The Urgent Need for Change and The Superior Path Forward

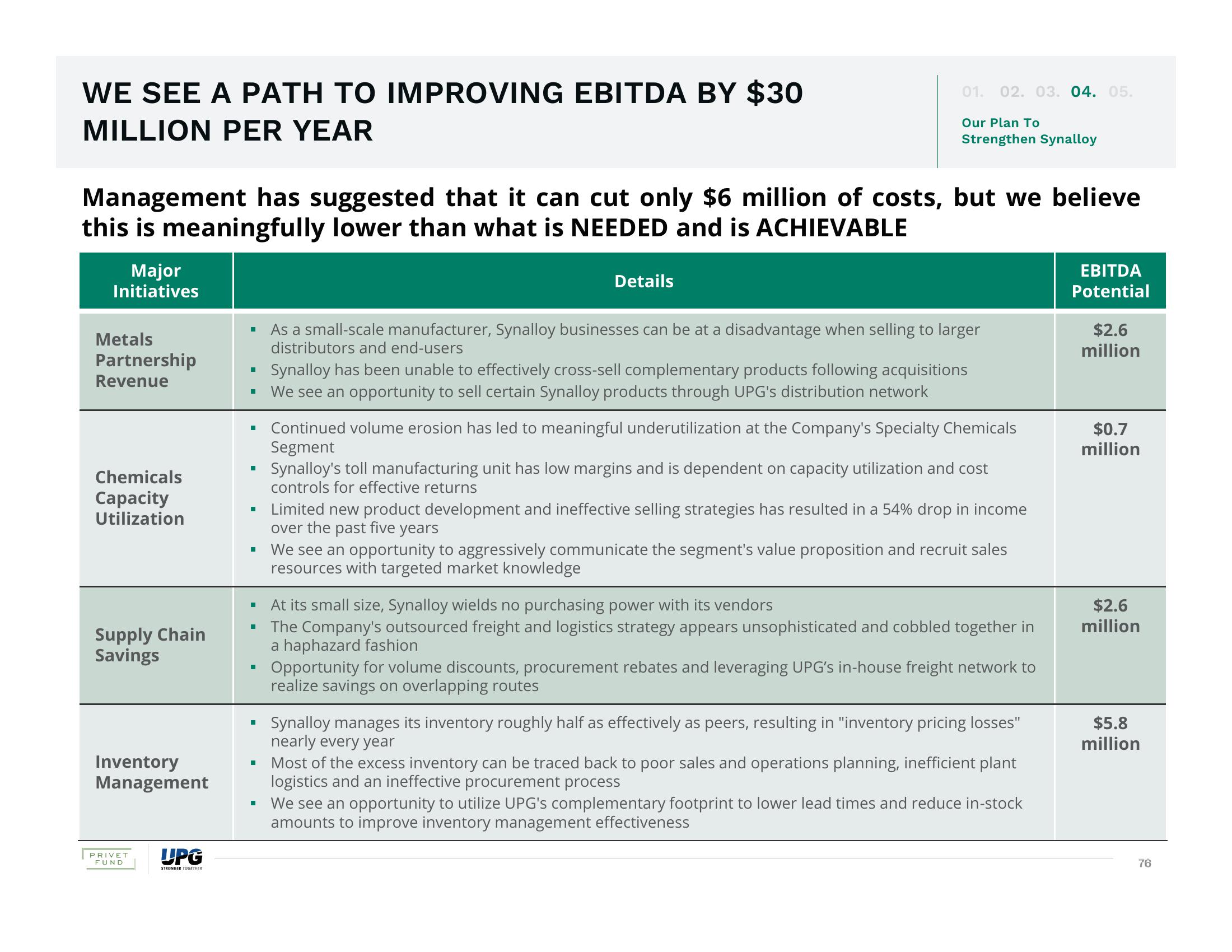

WE SEE A PATH TO IMPROVING EBITDA BY $30

MILLION PER YEAR

Major

Initiatives

Management has suggested that it can cut only $6 million of costs, but we believe

this is meaningfully lower than what is NEEDED and is ACHIEVABLE

Metals

Partnership

Revenue

Chemicals

Capacity

Utilization

Supply Chain

Savings

Inventory

Management

PRIVET

FUND

UPG

STRONGER TOGETHER

■

I

■

I

01. 02. 03. 04. 05.

Details

Our Plan To

Strengthen Synalloy

As a small-scale manufacturer, Synalloy businesses can be at a disadvantage when selling to larger

distributors and end-users

Synalloy has been unable to effectively cross-sell complementary products following acquisitions

We see an opportunity to sell certain Synalloy products through UPG's distribution network

Continued volume erosion has led to meaningful underutilization at the Company's Specialty Chemicals

Segment

Synalloy's toll manufacturing unit has low margins and is dependent on capacity utilization and cost

controls for effective returns

Limited new product development and ineffective selling strategies has resulted in a 54% drop in income

over the past five years

We see an opportunity to aggressively communicate the segment's value proposition and recruit sales

resources with targeted market knowledge

At its small size, Synalloy wields no purchasing power with its vendors

The Company's outsourced freight and logistics strategy appears unsophisticated and cobbled together in

a haphazard fashion

Opportunity for volume discounts, procurement rebates and leveraging UPG's in-house freight network to

realize savings on overlapping routes

Synalloy manages its inventory roughly half as effectively as peers, resulting in "inventory pricing losses"

nearly every year

Most of the excess inventory can be traced back to poor sales and operations planning, inefficient plant

logistics and an ineffective procurement process

We see an opportunity to utilize UPG's complementary footprint to lower lead times and reduce in-stock

amounts to improve inventory management effectiveness

EBITDA

Potential

$2.6

million

$0.7

million

$2.6

million

$5.8

million

76View entire presentation