Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

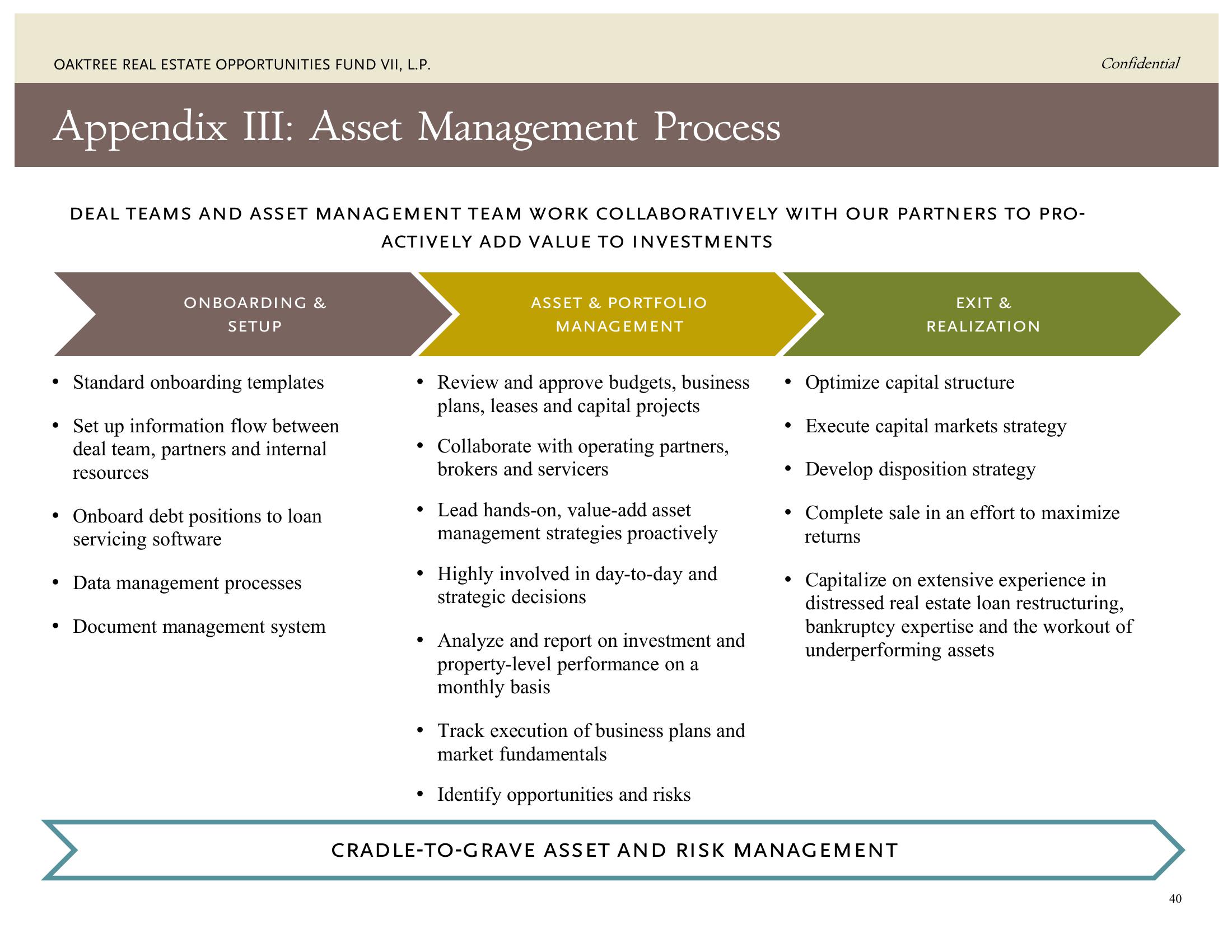

Appendix III: Asset Management Process

DEAL TEAMS AND ASSET MANAGEMENT TEAM WORK COLLABORATIVELY WITH OUR PARTNERS TO PRO-

ACTIVELY ADD VALUE TO INVESTMENTS

●

ONBOARDING &

SETUP

• Standard onboarding templates

Set up information flow between

deal team, partners and internal

resources

• Onboard debt positions to loan

servicing software

• Data management processes

Document management system

●

• Review and approve budgets, business

plans, leases and capital projects

●

ASSET & PORTFOLIO

●

MANAGEMENT

• Lead hands-on, value-add asset

management strategies proactively

●

Collaborate with operating partners,

brokers and servicers

Highly involved in day-to-day and

strategic decisions

Analyze and report on investment and

property-level performance on a

monthly basis

Track execution of business plans and

market fundamentals

Identify opportunities and risks

●

●

●

●

EXIT &

REALIZATION

Confidential

Optimize capital structure

Execute capital markets strategy

Develop disposition strategy

Complete sale in an effort to maximize

returns

CRADLE-TO-GRAVE ASSET AND RISK MANAGEMENT

Capitalize on extensive experience in

distressed real estate loan restructuring,

bankruptcy expertise and the workout of

underperforming assets

40View entire presentation