Shoals Results Presentation Deck

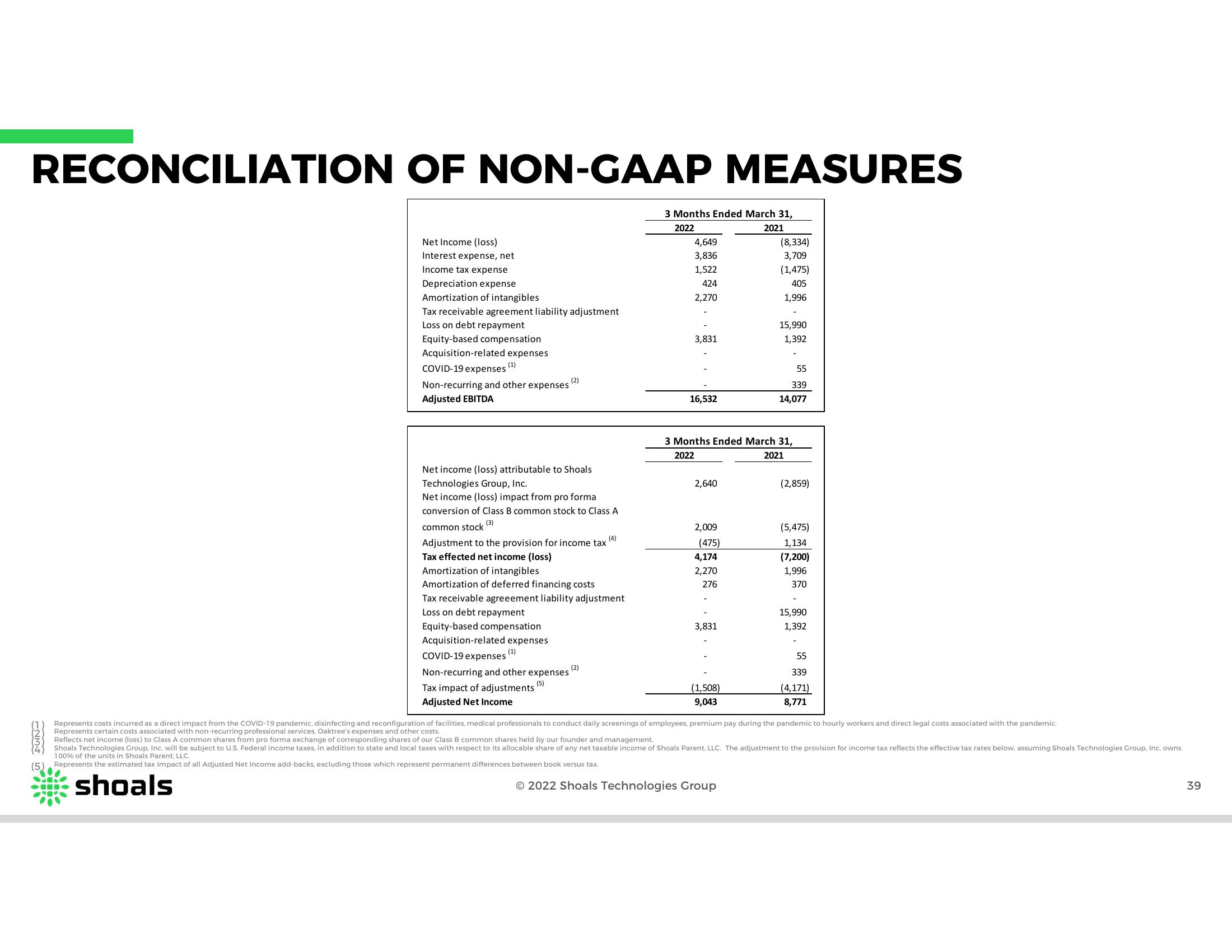

RECONCILIATION OF NON-GAAP MEASURES

1234

Net Income (loss)

Interest expense, net

Income tax expense

Depreciation expense

Amortization of intangibles

Tax receivable agreement liability adjustment

Loss on debt repayment

Equity-based compensation

Acquisition-related expenses

COVID-19 expenses (1)

Non-recurring and other expenses

Adjusted EBITDA

(2)

Net income (loss) attributable to Shoals

Technologies Group, Inc.

Net income (loss) impact from pro forma

conversion of Class B common stock to Class A

(3)

common stock

(4)

Adjustment to the provision for income tax

Tax effected net income (loss)

Amortization of intangibles

Amortization of deferred financing costs

Tax receivable agreeement liability adjustment

Loss on debt repayment

Equity-based compensation

Acquisition-related expenses

(1)

COVID-19 expenses

Non-recurring and other expenses

Tax impact of adjustments

Adjusted Net Income

(5)

(2)

3 Months Ended March 31,

2022

2021

4,649

3,836

1,522

424

2,270

3,831

16,532

2,640

2,009

3 Months Ended March 31,

2022

2021

(475)

4,174

2,270

276

3,831

(8,334)

3,709

(1,475)

405

1,996

(1,508)

9,043

15,990

1,392

55

339

14,077

(2,859)

(5,475)

1,134

(7,200)

1,996

370

15,990

1,392

55

339

(4,171)

8,771

Represents costs incurred as a direct impact from the COVID-19 pandemic, disinfecting and reconfiguration of facilities, medical professionals to conduct daily screenings of employees, premium pay during the pandemic to hourly workers and direct legal costs associated with the pandemic.

Represents certain costs associated with non-recurring professional services, Oaktree's expenses and other costs.

Reflects net income (loss) to Class A common shares from pro forma exchange of corresponding shares of our Class B common shares held by our founder and management.

Shoals Technologies Group, Inc. will be subject to U.S. Federal income taxes, in addition to state and local taxes with respect to its allocable share of any net taxable income of Shoals Parent, LLC. The adjustment to the provision for income tax reflects the effective tax rates below, assuming Shoals Technologies Group, Inc. owns

100% of the units in Shoals Parent, LLC.

Represents the estimated tax impact of all Adjusted Net Income add-backs, excluding those which represent permanent differences between book versus tax.

shoals

Ⓒ2022 Shoals Technologies Group

39View entire presentation