39-41)

2026F (new)

22-24

(prev. 25-27)

Chile: 440-470

Peru: 320-350

3.0-3.4

35-37

23-25

1. Copper business unit only. On a contained-metal basis. Total copper is the sum of Chile and Peru. In 2023, Chile production is lower due to unfiltered concentrate build at Collahuasi expected to unwind in 2024, and operational issues at El Soldado. Chile 2023

sales volumes will be lower than production, impacted by recent port closures due to high-swells and moisture levels. Chile guidance for the next three years is impacted by lower production at Los Bronces due to lower grades and ore hardness with one of the

two processing plants being put on care & maintenance in 2024, as well as the impact of a revised mine plan at El Soldado. In 2025, grades decline at all operations in Chile. In 2026, production benefits from improved grades at Collahuasi. Production guidance

in Chile for H2 2024 and 2025 is subject to water availability. Peru production is impacted by a revised mine plan to safely navigate a known geotechnical fault line.

conc

2. Nickel operations in Brazil only. The Group also produces approximately 20kt of nickel on an annual basis as a co-product from the PGM operations. Nickel production is impacted by declining grades.

5E + gold produced meto

trate (M&C) ounces. Includes own mined production and purch

centrate (POC lumes - please see above table. average M&C split by metal is Platinum: -45%, Palladium: -35% and Other: -20%. Metal in

concentrate production from own mined remains broadly at current levels (excluding Kroondal), but POC volumes will be lower as POC agreements reach their contractual conclusion. Kroondal is expected to move from 100% third-party POC to a toll

arrangement (3E metals) at the end of H1 2024. In 2025, the Siyanda POC contract will transition to a tolling arrangement (3E metals). At the end of 2026, the Sibanye-Stillwater toll agreement concludes (impacting POC due to the minor metal volumes

retained).

4. Production on a 100% basis except for the Gahcho Kué joint operation, which is on an attributable 51% basis. Venetia continues to transition to underground operations with full production ramp-up expected over the next few years. 2026 production benefits

from an expansion at the Gahcho Kué joint operation.

5. Total iron ore is the sum of Kumba and Minas-Rio on a wet basis.

6. Production excludes thermal coal by-product and reflects the challenging operating environment of the longwalls due to the gas, depth and strata as well as safety operating protocols.

7. 5E + gold produced refined ounces. Includes own mined production and POC volumes. Subject to the impact of Eskom load-curtailment.

8. Volumes are reported as wet metric tonnes (wmt). Product is shipped with -1.6% moisture and subject to the third-party rail and port performance. Production is impacted by third-party rail & port availability and performance, and the UHDMS plant remains

under review and is not captured in guidance.

9. Volumes are reported as wet metric tonnes (wmt). Product is shipped with ~9% moisture. Pipeline inspections impact 2020 and 2025 volumes.

Anglo American

33View entire presentation