Liberty Global Results Presentation Deck

SUNRISE(¹): CONTINUED

DESPITE ANNOUNCED

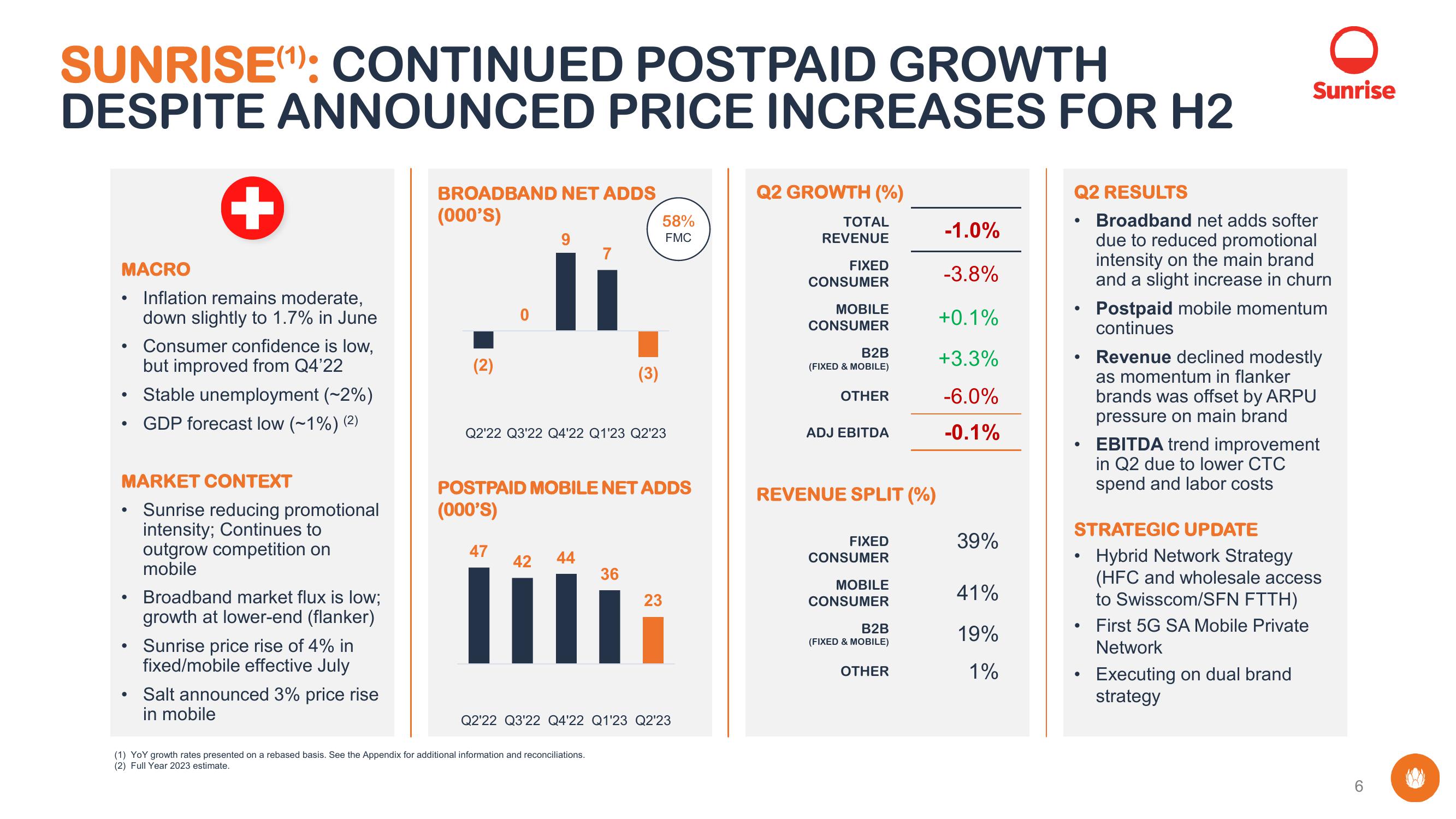

MACRO

Inflation remains moderate,

down slightly to 1.7% in June

●

• Consumer confidence is low,

but improved from Q4'22

• Stable unemployment (-2%)

GDP forecast low (~1%) (²)

●

+

MARKET CONTEXT

Sunrise reducing promotional

intensity; Continues to

outgrow competition on

mobile

●

●

●

Broadband market flux is low;

growth at lower-end (flanker)

Sunrise price rise of 4% in

fixed/mobile effective July

Salt announced 3% price rise

in mobile

BROADBAND NET ADDS

(000'S)

(2)

0

9

47

POSTPAID GROWTH

PRICE INCREASES FOR H2

42 44

7

Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

POSTPAID MOBILE NET ADDS

(000'S)

(1) YoY growth rates presented on a rebased basis. See the Appendix for additional information and reconciliations.

(2) Full Year 2023 estimate.

(3)

58%

FMC

36

23

Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

Q2 GROWTH (%)

TOTAL

REVENUE

FIXED

CONSUMER

MOBILE

CONSUMER

B2B

(FIXED & MOBILE)

OTHER

ADJ EBITDA

REVENUE SPLIT (%)

FIXED

CONSUMER

MOBILE

CONSUMER

B2B

(FIXED & MOBILE)

OTHER

-1.0%

-3.8%

+0.1%

+3.3%

-6.0%

-0.1%

39%

41%

19%

1%

Q2 RESULTS

Broadband net adds softer

due to reduced promotional

intensity on the main brand

and a slight increase in churn

●

●

●

STRATEGIC UPDATE

●

Sunrise

Postpaid mobile momentum

continues

Revenue declined modestly

as momentum in flanker

brands was offset by ARPU

pressure on main brand

EBITDA trend improvement

in Q2 due to lower CTC

spend and labor costs

Hybrid Network Strategy

(HFC and wholesale access

to Swisscom/SFN FTTH)

First 5G SA Mobile Private

Network

Executing on dual brand

strategyView entire presentation