Melrose Results Presentation Deck

Highlights

Melrose

Continuing operations

Revenue

Operating profit/(loss)

Profit/(loss) after tax

Diluted earnings per share

Net debt¹

■

■

2021

Actual

rates

£m

7,496

375

197

4.1p

950

1.3x

Adjusted¹ results

2020

Constant

currency¹

£m

7,351

122

Buy

Improve

Sell

(36)

(0.8)p

2,834

Actual

rates

£m

4.1x

7,723

141

(27)

(0.6)p

2,847

4.1x

Statutory results

2021

Actual

rates

£m

Leverage¹

Group

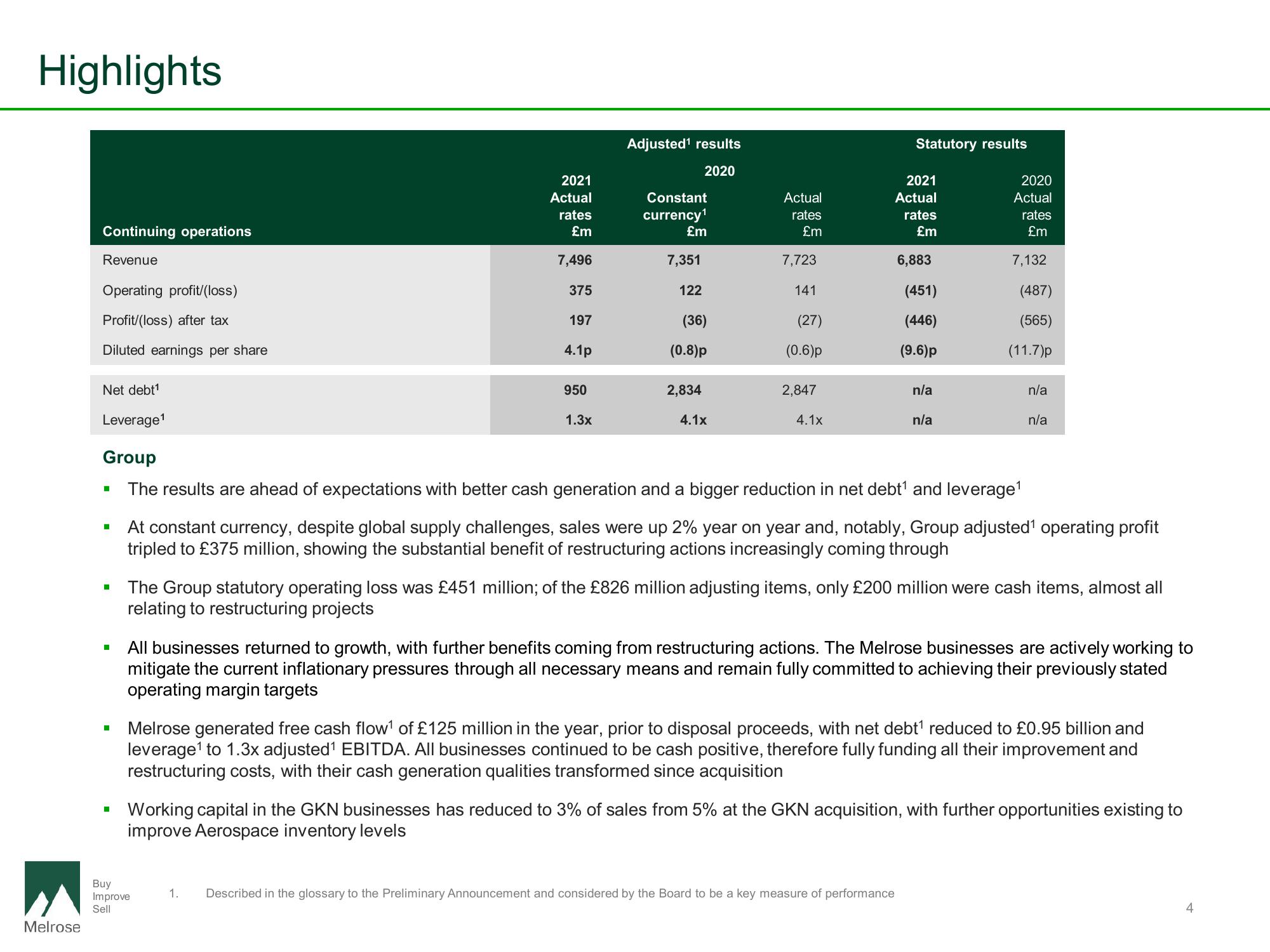

The results are ahead of expectations with better cash generation and a bigger reduction in net debt¹ and leverage¹

6,883

(451)

(446)

(9.6)p

n/a

n/a

2020

Actual

rates

£m

7,132

(487)

(565)

(11.7)p

1. Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

At constant currency, despite global supply challenges, sales were up 2% year on year and, notably, Group adjusted¹ operating profit

tripled to £375 million, showing the substantial benefit of restructuring actions increasingly coming through

n/a

n/a

The Group statutory operating loss was £451 million; of the £826 million adjusting items, only £200 million were cash items, almost all

relating to restructuring projects

All businesses returned to growth, with further benefits coming from restructuring actions. The Melrose businesses are actively working to

mitigate the current inflationary pressures through all necessary means and remain fully committed to achieving their previously stated

operating margin targets

Melrose generated free cash flow¹ of £125 million in the year, prior to disposal proceeds, with net debt¹ reduced to £0.95 billion and

leverage¹ to 1.3x adjusted¹ EBITDA. All businesses continued to be cash positive, therefore fully funding all their improvement and

restructuring costs, with their cash generation qualities transformed since acquisition

Working capital in the GKN businesses has reduced to 3% of sales from 5% at the GKN acquisition, with further opportunities existing to

improve Aerospace inventory levels

4View entire presentation