Uber Shareholder Engagement Presentation Deck

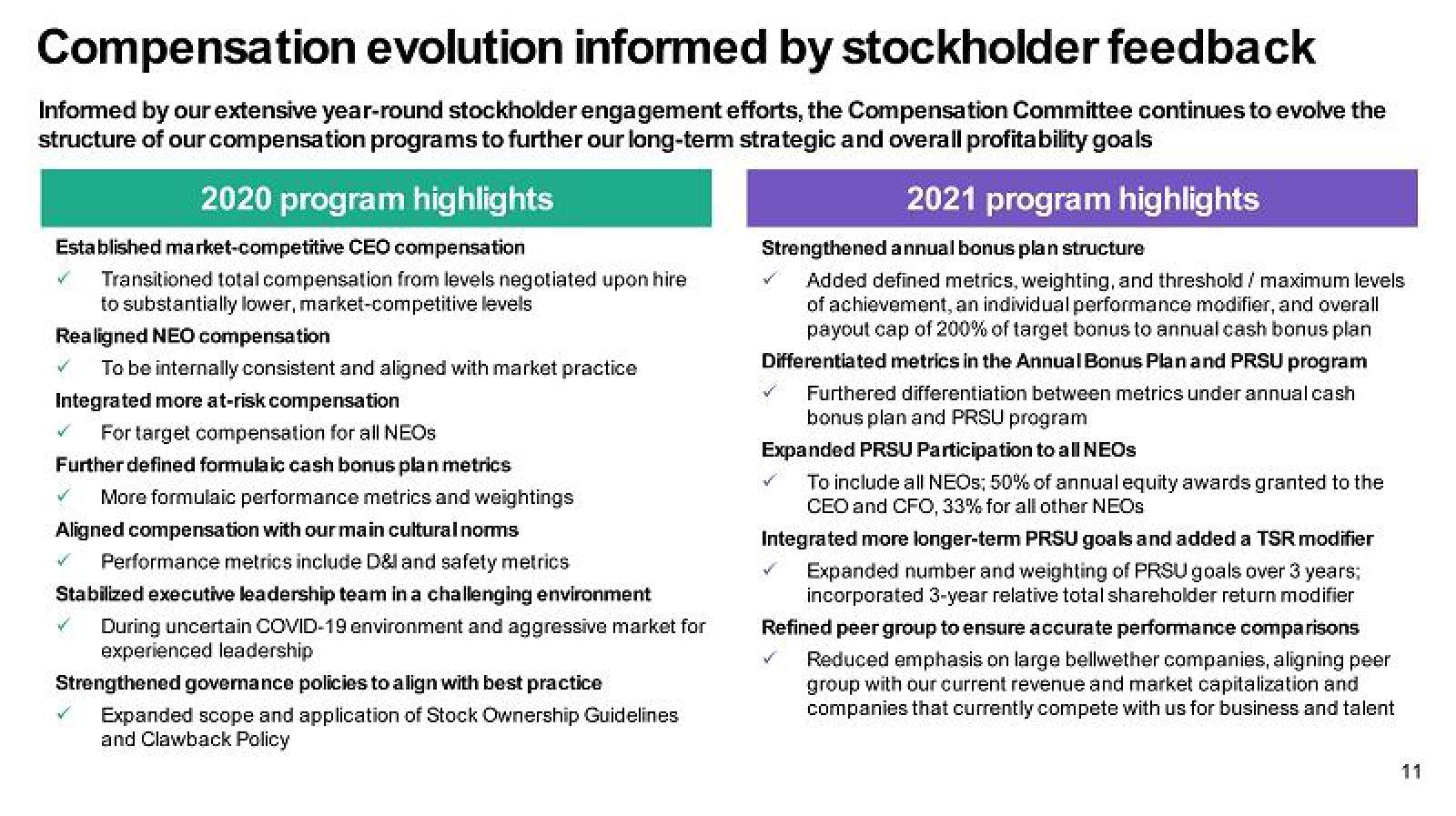

Compensation evolution informed by stockholder feedback

Informed by our extensive year-round stockholder engagement efforts, the Compensation Committee continues to evolve the

structure of our compensation programs to further our long-term strategic and overall profitability goals

2020 program highlights

Established market-competitive CEO compensation

Transitioned total compensation from levels negotiated upon hire

to substantially lower, market-competitive levels

Realigned NEO compensation

K To be internally consistent and aligned with market practice

Integrated more at-risk compensation

Bran For target compensation for all NEOS

Further defined formula ic cash bonus plan metrics

More formulaic performance metrics and weightings

Aligned compensation with our main cultural norms

w

Bi

Ba Performance metrics include D& and safety metrics

Stabilized executive leadership team in a challenging environment

During uncertain COVID-19 environment and aggressive market for

experienced leadership

Ba

Strengthened governance policies to align with best practice

Expanded scope and application of Stock Ownership Guidelines

and Clawback Policy

Benve

2021 program highlights

Strengthened annual bonus plan structure

Added defined metrics, weighting, and threshold / maximum levels

of achievement, an individual performance modifier, and overall

payout cap of 200% of target bonus to annual cash bonus plan

Differentiated metrics in the Annual Bonus Plan and PRSU program

Furthered differentiation between metrics under annual cash

bonus plan and PRSU program

Expanded PRSU Participation to all NEOs

www

To include all NEOS; 50% of annual equity awards granted to the

CEO and CFO, 33% for all other NEOS

Integrated more longer-term PRSU goals and added a TSR modifier

Expanded number and weighting of PRSU goals over 3 years;

incorporated 3-year relative total shareholder return modifier

Refined peer group to ensure accurate performance comparisons

Reduced emphasis on large bellwether companies, aligning peer

group with our current revenue and market capitalization and

companies that currently compete with us for business and talent

11View entire presentation