Kinnevik Results Presentation Deck

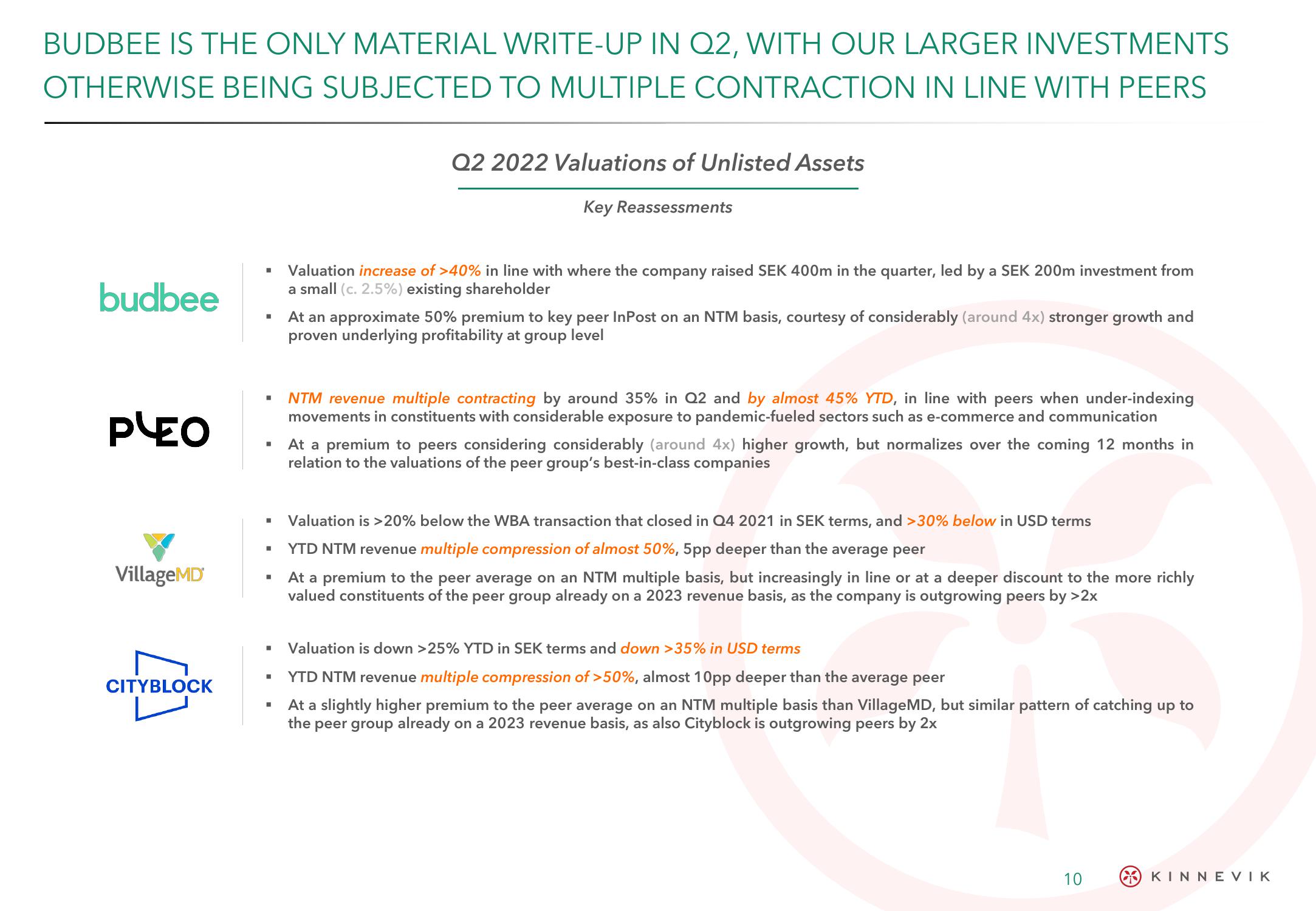

BUDBEE IS THE ONLY MATERIAL WRITE-UP IN Q2, WITH OUR LARGER INVESTMENTS

OTHERWISE BEING SUBJECTED TO MULTIPLE CONTRACTION IN LINE WITH PEERS

budbee

PLEO

VillageMD

CITYBLOCK

-

■

■

■

I

■

■

■

I

■

I

Q2 2022 Valuations of Unlisted Assets

Key Reassessments

Valuation increase of >40% in line with where the company raised SEK 400m in the quarter, led by a SEK 200m investment from

a small (c. 2.5%) existing shareholder

At an approximate 50% premium to key peer InPost on an NTM basis, courtesy of considerably (around 4x) stronger growth and

proven underlying profitability at group level

NTM revenue multiple contracting by around 35% in Q2 and by almost 45% YTD, in line with peers when under-indexing

movements in constituents with considerable exposure to pandemic-fueled sectors such as e-commerce and communication

At a premium to peers considering considerably (around 4x) higher growth, but normalizes over the coming 12 months in

relation to the valuations of the peer group's best-in-class companies

Valuation is >20% below the WBA transaction that closed in Q4 2021 in SEK terms, and >30% below in USD terms

YTD NTM revenue multiple compression of almost 50%, 5pp deeper than the average peer

At a premium to the peer average on an NTM multiple basis, but increasingly in line or at a deeper discount to the more richly

valued constituents of the peer group already on a 2023 revenue basis, as the company is outgrowing peers by >2x

Valuation is down >25% YTD in SEK terms and down >35% in USD terms

YTD NTM revenue multiple compression of >50%, almost 10pp deeper than the average peer

At a slightly higher premium to the peer average on an NTM multiple basis than VillageMD, but similar pattern of catching up to

the peer group already on a 2023 revenue basis, as also Cityblock is outgrowing peers by 2x

10

KINNEVIKView entire presentation