BlackRock Global Long/Short Credit Absolute Return Credit

Today's Landscape Reflects a Change in Regime

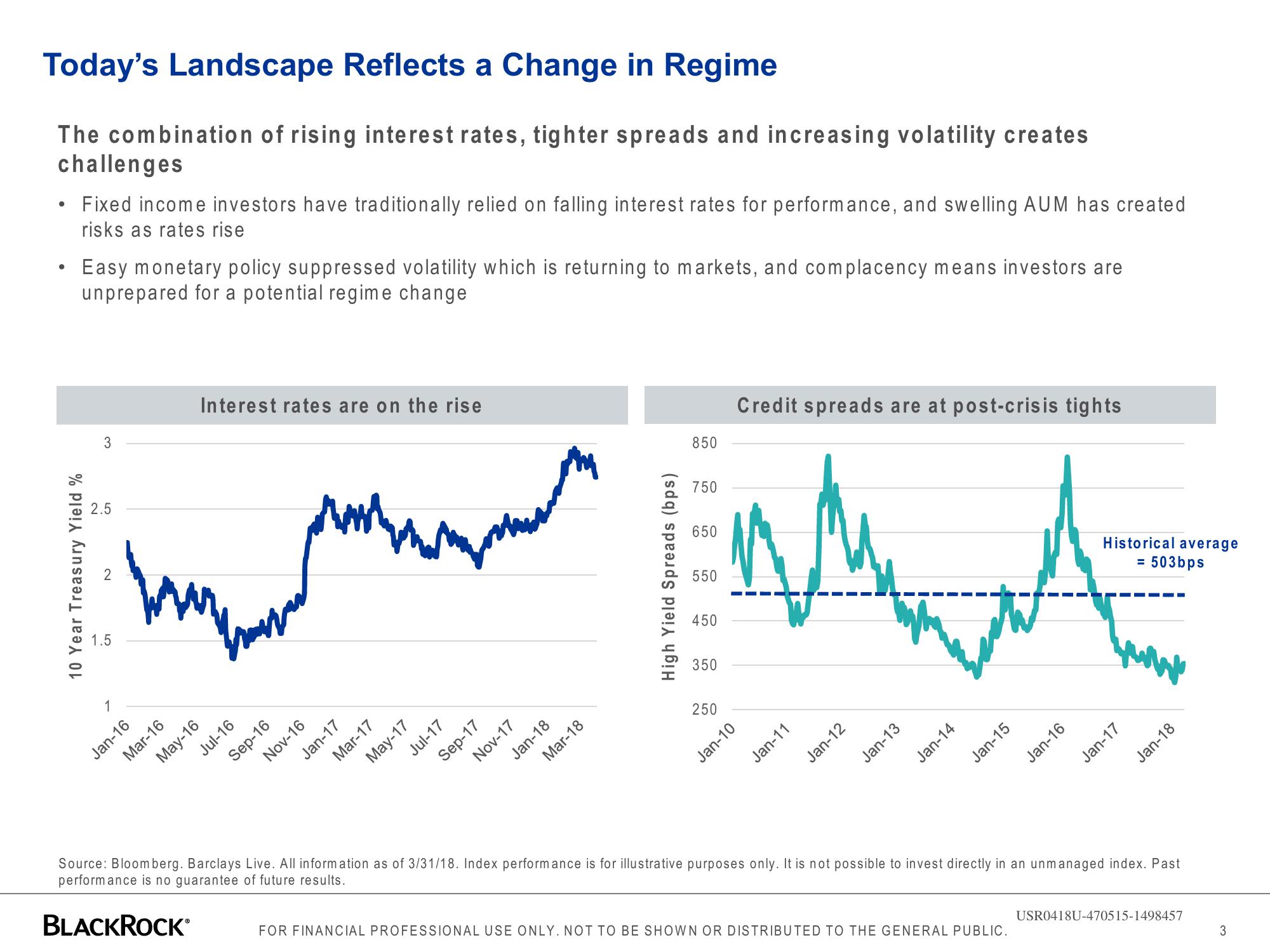

The combination of rising interest rates, tighter spreads and increasing volatility creates

challenges

Fixed income investors have traditionally relied on falling interest rates for performance, and swelling AUM has created

risks as rates rise

●

Easy monetary policy suppressed volatility which is returning to markets, and complacency means investors are

unprepared for a potential regime change

10 Year Treasury Yield %

3

2.5

2

1.5

1

Jan-16

Mar-16

Interest rates are on the rise

Your

May-16

Jul-16

Sep-16

Nov-16

Jan-17

Mar-17

What

May-17

Jul-17

Sep-17

Nov-17

Jan-18

Mar-18

High Yield Spreads (bps)

850

750

650

550

450

350

250

Credit spreads are at post-crisis tights

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

Jan-15

Jan-16

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

Historical average

= 503bps

Jan-17

Jan-18

Source: Bloomberg. Barclays Live. All information as of 3/31/18. Index performance is for illustrative purposes only. It is not possible to invest directly in an unmanaged index. Past

performance is no guarantee of future results.

BLACKROCK*

USR0418U-470515-1498457

3View entire presentation