Credit Suisse Investment Banking Pitch Book

CREDIT SUISSE DOES NOT PROVIDE ANY TAX ADVICE | MATERIALS ARE PRELIMINARY AND SUBJECT TO FURTHER CHANGE AND DEVELOPMENTS (WHICH MAY BE MATERIAL)

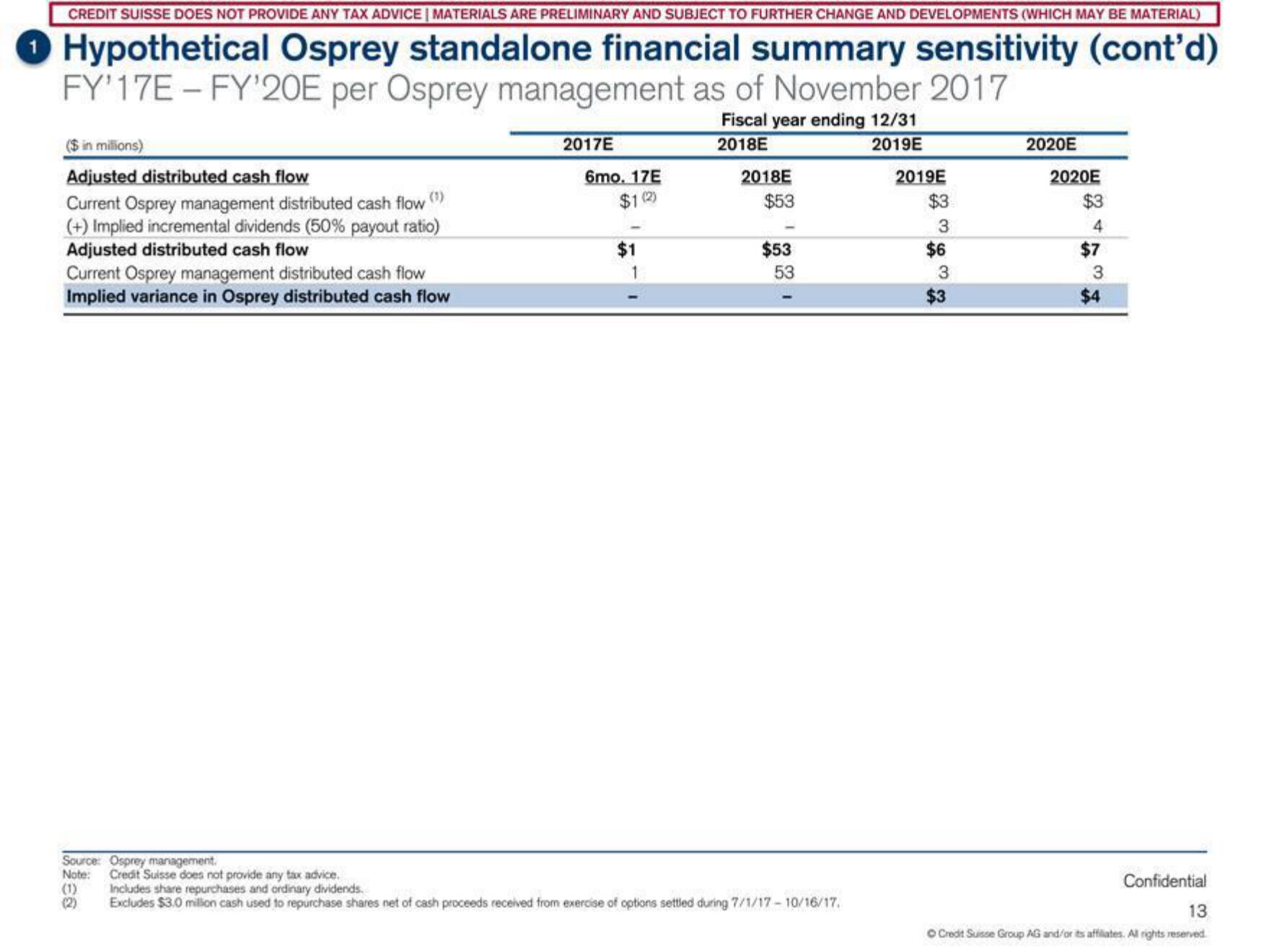

Hypothetical Osprey standalone financial summary sensitivity (cont'd)

FY'17E-FY'20E per Osprey management as of November 2017

Fiscal year ending 12/31

2018E

2019E

($ in millions)

Adjusted distributed cash flow

(1)

Current Osprey management distributed cash flow

(+) Implied incremental dividends (50% payout ratio)

Adjusted distributed cash flow

Current Osprey management distributed cash flow

Implied variance in Osprey distributed cash flow

Source: Osprey management.

Note: Credit Suisse does not provide any tax advice.

ចំ

(2)

2017E

6mo. 17E

$1(2)

$1

2018E

$53

$53

53

Includes share repurchases and ordinary dividends.

Excludes $3.0 million cash used to repurchase shares net of cash proceeds received from exercise of options settled during 7/1/17-10/16/17.

2019E

$3

3

$6

3

$3

2020E

2020E

$3

4

$7

3

$4

Confidential

13

Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation