Bank of America Investment Banking Pitch Book

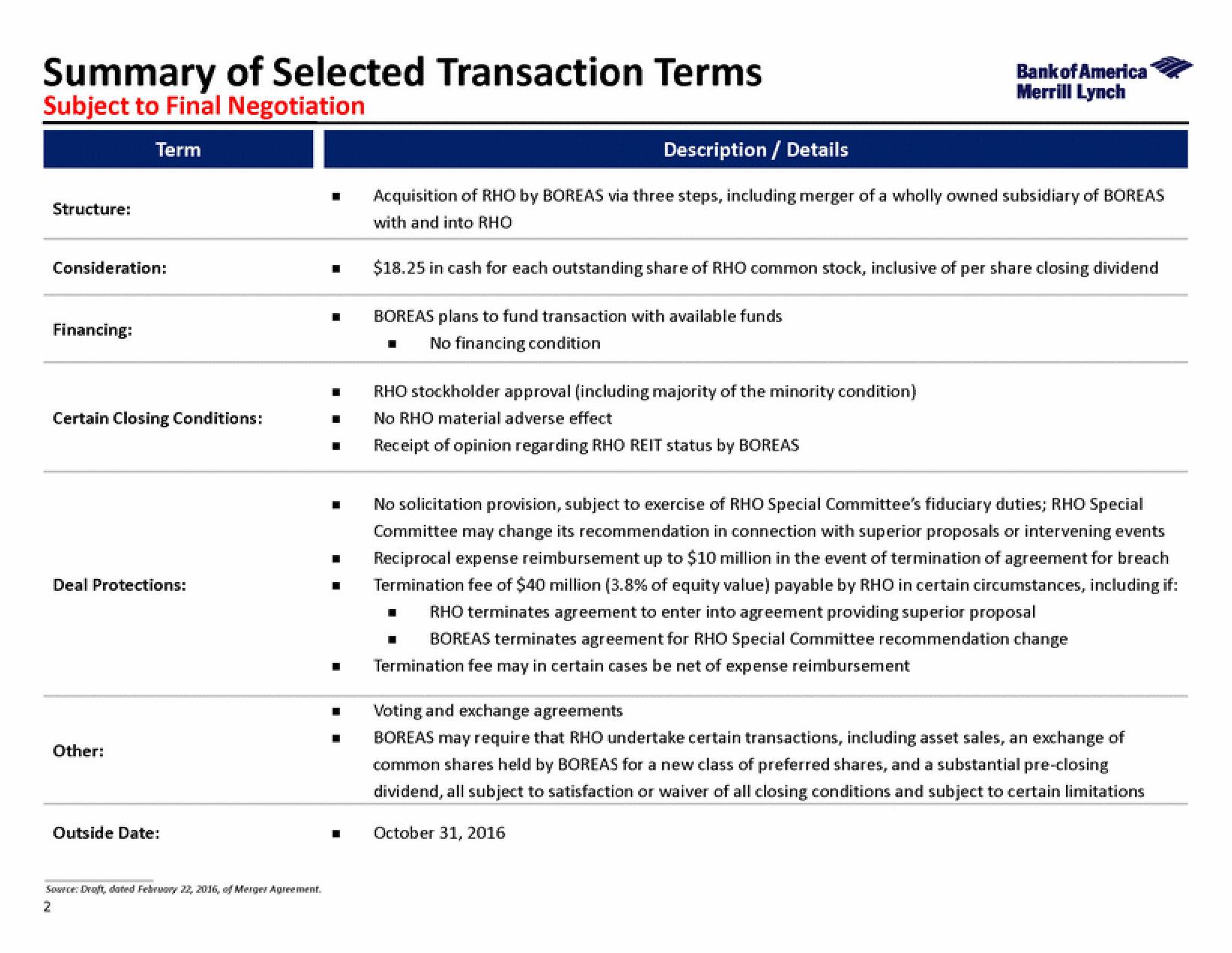

Summary of Selected Transaction Terms

Subject to Final Negotiation

Term

Structure:

Consideration:

Financing:

Certain Closing Conditions:

Deal Protections:

Other:

Outside Date:

Source: Draft, dated February 22, 2016, of Merger Agreement.

2

Description / Details

■ Acquisition of RHO by BOREAS via three steps, including merger of a wholly owned subsidiary of BOREAS

with and into RHO

■ $18.25 in cash for each outstanding share of RHO common stock, inclusive of per share closing dividend

■

BOREAS plans to fund transaction with available funds

No financing condition

■

RHO stockholder approval (including majority of the minority condition)

No RHO material adverse effect

Receipt of opinion regarding RHO REIT status by BOREAS

Bank of America

Merrill Lynch

- No solicitation provision, subject to exercise of RHO Special Committee's fiduciary duties; RHO Special

Committee may change its recommendation in connection with superior proposals or intervening events

Reciprocal expense reimbursement up to $10 million in the event of termination of agreement for breach

Termination fee of $40 million (3.8% of equity value) payable by RHO in certain circumstances, including if:

RHO terminates agreement to enter into agreement providing superior proposal

BOREAS terminates agreement for RHO Special Committee recommendation change

Termination fee may in certain cases be net of expense reimbursement

DE

■

Voting and exchange agreements

BOREAS may require that RHO undertake certain transactions, including asset sales, an exchange of

common shares held by BOREAS for a new class of preferred shares, and a substantial pre-closing

dividend, all subject to satisfaction or waiver of all closing conditions and subject to certain limitations

October 31, 2016View entire presentation